Main Street Capital Investor Day Presentation Deck

Dividend Paying BDCs

Public for >2 Years (3)

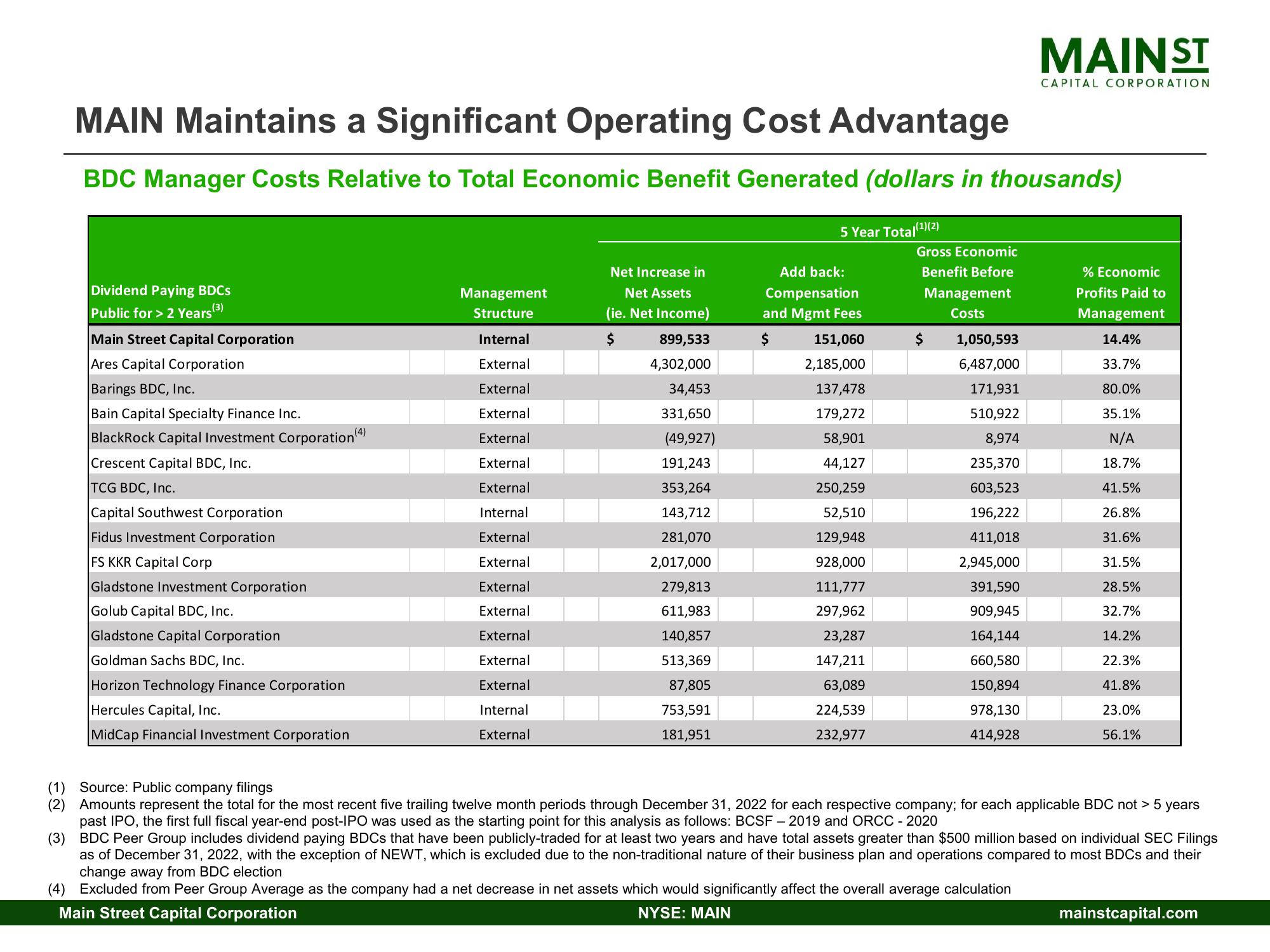

MAIN Maintains a Significant Operating Cost Advantage

BDC Manager Costs Relative to Total Economic Benefit Generated (dollars in thousands)

Main Street Capital Corporation

Ares Capital Corporation

Barings BDC, Inc.

Bain Capital Specialty Finance Inc.

BlackRock Capital Investment Corporation (4)

Crescent Capital BDC, Inc.

TCG BDC, Inc.

Capital Southwest Corporation

Fidus Investment Corporation

FS KKR Capital Corp

Gladstone Investment Corporation

Golub Capital BDC, Inc.

Gladstone Capital Corporation

Goldman Sachs BDC, Inc.

Horizon Technology Finance Corporation

Hercules Capital, Inc.

MidCap Financial Investment Corporation

M

ment

Structure

Internal

External

External

External

External

External

External

Internal

External

External

External

External

External

External

External

Internal

External

Net Increase in

Net Assets

(ie. Net Income)

$ 899,533

4,302,000

34,453

331,650

(49,927)

191,243

353,264

143,712

281,070

2,017,000

279,813

611,983

140,857

513,369

87,805

753,591

181,951

5 Year Total(¹)(2)

Add back:

Compensation

and Mgmt Fees

$ 151,060

2,185,000

137,478

179,272

58,901

44,127

250,259

52,510

129,948

928,000

111,777

297,962

23,287

147,211

63,089

224,539

232,977

Gross Economic

Benefit Before

Management

Costs

$

MAINST

1,050,593

6,487,000

171,931

510,922

8,974

235,370

603,523

196,222

411,018

2,945,000

391,590

909,945

164,144

660,580

150,894

978,130

414,928

CAPITAL CORPORATION

% Economic

Profits Paid

Management

14.4%

33.7%

80.0%

35.1%

N/A

18.7%

41.5%

26.8%

31.6%

31.5%

28.5%

32.7%

14.2%

22.3%

41.8%

23.0%

56.1%

(1) Source: Public company filings

(2) Amounts represent the total for the most recent five trailing twelve month periods through December 31, 2022 for each respective company; for each applicable BDC not > 5 years

past IPO, the first full fiscal year-end post-IPO was used as the starting point for this analysis as follows: BCSF - 2019 and ORCC - 2020

(3)

BDC Peer Group includes dividend paying BDCs that have been publicly-traded for at least two years and have total assets greater than $500 million based on individual SEC Filings

as of December 31, 2022, with the exception of NEWT, which is excluded due to the non-traditional nature of their business plan and operations compared to most BDCs and their

change away from BDC election

(4) Excluded from Peer Group Average as the company had a net decrease in net assets which would significantly affect the overall average calculation

Main Street Capital Corporation

NYSE: MAIN

mainstcapital.comView entire presentation