Barclays Capital 2010 Global Financial Services Conference

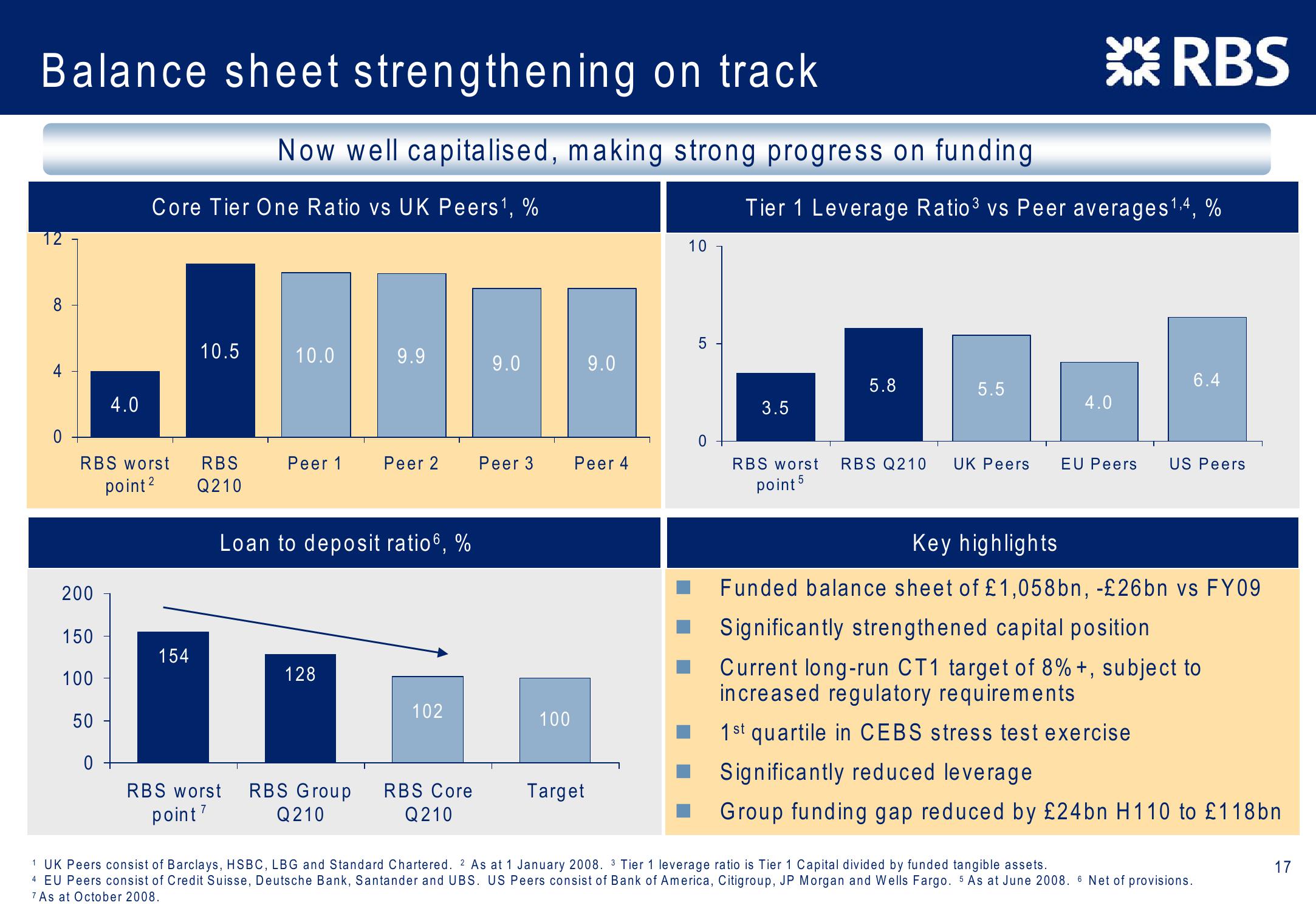

Balance sheet strengthening on track

12

Now well capitalised, making strong progress on funding

Core Tier One Ratio vs UK Peers¹, %

10

RBS

Tier 1 Leverage Ratio³ vs Peer averages 14, %

10.5

10.0

9.9

9.0

9.0

4.0

LO

5

5.8

6.4

5.5

3.5

4.0

0

RBS worst

point 2

RBS

Peer 1

Peer 2

Peer 3

Peer 4

Q210

RBS worst RBS Q210 UK Peers

point 5

EU Peers US Peers

Loan to deposit ratio6, %

200

150

154

100

128

102

50

100

0

RBS worst

point 7

RBS Group

Q210

RBS Core

Q210

Target

Key highlights

Funded balance sheet of £1,058bn, -£26bn vs FY09

Significantly strengthened capital position

Current long-run CT1 target of 8% +, subject to

increased regulatory requirements

1st quartile in CEBS stress test exercise

Significantly reduced leverage

Group funding gap reduced by £24bn H110 to £118bn

1 UK Peers consist of Barclays, HSBC, LBG and Standard Chartered. 2 As at 1 January 2008. 3 Tier 1 leverage ratio is Tier 1 Capital divided by funded tangible assets.

4 EU Peers consist of Credit Suisse, Deutsche Bank, Santander and UBS. US Peers consist of Bank of America, Citigroup, JP Morgan and Wells Fargo. 5 As at June 2008. 6 Net of provisions.

7 As at October 2008.

17View entire presentation