FCX Conference Call 3rd Quarter 2023 Results

●

●

●

3Q23 Highlights

FREEPORT FOREMOST IN COPPER

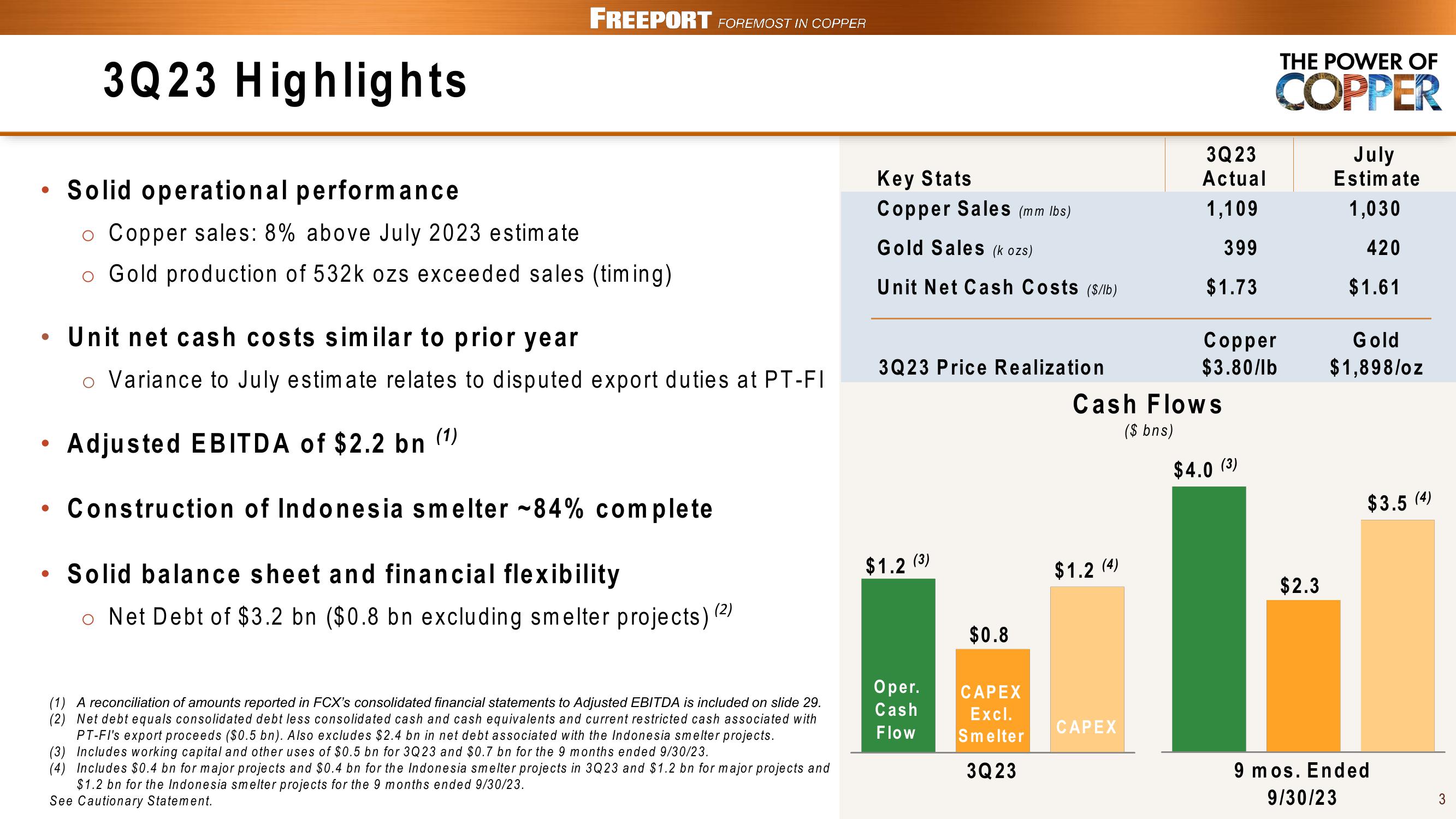

Solid operational performance

o Copper sales: 8% above July 2023 estimate

o Gold production of 532k ozs exceeded sales (timing)

Unit net cash costs similar to prior year

Variance to July estimate relates to disputed export duties at PT-FI

Adjusted EBITDA of $2.2 bn (1)

• Construction of Indonesia smelter ~84% complete

●

• Solid balance sheet and financial flexibility

●

o Net Debt of $3.2 bn ($0.8 bn excluding smelter projects)

(2)

(1) A reconciliation of amounts reported in FCX's consolidated financial statements to Adjusted EBITDA is included on slide 29.

(2) Net debt equals consolidated debt less consolidated cash and cash equivalents and current restricted cash associated with

PT-FI's export proceeds ($0.5 bn). Also excludes $2.4 bn in net debt associated with the Indonesia smelter projects.

(3) Includes working capital and other uses of $0.5 bn for 3Q23 and $0.7 bn for the 9 months ended 9/30/23.

(4) Includes $0.4 bn for major projects and $0.4 bn for the Indonesia smelter projects in 3Q23 and $1.2 bn for major projects and

$1.2 bn for the Indonesia smelter projects for the 9 months ended 9/30/23.

See Cautionary Statement.

Key Stats

Copper Sales (mm lbs)

Gold Sales (k ozs)

Unit Net Cash Costs ($/lb)

3Q23 Price Realization

$1.2 (3)

Oper.

Cash

Flow

$0.8

CAPEX

Excl.

Smelter

3Q23

$1.2 (4)

3Q23

Actual

1,109

399

$1.73

Cash FlowS

($ bns)

CAPEX

Copper

$3.80/lb

THE POWER OF

COPPER

$4.0 (3)

$2.3

July

Estimate

1,030

420

$1.61

Gold

$1,898/oz

$3.5 (4)

9 mos. Ended

9/30/23

3View entire presentation