IGI SPAC Presentation Deck

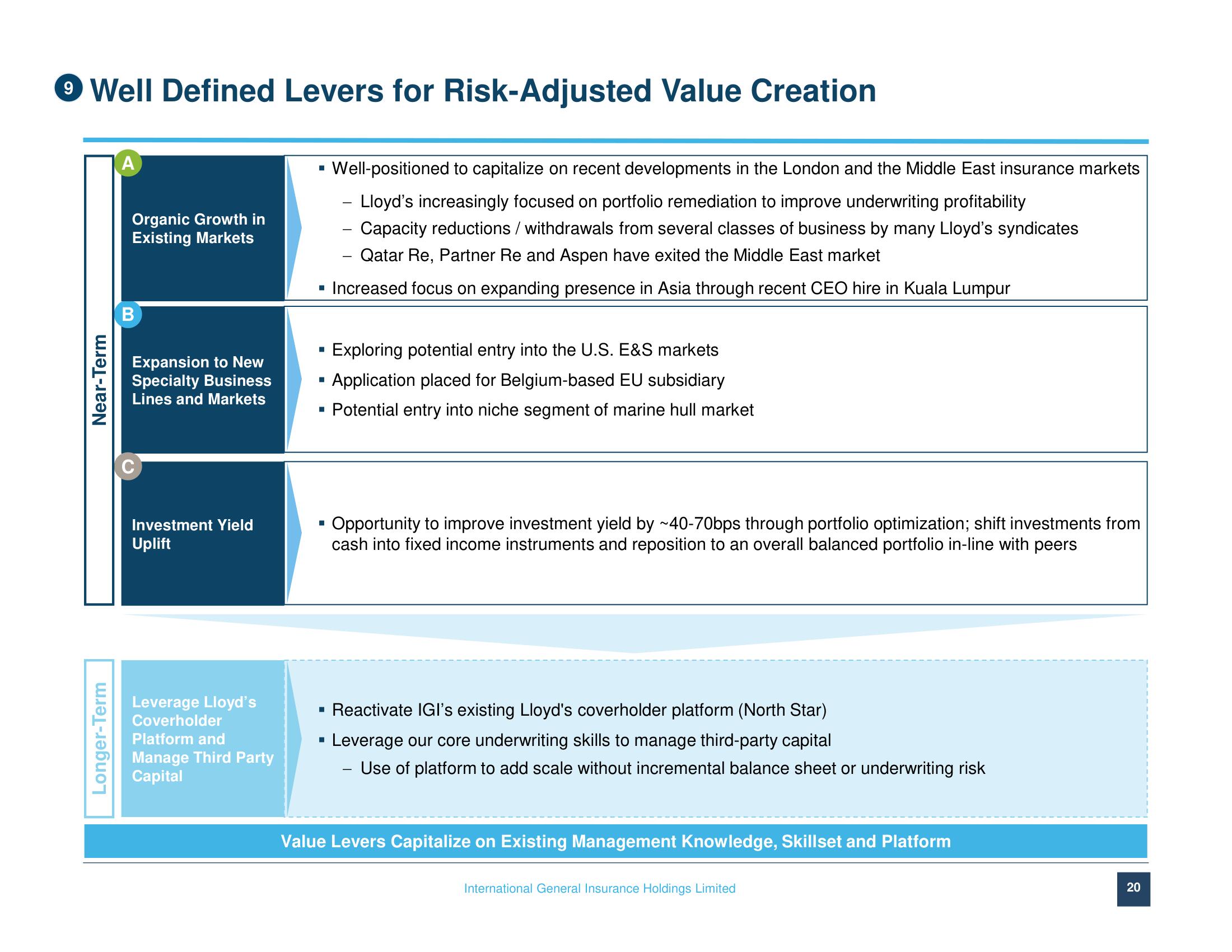

9 Well Defined Levers for Risk-Adjusted Value Creation

Near-Term

Longer-Term

A

Organic Growth in

Existing Markets

B

Expansion to New

Specialty Business

Lines and Markets

Investment Yield

Uplift

Leverage Lloyd's

Coverholder

Platform and

Manage Third Party

Capital

■

■

Exploring potential entry into the U.S. E&S markets

Application placed for Belgium-based EU subsidiary

▪ Potential entry into niche segment of marine hull market

■

■

Well-positioned to capitalize on recent developments in the London and the Middle East insurance markets

- Lloyd's increasingly focused on portfolio remediation to improve underwriting profitability

- Capacity reductions / withdrawals from several classes of business by many Lloyd's syndicates

Qatar Re, Partner Re and Aspen have exited the Middle East market

Increased focus on expanding presence in Asia through recent CEO hire in Kuala Lumpur

■

Opportunity to improve investment yield by ~40-70bps through portfolio optimization; shift investments from

cash into fixed income instruments and reposition to an overall balanced portfolio in-line with peers

▪ Reactivate IGI's existing Lloyd's coverholder platform (North Star)

Leverage our core underwriting skills to manage third-party capital

- Use of platform to add scale without incremental balance sheet or underwriting risk

Value Levers Capitalize on Existing Management Knowledge, Skillset and Platform

International General Insurance Holdings Limited

20View entire presentation