Snap Inc Investor Presentation Deck

Snap Inc.

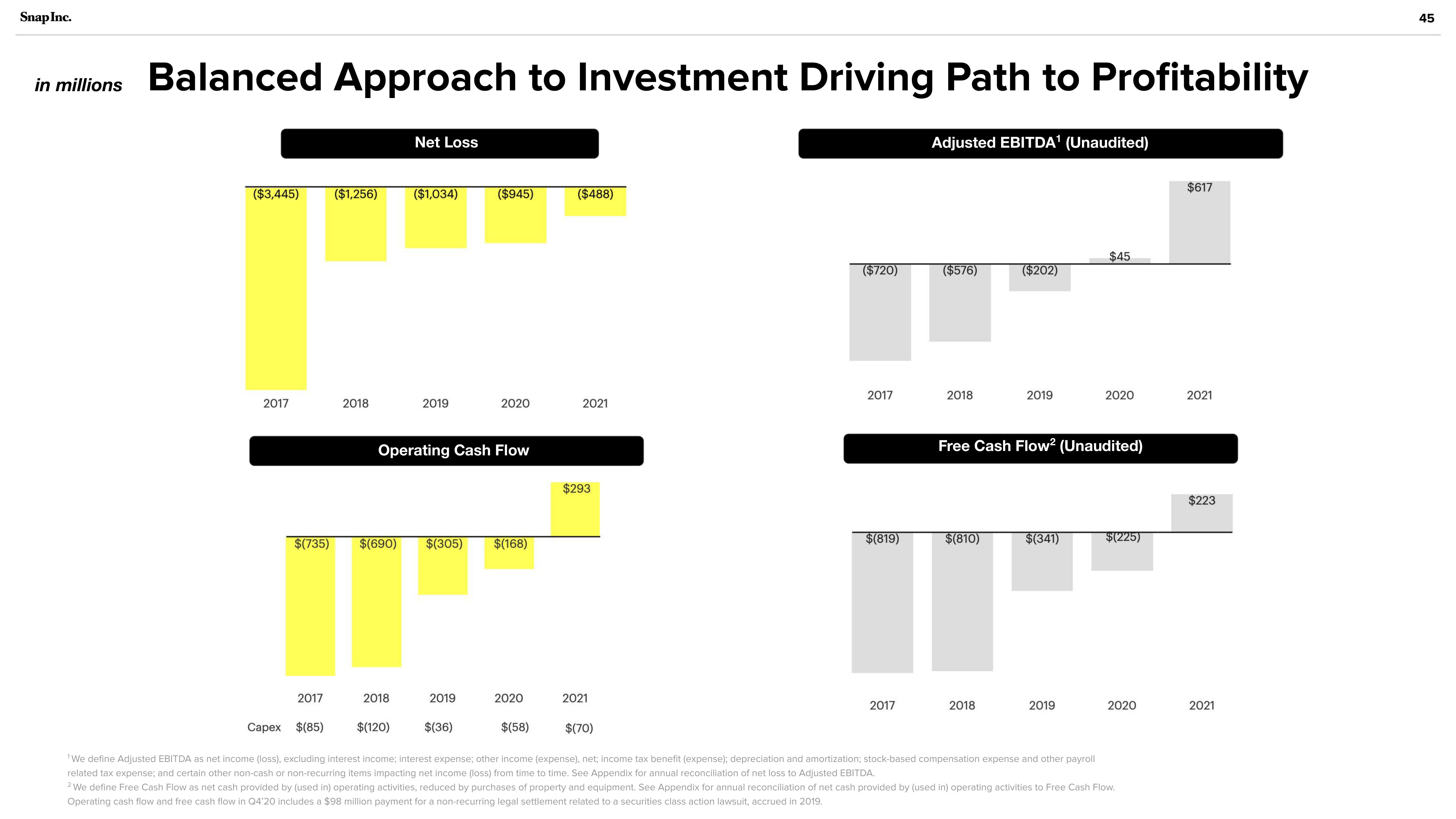

in millions Balanced Approach to Investment Driving Path to Profitability

($3,445)

2017

$(735)

2017

Capex $(85)

($1,256)

2018

$(690)

2018

Net Loss

$(120)

($1,034)

2019

Operating Cash Flow

$(305)

2019

($945)

$(36)

2020

$(168)

2020

$(58)

($488)

2021

$293

2021

$(70)

($720)

2017

$(819)

2017

Adjusted EBITDA¹ (Unaudited)

($576)

2018

$(810)

($202)

2018

2019

Free Cash Flow² (Unaudited)

$(341)

$45

2019

2020

$(225)

2020

¹We define Adjusted EBITDA as net income (loss), excluding interest income; interest expense; other income (expense), net; income tax benefit (expense); depreciation and amortization; stock-based compensation expense and other payroll

related tax expense; and certain other non-cash or non-recurring items impacting net income (loss) from time to time. See Appendix for annual reconciliation of net loss to Adjusted EBITDA.

2 We define Free Cash Flow as net cash provided by (used in) operating activities, reduced by purchases of property and equipment. See Appendix for annual reconciliation of net cash provided by (used in) operating activities to Free Cash Flow.

Operating cash flow and free cash flow in Q4'20 includes a $98 million payment for a non-recurring legal settlement related to a securities class action lawsuit, accrued in 2019.

$617

2021

$223

2021

45View entire presentation