Lyft Results Presentation Deck

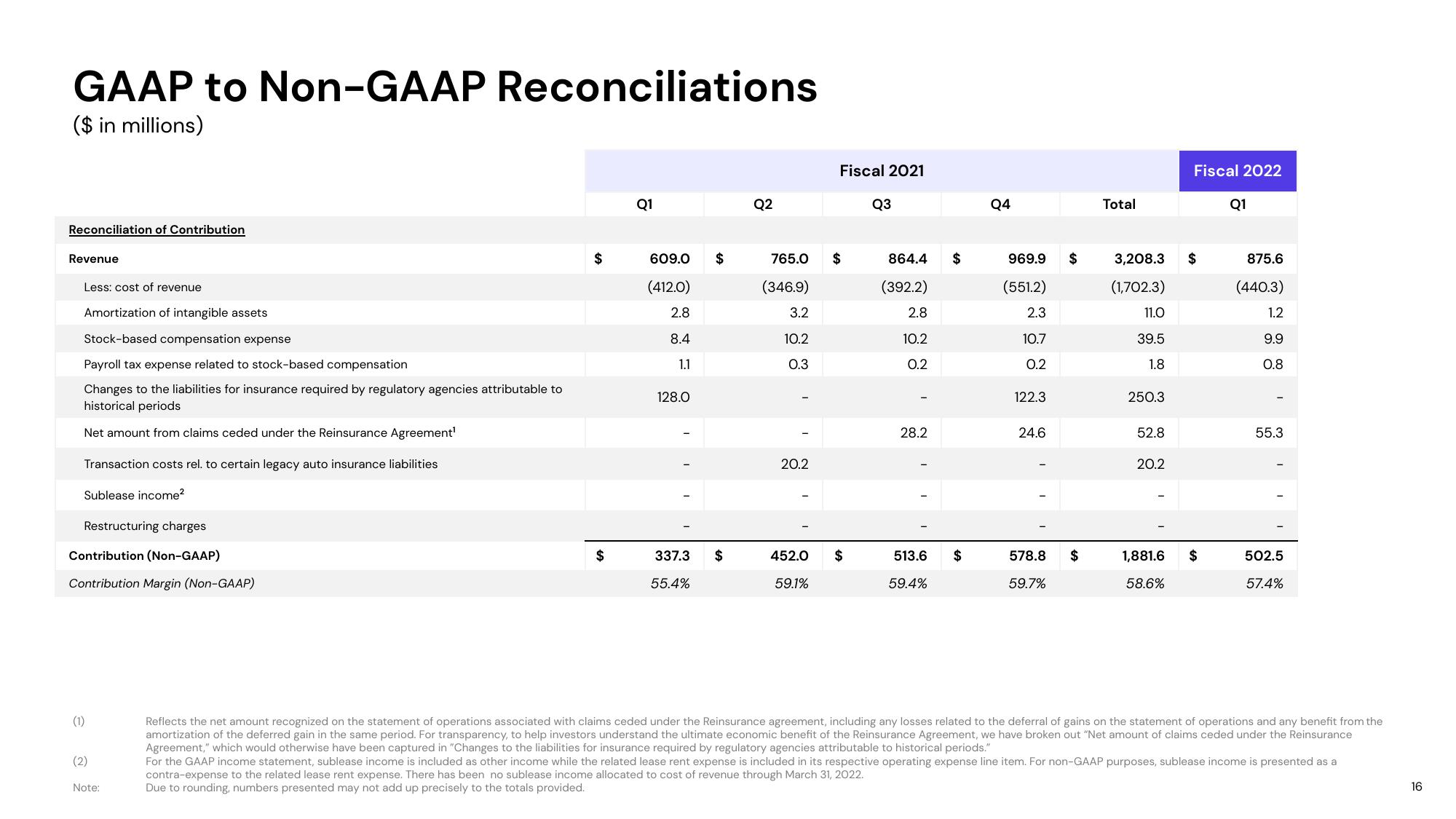

GAAP to Non-GAAP Reconciliations

($ in millions)

Reconciliation of Contribution

Revenue

Less: cost of revenue

Amortization of intangible assets

Stock-based compensation expense

Payroll tax expense related to stock-based compensation

Changes to the liabilities for insurance required by regulatory agencies attributable to

historical periods

Net amount from claims ceded under the Reinsurance Agreement¹

Transaction costs rel. to certain legacy auto insurance liabilities

Sublease income²

Restructuring charges

Contribution (Non-GAAP)

Contribution Margin (Non-GAAP)

(1)

(2)

Note:

$

Q1

609.0

(412.0)

2.8

8.4

1.1

128.0

337.3

55.4%

$

$

Q2

Fiscal 2021

765.0 $

(346.9)

3.2

10.2

0.3

20.2

452.0 $

59.1%

Q3

864.4 $

(392.2)

2.8

10.2

0.2

28.2

513.6 $

59.4%

Q4

969.9

(551.2)

2.3

10.7

0.2

122.3

24.6

578.8

59.7%

$

$

Total

3,208.3 $

(1,702.3)

11.0

39.5

1.8

250.3

52.8

20.2

Fiscal 2022

1,881.6

58.6%

$

Q1

875.6

(440.3)

1.2

9.9

0.8

55.3

502.5

57.4%

Reflects the net amount recognized on the statement of operations associated with claims ceded under the Reinsurance agreement, including any losses related to the deferral of gains on the statement of operations and any benefit from the

amortization of the deferred gain in the same period. For transparency, to help investors understand the ultimate economic benefit of the Reinsurance Agreement, we have broken out "Net amount of claims ceded under the Reinsurance

Agreement," which would otherwise have been captured in "Changes to the liabilities for insurance required by regulatory agencies attributable to historical periods."

For the GAAP income statement, sublease income is included as other income while the related lease rent expense is included in its respective operating expense line item. For non-GAAP purposes, sublease income is presented as a

contra-expense to the related lease rent expense. There has been no sublease income allocated to cost of revenue through March 31, 2022.

Due to rounding, numbers presented may not add up precisely to the totals provided.

16View entire presentation