Digerati SPAC Presentation Deck

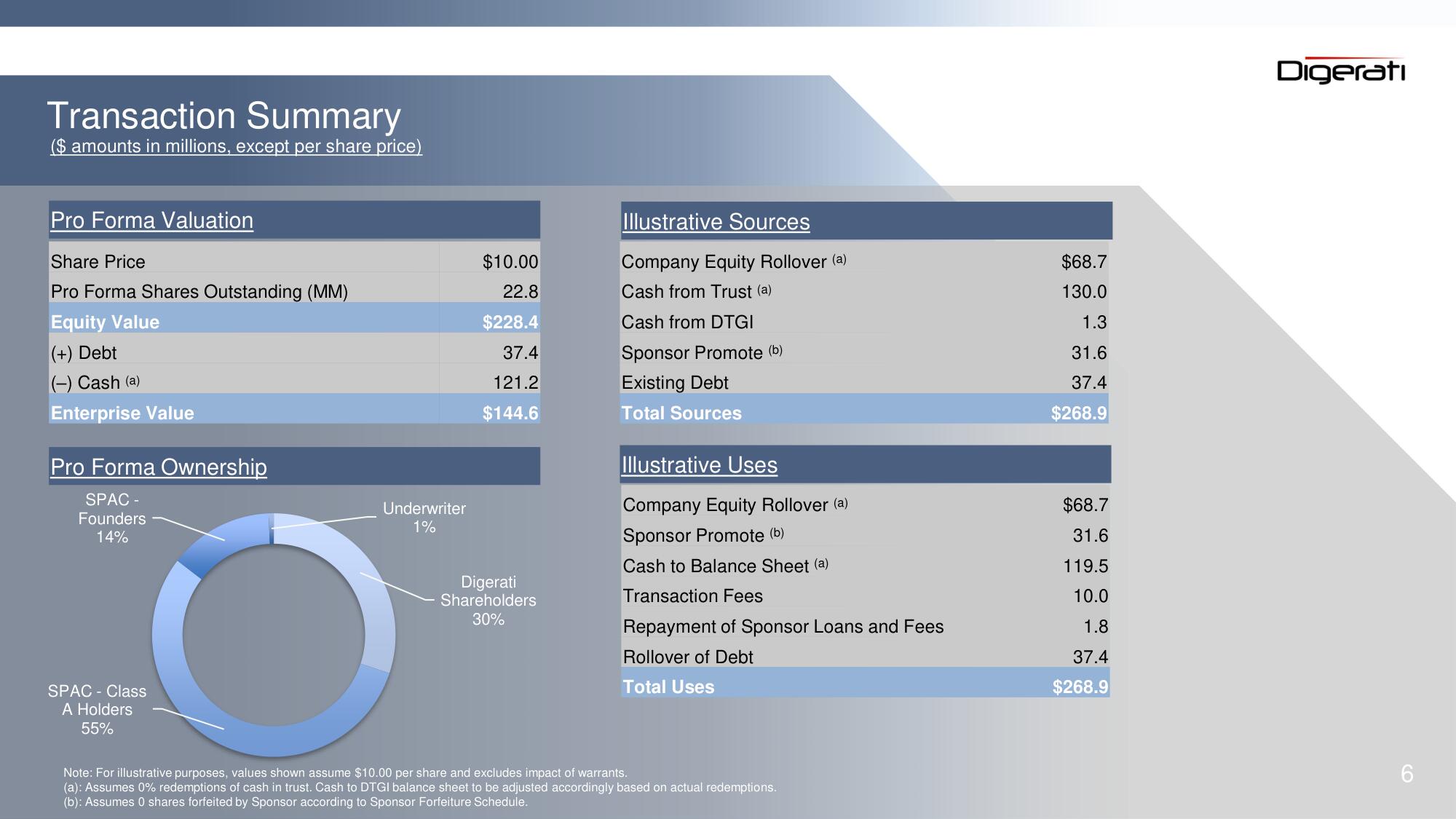

Transaction Summary

($ amounts in millions, except per share price)

Pro Forma Valuation

Share Price

Pro Forma Shares Outstanding (MM)

Equity Value

(+) Debt

(-) Cash (a)

Enterprise Value

Pro Forma Ownership

SPAC -

Founders

14%

SPAC - Class

A Holders

55%

Underwriter

1%

$10.00

22.8

$228.4

37.4

121.2

$144.6

Digerati

Shareholders

30%

Illustrative Sources

Company Equity Rollover (a)

Cash from Trust (a)

Cash from DTGI

Sponsor Promote (b)

Existing Debt

Total Sources

Illustrative Uses

Company Equity Rollover (a)

Sponsor Promote (b)

Cash to Balance Sheet (a)

Transaction Fees

Repayment of Sponsor Loans and Fees

Rollover of Debt

Total Uses

Note: For illustrative purposes, values shown assume $10.00 per share and excludes impact of warrants.

(a): Assumes 0% redemptions of cash in trust. Cash to DTGI balance sheet to be adjusted accordingly based on actual redemptions.

(b): Assumes 0 shares forfeited by Sponsor according to Sponsor Forfeiture Schedule.

$68.7

130.0

1.3

31.6

37.4

$268.9

$68.7

31.6

119.5

10.0

1.8

37.4

$268.9

DigeratiView entire presentation