Bank of America Investment Banking Pitch Book

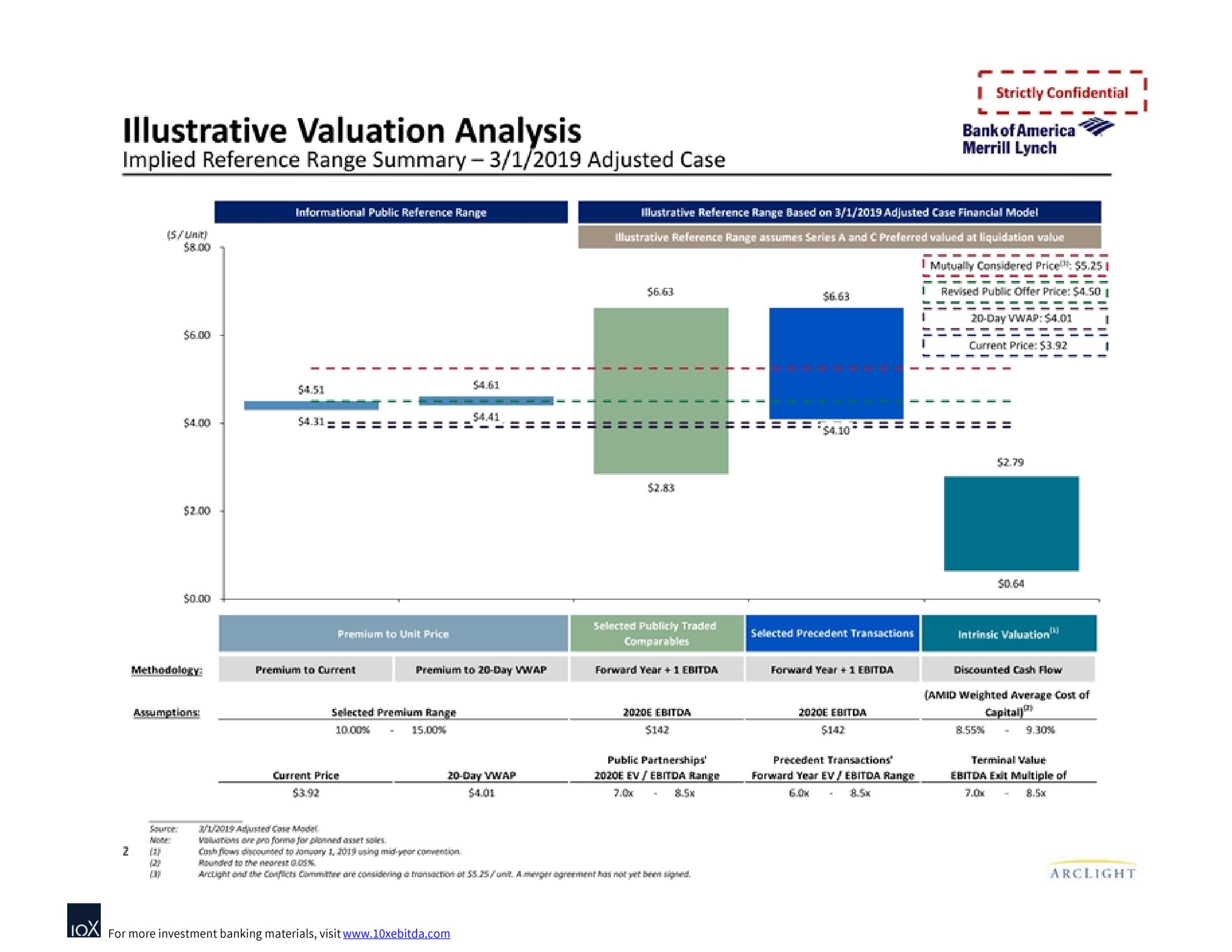

Illustrative Valuation Analysis

Implied Reference Range Summary - 3/1/2019 Adjusted Case

2

(S/Unit)

$8.00

$6.00

(AP

(2)

3)

$4.00

$2.00

$0.00

MethodologyE

Assumptions:

Informational Public Reference Range

$4.51

$4.31

II

Premium to Current

II

Current Price

$3.92

II

Premium to Unit Price

II

11

Selected Premium Range

10.00%

15.00%

$4.61

$4.41

11

Premium to 20-Day VWAP

LOX For more investment banking materials, visit www.10xebitda.com

20-Day VWAP

$4.01

11

II

T

I

T

I

illustrative Reference Range Based on 3/1/2019 Adjusted Case Financial Model

illustrative Reference Range assumes Series A and C Preferred valued at liquidation value

Mutually Considered Price: $5.25 |

Revised Public Offer Price: $4.50

20-Day VWAP: $4.01

Current Price: $3.92

I

$6.63

I

I

I

1

$2.83

2020E EBITDA

I

$142

|

Selected Publicly Traded

Comparables

3/1/2019 Adjusted Case Model

Valuations are pro forma for planned asset sales

Cashflows discounted to January 1, 2019 sing mid-year convention

Bounded to the nearest 0.05%

Arctight and the Conflicts Committee are considering transaction at 55.25/unt. Amerper ogreement has not yet been signed.

I

Forward Year + 1 EBITDA

I

8.5x

11

Public Partnerships'

2020E EV EBITDA Range

7,0x

I

I

I

II

1

II

II

11

11

$6.63

$4.10

"I

11

III

Selected Precedent Transactions

Forward Year + 1 EBITDA

2020E EBITDA

$142

Precedent Transactions"

Forward Year EV EBITDA Range

I

I

T

II

Bank of America

Merrill Lynch

I

II

Strictly Confidential

II

$2.79

$0.64

Intrinsic Valuation"

8.55%

Discounted Cash Flow

(AMID Weighted Average Cost of

Capital

9.30%

Terminal Value

EBITDA Exit Multiple of

7.0x

ARCLIGHTView entire presentation