Investor Insights: Q1 MCR Corp

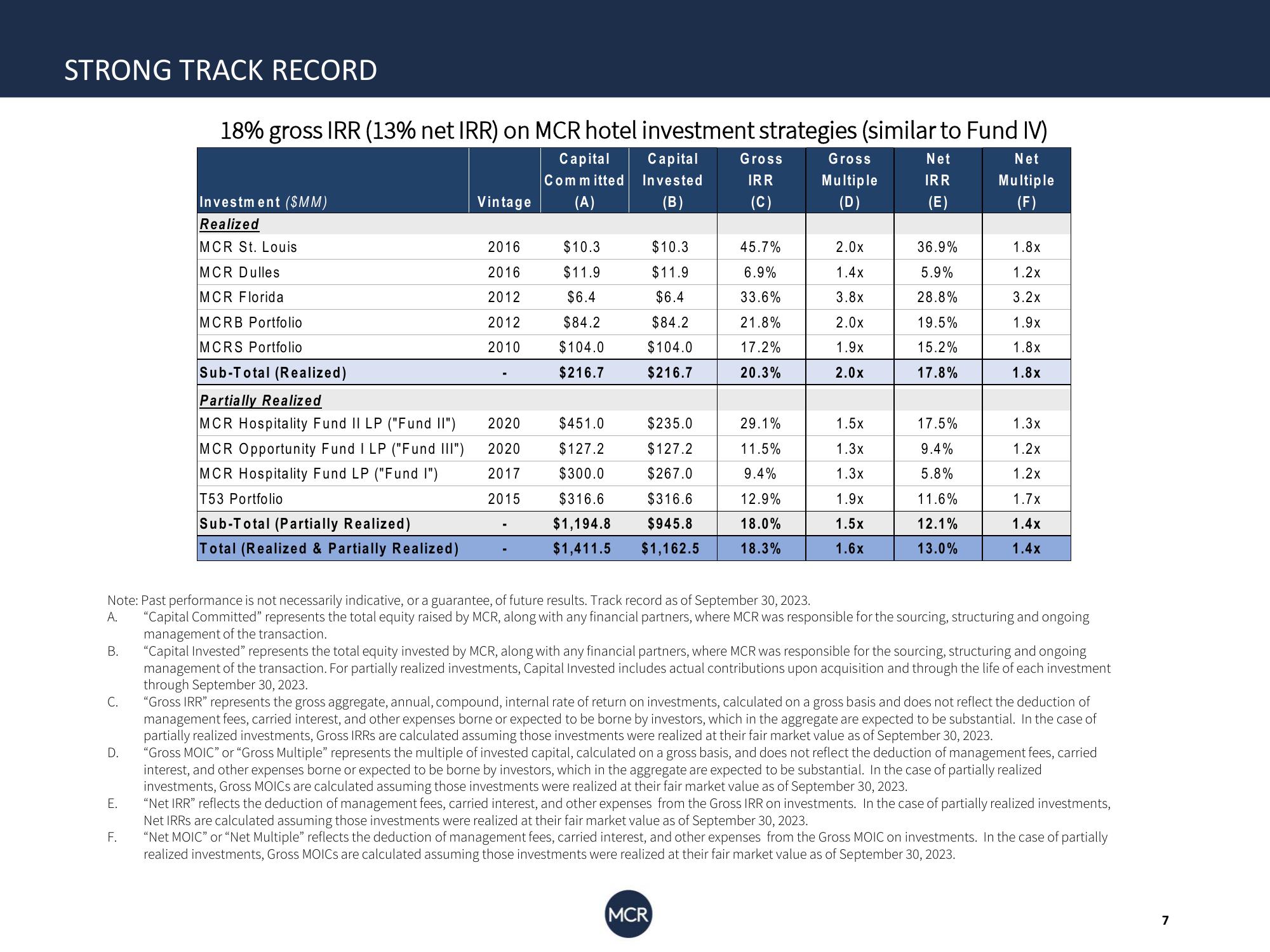

STRONG TRACK RECORD

B.

C.

D.

E.

18% gross IRR (13% net IRR) on MCR hotel investment strategies (similar to Fund IV)

Net

Net

IRR

Multiple

(E)

(F)

F.

Investment ($MM)

Realized

MCR St. Louis

MCR Dulles

MCR Florida

MCRB Portfolio

MCRS Portfolio

Sub-Total (Realized)

Partially Realized

MCR Hospitality Fund II LP ("Fund II")

MCR Opportunity Fund I LP ("Fund III")

MCR Hospitality Fund LP ("Fund I")

T53 Portfolio

Sub-Total (Partially Realized)

Total (Realized & Partially Realized)

Vintage

2016

2016

2012

2012

2010

2020

2020

2017

2015

Capital

Committed

(A)

$10.3

$11.9

$6.4

$84.2

$104.0

$216.7

Capital

Invested

(B)

$10.3

$11.9

$6.4

$84.2

$104.0

$216.7

$451.0

$235.0

$127.2

$127.2

$300.0

$267.0

$316.6

$316.6

$1,194.8

$945.8

$1,411.5 $1,162.5

Gross

IRR

(C)

45.7%

6.9%

33.6%

21.8%

17.2%

20.3%

29.1%

11.5%

9.4%

12.9%

18.0%

18.3%

MCR

Gross

Multiple

(D)

2.0x

1.4x

3.8x

2.0x

1.9x

2.0x

Note: Past performance is not necessarily indicative, or a guarantee, of future results. Track record as of September 30, 2023.

A. "Capital Committed" represents the total equity raised by MCR, along with any financial partners, where MCR was responsible for the sourcing, structuring and ongoing

management of the transaction.

1.5x

1.3x

1.3x

1.9x

1.5x

1.6x

36.9%

5.9%

28.8%

19.5%

15.2%

17.8%

17.5%

9.4%

5.8%

11.6%

12.1%

13.0%

1.8x

1.2x

3.2x

1.9x

1.8x

1.8x

1.3x

1.2x

1.2x

1.7x

1.4x

1.4x

"Capital Invested" represents the total equity invested by MCR, along with any financial partners, where MCR was responsible for the sourcing, structuring and ongoing

management of the transaction. For partially realized investments, Capital Invested includes actual contributions upon acquisition and through the life of each investment

through September 30, 2023.

"Gross IRR" represents the gross aggregate, annual, compound, internal rate of return on investments, calculated on a gross basis and does not reflect the deduction of

management fees, carried interest, and other expenses borne or expected to be borne by investors, which in the aggregate are expected to be substantial. In the case of

partially realized investments, Gross IRRS are calculated assuming those investments were realized at their fair market value as of September 30, 2023.

"Gross MOIC" or "Gross Multiple" represents the multiple of invested capital, calculated on a gross basis, and does not reflect the deduction of management fees, carried

interest, and other expenses borne or expected to be borne by investors, which in the aggregate are expected to be substantial. In the case of partially realized

investments, Gross MOICs are calculated assuming those investments were realized at their fair market value as of September 30, 2023.

"Net IRR" reflects the deduction of management fees, carried interest, and other expenses from the Gross IRR on investments. In the case of partially realized investments,

Net IRRs are calculated assuming those investments were realized at their fair market value as of September 30, 2023.

"Net MOIC" or "Net Multiple" reflects the deduction of management fees, carried interest, and other expenses from the Gross MOIC on investments. In the case of partially

realized investments, Gross MOICs are calculated assuming those investments were realized at their fair market value as of September 30, 2023.

7View entire presentation