Credit Suisse Credit Presentation Deck

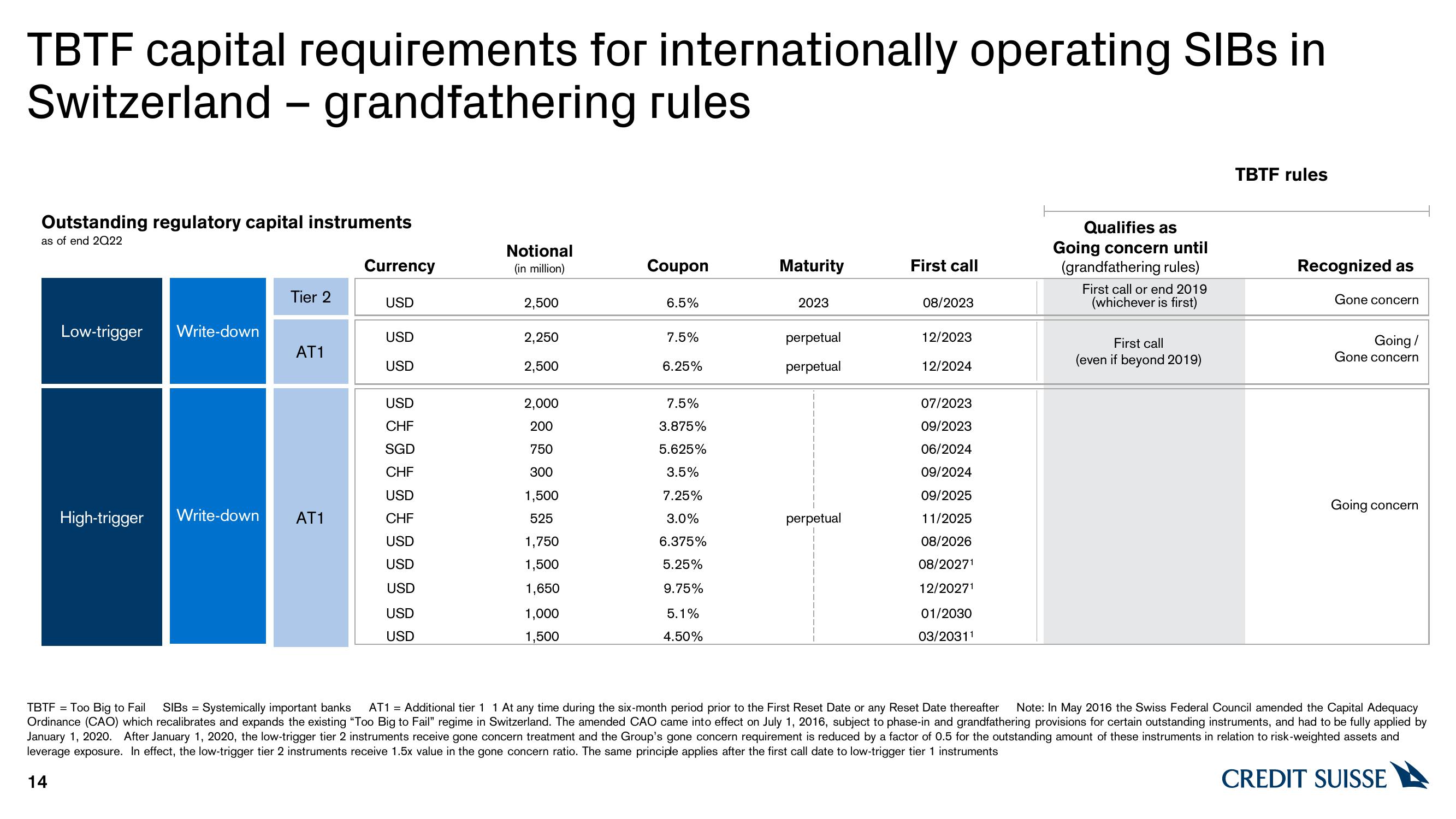

TBTF capital requirements for internationally operating SIBs in

Switzerland - grandfathering rules

Outstanding regulatory capital instruments

as of end 2Q22

Low-trigger

High-trigger

Write-down

Tier 2

AT1

Write-down AT1

Currency

USD

USD

USD

USD

CHF

SGD

CHF

USD

CHF

USD

USD

USD

USD

USD

Notional

(in million)

2,500

2,250

2,500

2,000

200

750

300

1,500

525

1,750

1,500

1,650

1,000

1,500

Coupon

6.5%

7.5%

6.25%

7.5%

3.875%

5.625%

3.5%

7.25%

3.0%

6.375%

5.25%

9.75%

5.1%

4.50%

Maturity

2023

perpetual

perpetual

perpetual

First call

08/2023

12/2023

12/2024

07/2023

09/2023

06/2024

09/2024

09/2025

11/2025

08/2026

08/20271

12/20271

01/2030

03/20311

Qualifies as

Going concern until

(grandfathering rules)

First call or end 2019

(whichever is first)

First call

(even if beyond 2019)

TBTF rules

Recognized as

Gone concern

Going /

Gone concern

Going concern

TBTF = Too Big to Fail SIBS = Systemically important banks AT1 = Additional tier 1 1 At any time during the six-month period prior to the First Reset Date or any Reset Date thereafter Note: In May 2016 the Swiss Federal Council amended the Capital Adequacy

Ordinance (CAO) which recalibrates and expands the existing "Too Big to Fail" regime in Switzerland. The amended CAO came into effect on July 1, 2016, subject to phase-in and grandfathering provisions for certain outstanding instruments, and had to be fully applied by

January 1, 2020. After January 1, 2020, the low-trigger tier 2 instruments receive gone concern treatment and the Group's gone concern requirement is reduced by a factor of 0.5 for the outstanding amount of these instruments in relation to risk-weighted assets and

leverage exposure. In effect, the low-trigger tier 2 instruments receive 1.5x value in the gone concern ratio. The same principle applies after the first call date to low-trigger tier 1 instruments

14

CREDIT SUISSEView entire presentation