Nexters Results Presentation Deck

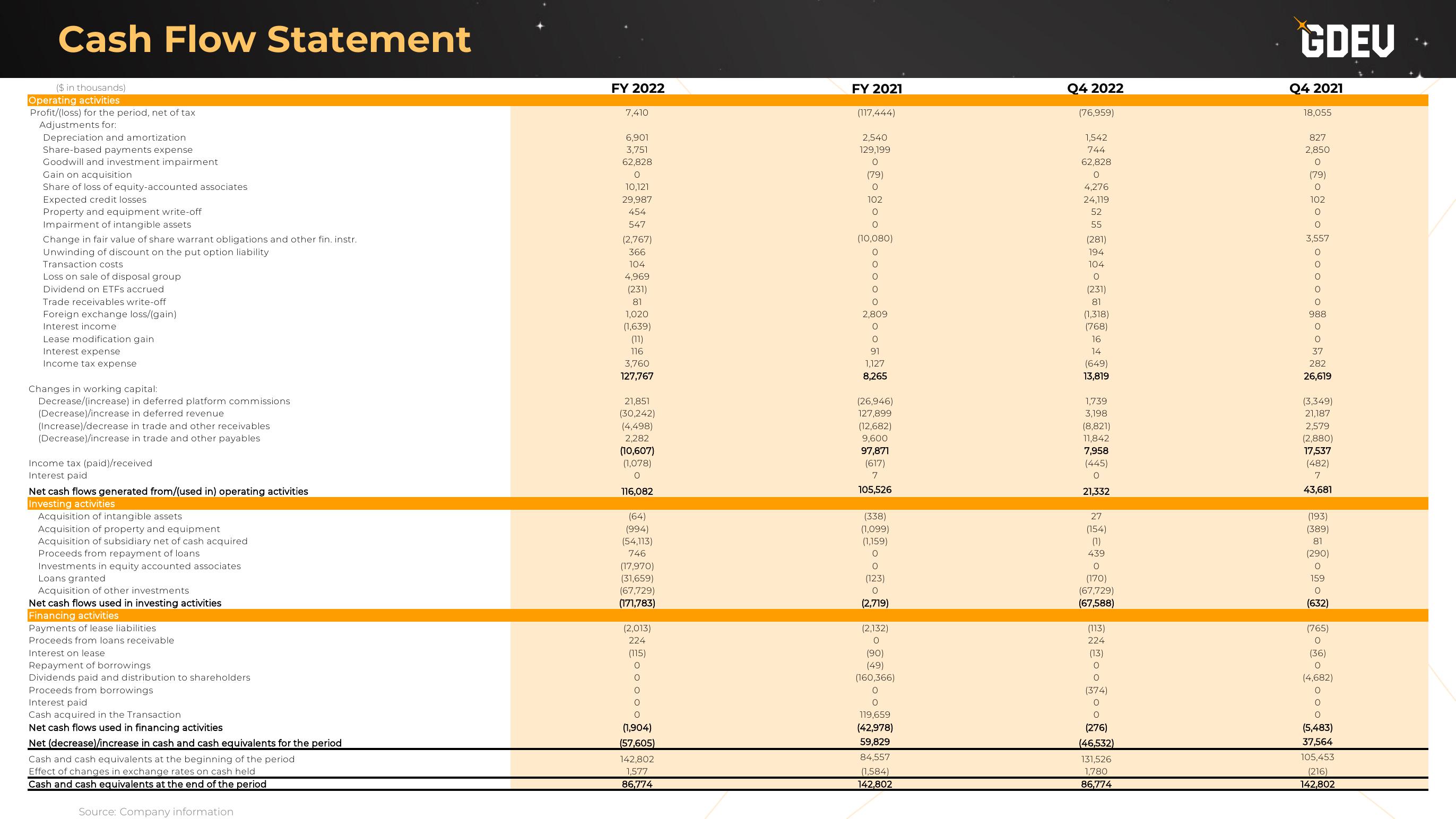

Cash Flow Statement

($ in thousands)

Operating activities

Profit/(loss) for the period, net of tax

Adjustments for:

Depreciation and amortization

Share-based payments expense

Goodwill and investment impairment

Gain on acquisition

Share of loss of equity-accounted associates

Expected credit losses.

Property and equipment write-off

Impairment of intangible assets

Change in fair value of share warrant obligations and other fin. instr.

Unwinding of discount on the put option liability

Transaction costs

Loss on sale of disposal group

Dividend on ETFS accrued

Trade receivables write-off

Foreign exchange loss/(gain)

Interest income

Lease modification gain

Interest expense

Income tax expense

Changes in working capital:

Decrease/(increase) in deferred platform commissions

(Decrease)/increase in deferred revenue

(Increase)/decrease in trade and other receivables

(Decrease)/increase in trade and other payables

Income tax (paid)/received

Interest paid

Net cash flows generated from/(used in) operating activities

Investing activities

Acquisition of intangible assets

Acquisition of property and equipment

Acquisition of subsidiary net of cash acquired

Proceeds from repayment of loans

Investments in equity accounted associates

Loans granted

Acquisition of other investments.

Net cash flows used in investing activities

Financing activities

Payments of lease liabilities

Proceeds from loans receivable

Interest on lease

Repayment of borrowings

Dividends paid and distribution to shareholders

Proceeds from borrowings

Interest paid

Cash acquired in the Transaction

Net cash flows used in financing activities

Net (decrease)/increase in cash and cash equivalents for the period

Cash and cash equivalents at the beginning of the period

Effect of changes in exchange rates on cash held

Cash and cash equivalents at the end of the period

Source: Company information

FY 2022

7,410

6,901

3,751

62,828

O

10,121

29,987

454

547

(2,767)

366

104

4,969

(231)

81

1,020

(1,639)

(11)

116

3,760

127,767

21,851

(30,242)

(4,498)

2,282

(10,607)

(1,078)

116,082

(64)

(994)

(54,113)

746

(17,970)

(31,659)

(67,729)

(171,783)

(2,013)

224

(115)

O

O

O

O

(1,904)

(57,605)

142,802

1,577

86,774

FY 2021

(117,444)

2,540

129,199

O

(79)

O

102

O

0

(10,080)

O o o o o

2,809

оо

91

1,127

8,265

(26,946)

127,899

(12,682)

9,600

97,871

(617)

7

105,526

(338)

(1,099)

(1,159)

o c

0

(123)

O

(2,719)

(2,132)

O

(90)

(49)

(160,366)

00

119,659

(42,978)

59,829

84,557

(1,584)

142,802

Q4 2022

(76,959)

1,542

744

62,828

O

4,276

24,119

52

55

(281)

194

104

O

(231)

81

(1,318)

(768)

16

14

(649)

13,819

1,739

3,198

(8,821)

11,842

7,958

(445)

O

21,332

27

(154)

(1)

439

O

(170)

(67,729)

(67,588)

(113)

224

(13)

O

O

(374)

O

O

(276)

(46,532)

131,526

1,780

86,774

GDEU

Q4 2021

18,055

827

2,850

ܪܐ

ܘ

ܘ

ܘ

ܘ

ܘ

ܘ

ܘ

ܘ

ܘ

ܘ

ܘ

O

(79)

O

102

O

O

3,557

O

O

0

O

988

O

37

282

26,619

(3,349)

21,187

2,579

(2,880)

17,537

(482)

7

43,681

(193)

(389)

81

(290)

O

159

O

(632)

(765)

O

(36)

O

(4,682)

ooo

(5,483)

37,564

105,453

(216)

142,802View entire presentation