Pershing Square Activist Presentation Deck

A. Pershing's Proposal: Assumptions

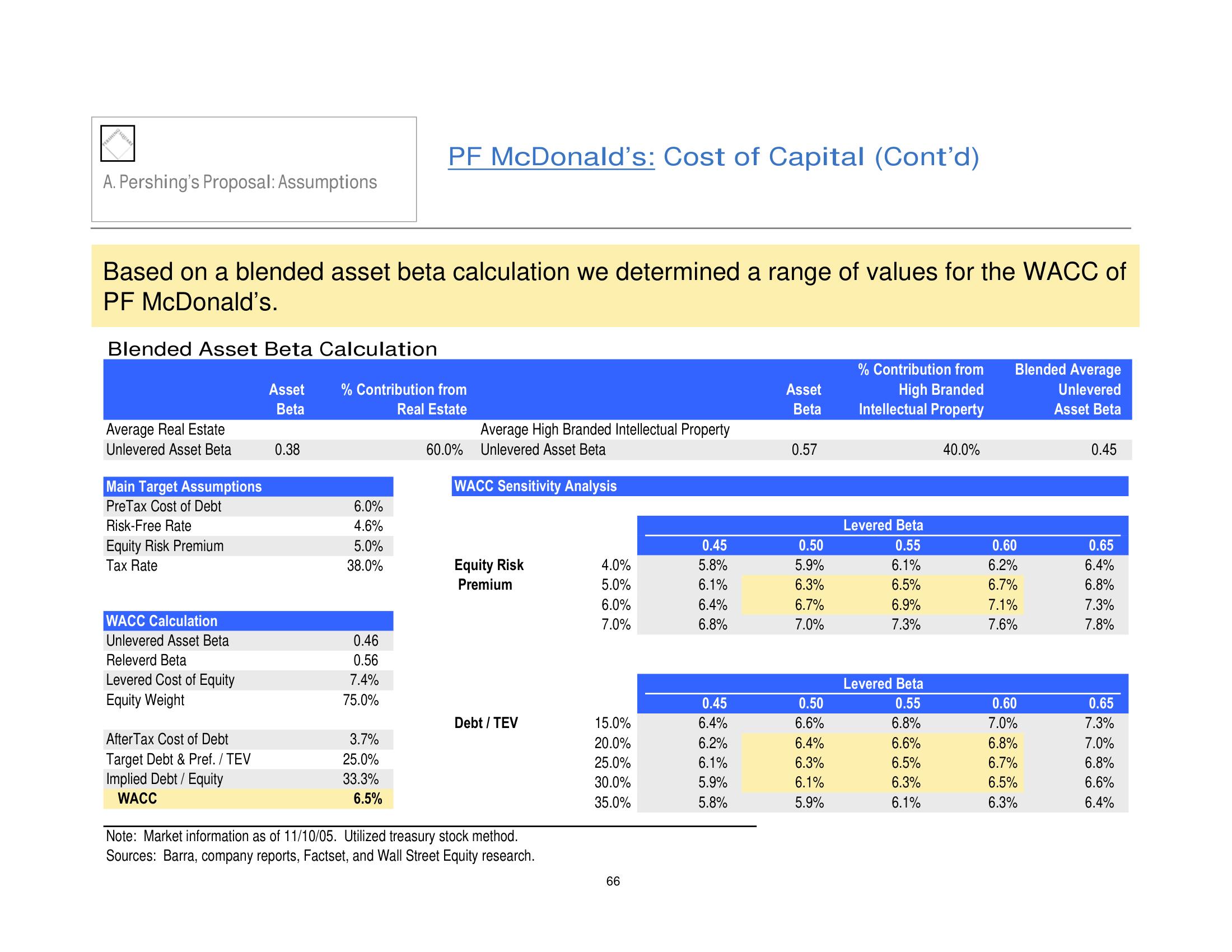

Based on a blended asset beta calculation we determined a range of values for the WACC of

PF McDonald's.

Blended Asset Beta Calculation

Asset

Beta

Average Real Estate

Unlevered Asset Beta

Main Target Assumptions

PreTax Cost of Debt

Risk-Free Rate

Equity Risk Premium

Tax Rate

WACC Calculation

Unlevered Asset Beta

Releverd Beta

Levered Cost of Equity

Equity Weight

After Tax Cost of Debt

Target Debt & Pref. / TEV

Implied Debt / Equity

WACC

0.38

% Contribution from

Real Estate

6.0%

4.6%

5.0%

38.0%

0.46

0.56

7.4%

75.0%

PF McDonald's: Cost of Capital (Cont'd)

3.7%

25.0%

33.3%

6.5%

Average High Branded Intellectual Property

60.0% Unlevered Asset Beta

WACC Sensitivity Analysis

Equity Risk

Premium

Debt / TEV

Note: Market information as of 11/10/05. Utilized treasury stock method.

Sources: Barra, company reports, Factset, and Wall Street Equity research.

4.0%

5.0%

6.0%

7.0%

15.0%

20.0%

25.0%

30.0%

35.0%

66

0.45

5.8%

6.1%

6.4%

6.8%

0.45

6.4%

6.2%

6.1%

5.9%

5.8%

Asset

Beta

0.57

0.50

5.9%

6.3%

6.7%

7.0%

0.50

6.6%

6.4%

6.3%

6.1%

5.9%

% Contribution from

High Branded

Intellectual Property

Levered Beta

0.55

6.1%

6.5%

6.9%

7.3%

Levered Beta

0.55

6.8%

6.6%

6.5%

6.3%

6.1%

40.0%

Blended Average

Unlevered

Asset Beta

0.60

6.2%

6.7%

7.1%

7.6%

0.60

7.0%

6.8%

6.7%

6.5%

6.3%

0.45

0.65

6.4%

6.8%

7.3%

7.8%

0.65

7.3%

7.0%

6.8%

6.6%

6.4%View entire presentation