LandSea Homes Investor Presentation

5 |

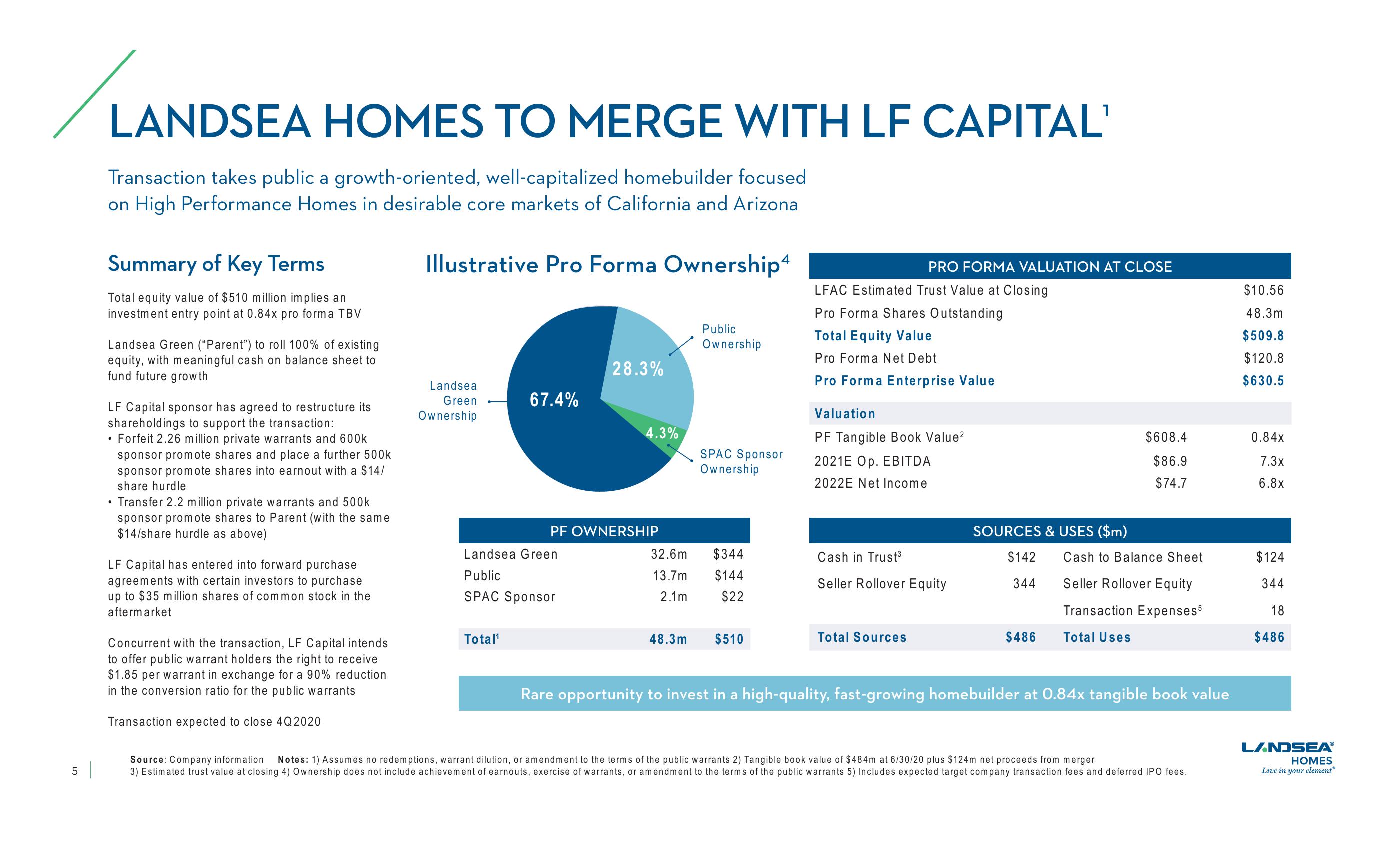

LANDSEA HOMES TO MERGE WITH LF CAPITAL

Transaction takes public a growth-oriented, well-capitalized homebuilder focused

on High Performance Homes in desirable core markets of California and Arizona

Illustrative Pro Forma Ownership4

Summary of Key Terms

Total equity value of $510 million implies an

investment entry point at 0.84x pro forma TBV

Landsea Green ("Parent") to roll 100% of existing

equity, with meaningful cash on balance sheet to

fund future growth

LF Capital sponsor has agreed to restructure its

shareholdings to support the transaction:

• Forfeit 2.26 million private warrants and 600k

sponsor promote shares and place a further 500k

sponsor promote shares into earnout with a $14/

share hurdle

• Transfer 2.2 million private warrants and 500k

sponsor promote shares to Parent (with the same

$14/share hurdle as above)

LF Capital has entered into forward purchase

agreements with certain investors to purchase

up to $35 million shares of common stock in the

aftermarket

Concurrent with the transaction, LF Capital intends

to offer public warrant holders the right to receive

$1.85 per warrant in exchange for a 90% reduction

in the conversion ratio for the public warrants

Transaction expected to close 4Q2020

Landsea

Green

Ownership

67.4%

Total¹

Landsea Green

Public

SPAC Sponsor

28.3%

4.3%

PF OWNERSHIP

32.6m

13.7m

2.1m

48.3m

Public

Ownership

SPAC Sponsor

Ownership

$344

$144

$22

$510

PRO FORMA VALUATION AT CLOSE

LFAC Estimated Trust Value at Closing

Pro Forma Shares Outstanding

Total Equity Value

Pro Forma Net Debt

Pro Forma Enterprise Value

Valuation

PF Tangible Book Value²

2021E Op. EBITDA

2022E Net Income

Cash in Trust³

Seller Rollover Equity

Total Sources

SOURCES & USES ($m)

$142

344

$486

$608.4

$86.9

$74.7

Cash to Balance Sheet

Seller Rollover Equity

Transaction Expenses5

Total Uses

Rare opportunity to invest in a high-quality, fast-growing homebuilder at 0.84x tangible book value

Source: Company information Notes: 1) Assumes no redemptions, warrant dilution, or amendment to the terms of the public warrants 2) Tangible book value of $484m at 6/30/20 plus $124m net proceeds from merger

3) Estimated trust value at closing 4) Ownership does not include achievement of earnouts, exercise of warrants, or amendment to the terms of the public warrants 5) Includes expected target company transaction fees and deferred IPO fees.

$10.56

48.3m

$509.8

$120.8

$630.5

0.84x

7.3x

6.8x

$124

344

18

$486

LANDSEAⓇ

HOMES

Live in your elementⓇView entire presentation