Active and Passive Investing

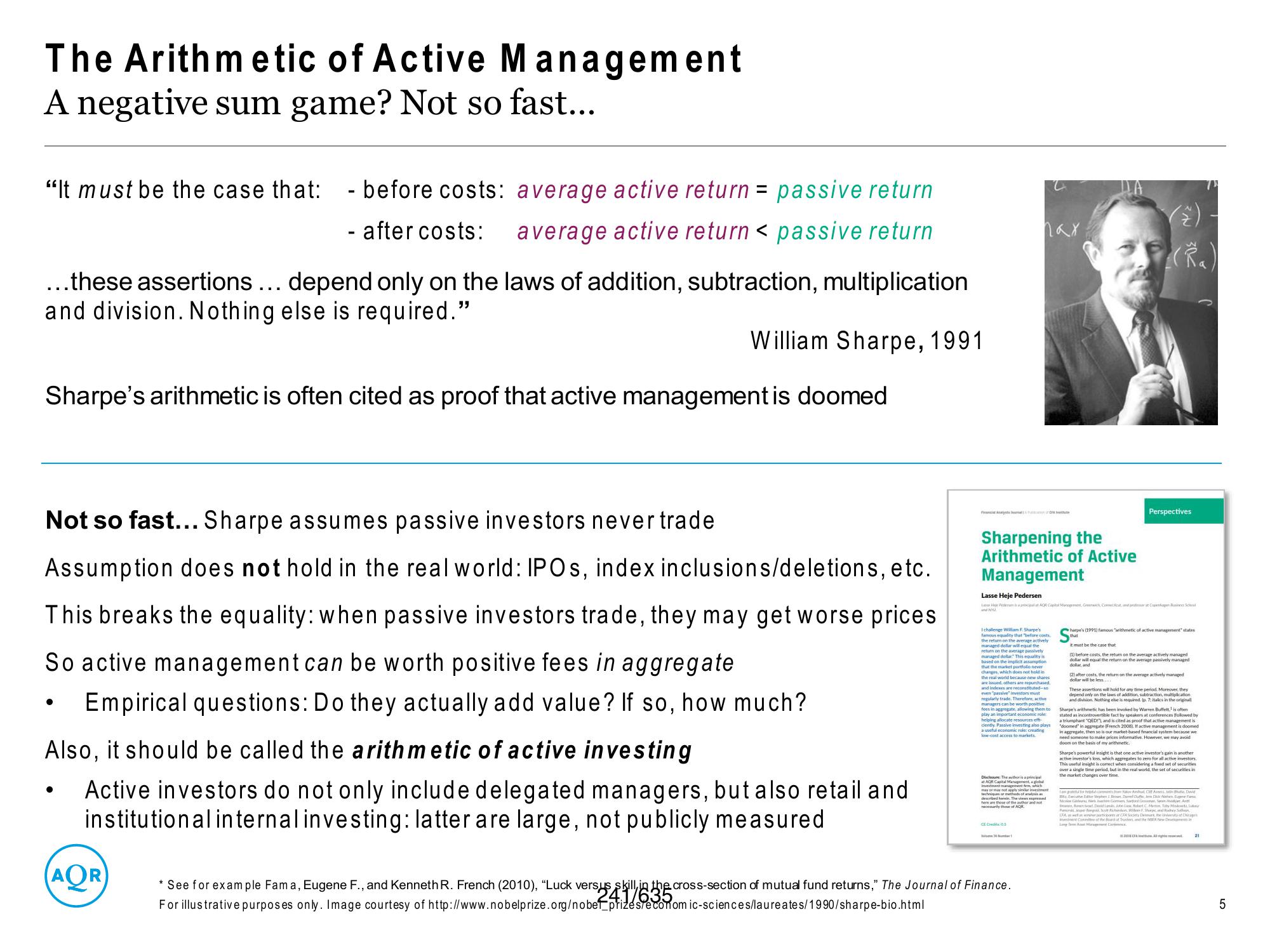

The Arithmetic of Active Management

A negative sum game? Not so fast...

"It must be the case that: - before costs: average active return = passive return

- after costs: average active return < passive return

...these assertions... depend only on the laws of addition, subtraction, multiplication

and division. Nothing else is required."

Sharpe's arithmetic is often cited as proof that active management is doomed

William Sharpe, 1991

Not so fast... Sharpe assumes passive investors never trade

Assumption does not hold in the real world: IPOs, index inclusions/deletions, etc.

This breaks the equality: when passive investors trade, they may get worse prices

So active management can be worth positive fees in aggregate

Empirical questions: Do they actually add value? If so, how much?

Also, it should be called the arithmetic of active investing

Active investors do not only include delegated managers, but also retail and

institutional internal investing: latter are large, not publicly measured

●

(AQR)

P

Sharpening the

Arithmetic of Active

Management

and NY

пах

Lasse Heje Pedersen

Lalat AQR Capital Management Greenwich Connect, un progen Rino Somal

Ichallenge William F. Sharpe's

famous equality that "before costs.

the return on the average actively

managed dollar will equal the

return on the average passively

managed dollar. This equality is

based on the implicit assumption

that the market portfolio never

changes, which does not hold in

the real world because new shares

are issued, others are repurchased.

and indexes are reconstituted-so

even passive investors must

regularly trade. Therefore, active

managers can be worth positive

fees in aggregate, allowing them to

play an important economic role

helping allocate resources eff

dently Passive investing also plays

a useful economic role: creating

low-cost access to markets.

Die Theerthoris a principa

at AQR Capital Management, a dob

investment management firm, which

may or may not apply similar invest

tachometheads of analysis a

described in The views expressed

necessarily those of A

CEC05

* See for example Fama, Eugene F., and Kenneth R. French (2010), "Luck versus skill in the cross-section of mutual fund returns," The Journal of Finance.

41/635

For illustrative purposes only. Image courtesy of http://www.nobelprize.org/nobel prizes economic-sciences/laureates/1990/sharpe-bio.html

(Ra)

Perspectives

harpe's (1991) famous "arithmetic of active management states

it must be the case that

(1) before costs, the return on the average actively managed

dollar will equal the return on the average passively managed

dollar, and

(2) after costs, the return on the average actively managed

dollar will be less

These assertions will hold for any time period. Moreover, they

depend only on the laws of addition, subtraction, multiplication

and division. Nothing else is required. (p. 7: italics in the originall

Sharpe's arithmetic has been invoked by Warren Buffett is often

stated as incontrovertible fact by speakers at conferences followed by

a triumphant "QED!"), and is cited as proof that active management is

"doomed" in aggregate (French 2008). If active management is doomed

in aggregate, then so is our market-based financial system because we

need someone to make prices informative. However, we may avoid

doom on the basis of my arithmetic.

Sharpe's powerful insight is that one active investor's gain is another

active investor's loss, which aggregates to zero for all active investors.

This useful insight is correct when considering a fond set of securities

over a single time period, but in the real world, the set of securities in

the market changes over time.

fdcom

Anbu C Ashute Devid

Tttarita rosur Mms Clickr

MG Com Sartond Se

Devid Jon Debet C Martin Tidy Moireet, Li

Pe Bag Scotchon Wien F. Sharpe, S

Articipo a CFAS Det the sty at Drag

ere Come ant at the New Desi

Larg:amaCurt

21

LO

5View entire presentation