Investor Presentation

FINANCIALS

TECHNOLOGY

22

22

ENERGY EVOLUTION

NATURAL RESOURCES

INTRO

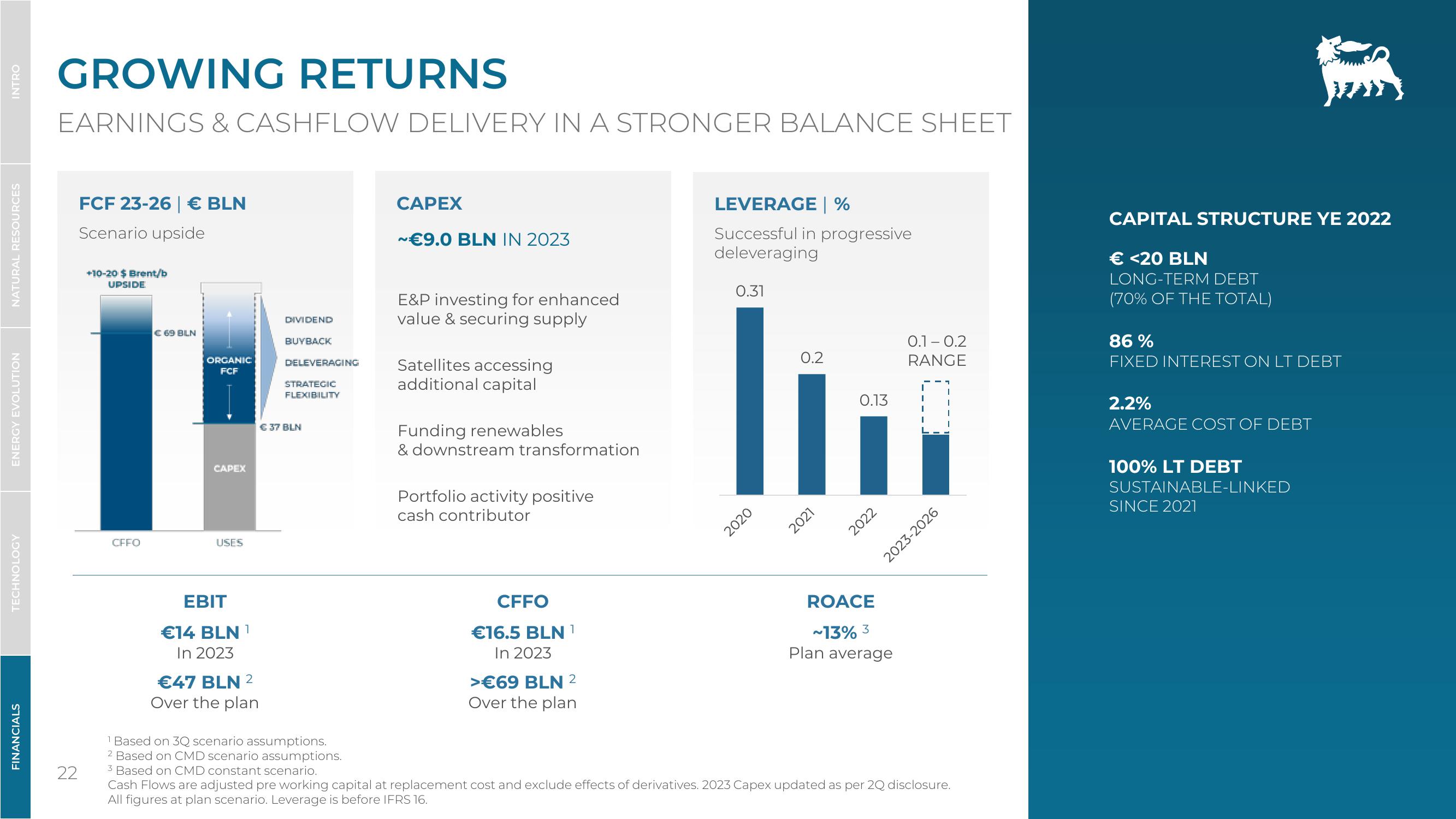

GROWING RETURNS

EARNINGS & CASHFLOW DELIVERY IN A STRONGER BALANCE SHEET

FCF 23-26 | € BLN

Scenario upside

+10-20 $ Brent/b

UPSIDE

CFFO

€69 BLN

ORGANIC

FCF

CAPEX

USES

DIVIDEND

BUYBACK

DELEVERAGING

STRATEGIC

FLEXIBILITY

€ 37 BLN

CAPEX

~€9.0 BLN IN 2023

E&P investing for enhanced

value & securing supply

Satellites accessing

additional capital

Funding renewables

& downstream transformation

Portfolio activity positive

cash contributor

LEVERAGE | %

Successful in progressive

deleveraging

0.31

0.2

0.13

0.1-0.2

RANGE

I…..

2020

2021

2022

2023-2026

CAPITAL STRUCTURE YE 2022

€ <20 BLN

LONG-TERM DEBT

(70% OF THE TOTAL)

86%

FIXED INTEREST ON LT DEBT

2.2%

AVERAGE COST OF DEBT

100% LT DEBT

SUSTAINABLE-LINKED

SINCE 2021

EBIT

€14 BLN

In 2023

1

CFFO

€16.5 BLN 1

In 2023

>€69 BLN 2

ROACE

~13% 3

Plan average

€47 BLN 2

Over the plan

1 Based on 3Q scenario assumptions.

2 Based on CMD scenario assumptions.

3 Based on CMD constant scenario.

Over the plan

Cash Flows are adjusted pre working capital at replacement cost and exclude effects of derivatives. 2023 Capex updated as per 2Q disclosure.

All figures at plan scenario. Leverage is before IFRS 16.View entire presentation