3Q20 Earnings Call Presentation

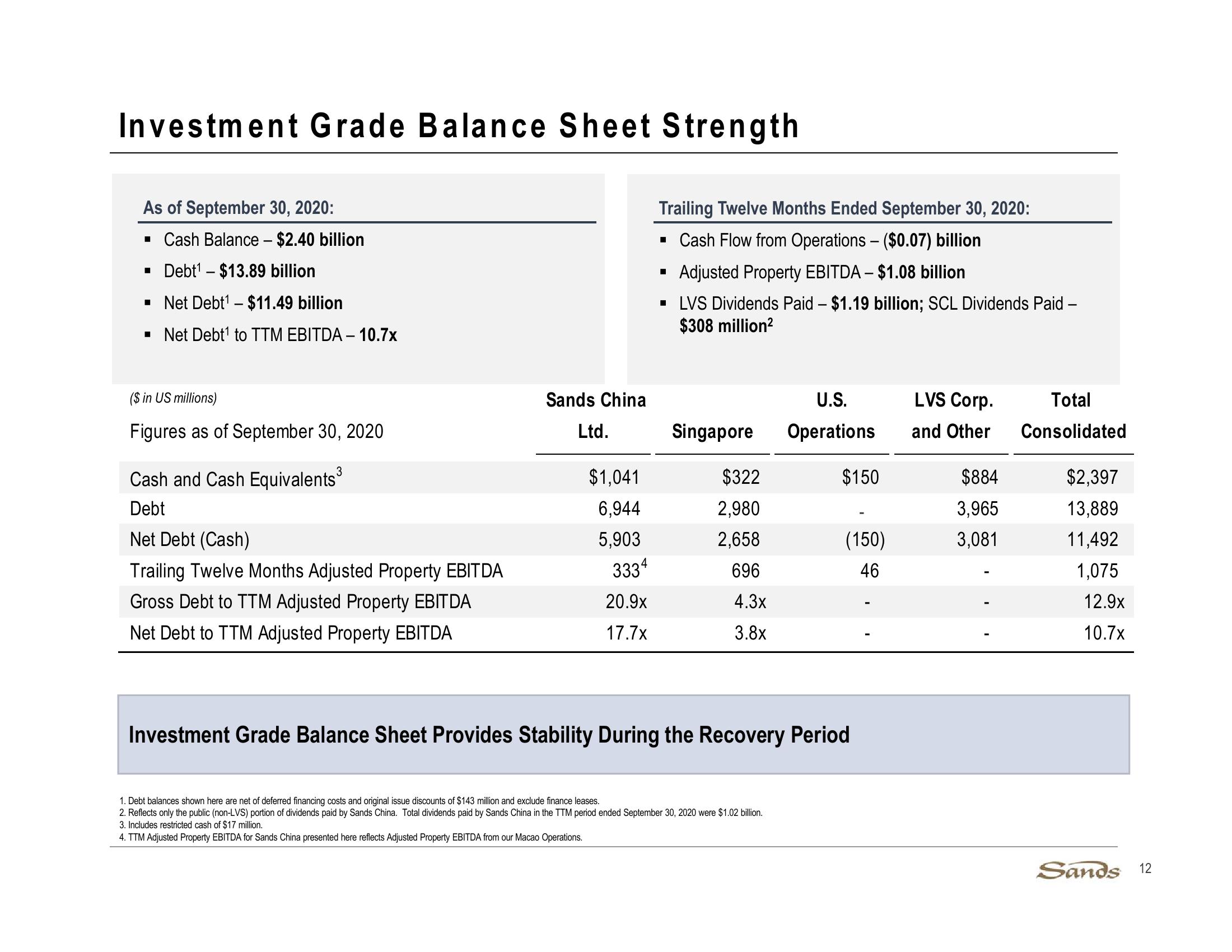

Investment Grade Balance Sheet Strength

As of September 30, 2020:

■ Cash Balance - $2.40 billion

■ Debt¹ - $13.89 billion

■ Net Debt¹ - $11.49 billion

■ Net Debt¹ to TTM EBITDA - 10.7x

Trailing Twelve Months Ended September 30, 2020:

■ Cash Flow from Operations – ($0.07) billion

◉

Adjusted Property EBITDA - $1.08 billion

■ LVS Dividends Paid - $1.19 billion; SCL Dividends Paid -

$308 million²

($ in US millions)

Sands China

U.S.

LVS Corp.

Total

Figures as of September 30, 2020

Ltd.

Singapore

Operations

and Other

Consolidated

Cash and Cash Equivalents³

$1,041

$322

$150

$884

$2,397

Debt

6,944

2,980

3,965

13,889

Net Debt (Cash)

5,903

2,658

(150)

3,081

11,492

Trailing Twelve Months Adjusted Property EBITDA

3334

696

46

1,075

Gross Debt to TTM Adjusted Property EBITDA

20.9x

4.3x

12.9x

Net Debt to TTM Adjusted Property EBITDA

17.7x

3.8x

10.7x

Investment Grade Balance Sheet Provides Stability During the Recovery Period

1. Debt balances shown here are net of deferred financing costs and original issue discounts of $143 million and exclude finance leases.

2. Reflects only the public (non-LVS) portion of dividends paid by Sands China. Total dividends paid by Sands China in the TTM period ended September 30, 2020 were $1.02 billion.

3. Includes restricted cash of $17 million.

4. TTM Adjusted Property EBITDA for Sands China presented here reflects Adjusted Property EBITDA from our Macao Operations.

Sands 12View entire presentation