NioCorp Investor Presentation Deck

Classification

●

Proven

Probable

.

TOTAL

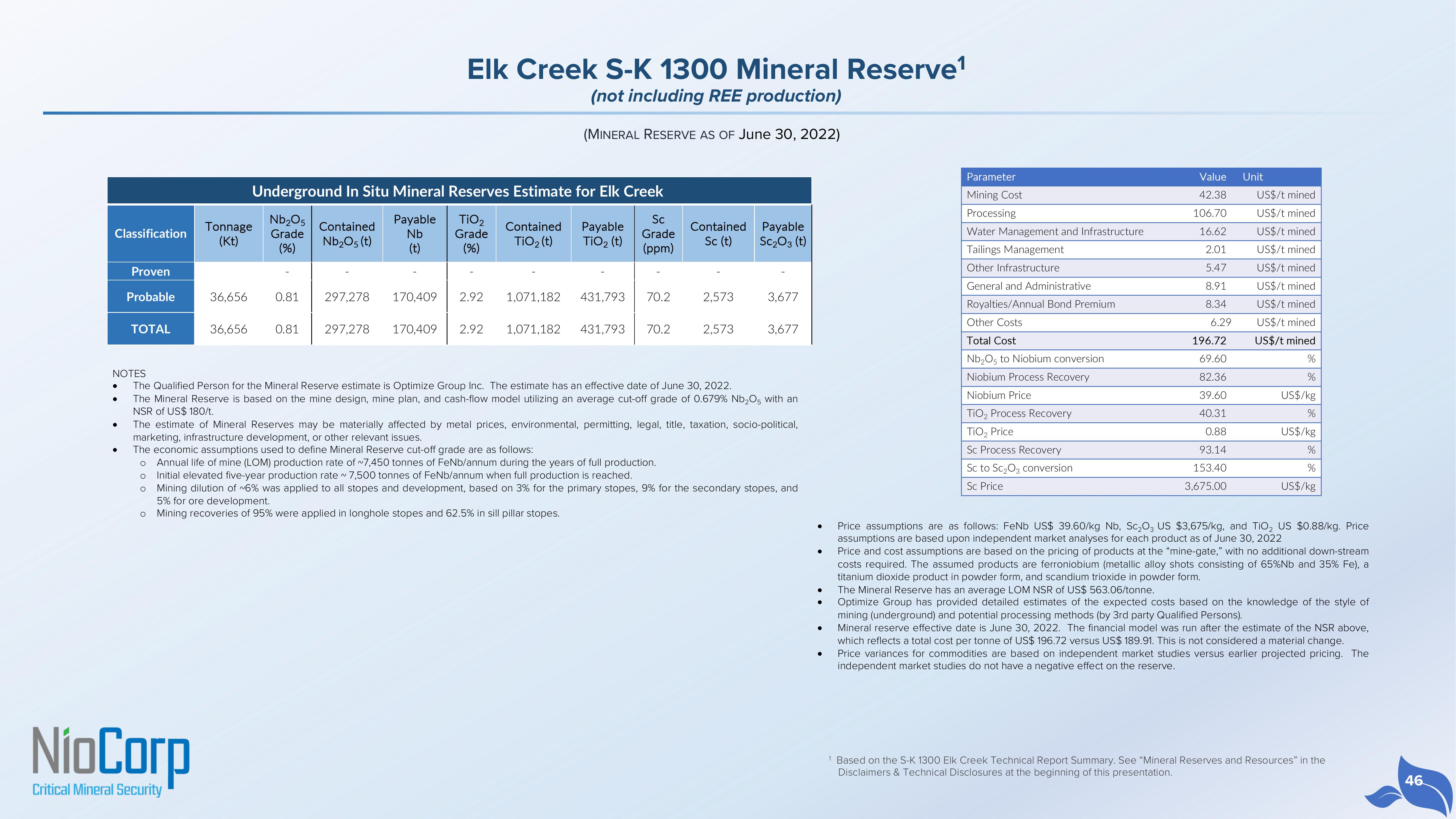

Underground In Situ Mineral Reserves Estimate for Elk Creek

Payable

Nb

(t)

TiO₂

Grade

(%)

Tonnage

(Kt)

Nb₂05

Grade

(%)

NioCorp

Critical Mineral Security

36,656 0.81

36,656 0.81

Contained

Nb₂O5 (t)

297,278

Elk Creek S-K 1300 Mineral Reserve¹

(not including REE production)

(MINERAL RESERVE AS OF June 30, 2022)

297,278

170,409 2.92

170,409 2.92

Contained Payable

TiO₂ (t) TiO₂ (t)

1,071,182

1,071,182

431,793

Sc

Grade

(ppm)

70.2

431,793 70.2

Contained Payable

Sc (t) Sc₂O3 (t)

2,573

2.573

NOTES

The Qualified Person for the Mineral Reserve estimate is Optimize Group Inc. The estimate has an effective date of June 30, 2022.

The Mineral Reserve is based on the mine design, mine plan, and cash-flow model utilizing an average cut-off grade of 0.679% Nb₂O5 with an

NSR of US$ 180/t.

3.677

3,677

The estimate of Mineral Reserves may be materially affected by metal prices, environmental, permitting, legal, title, taxation, socio-political,

marketing, infrastructure development, or other relevant issues.

The economic assumptions used to define Mineral Reserve cut-off grade are as follows:

O Annual life of mine (LOM) production rate of ~7,450 tonnes of FeNb/annum during the years of full production.

O Initial elevated five-year production rate ~ 7,500 tonnes of FeNb/annum when full production is reached.

O Mining dilution of ~6% was applied to all stopes and development, based on 3% for the primary stopes, 9% for the secondary stopes, and

5% for ore development.

O Mining recoveries of 95% were applied in longhole stopes and 62.5% in sill pillar stopes.

●

Parameter

Mining Cost

Processing

Water Management and Infrastructure.

Tailings Management

Other Infrastructure

General and Administrative

Royalties/Annual Bond Premium

Other Costs

Total Cost

Nb₂O5 to Niobium conversion

Niobium Process Recovery

Niobium Price

TiO₂ Process Recovery

TiO₂ Price

Sc Process Recovery

Sc to Sc₂O3 conversion

Sc Price

Value

42.38

106.70

16.62

2.01

5.47

8.91

8.34

6.29

196.72

69.60

82.36

39.60

40.31

0.88

93.14

153.40

3,675.00

Unit

US$/t mined

US$/t mined

US$/t mined

US$/t mined

US$/t mined

US$/t mined

US$/t mined

US$/t mined

US$/t mined

%

%

US$/kg

%

US$/kg

%

%

US$/kg

Price assumptions are as follows: FeNb US$ 39.60/kg Nb, Sc₂O3 US $3,675/kg, and TiO₂ US $0.88/kg. Price

assumptions are based upon independent market analyses for each product as of June 30, 2022

Price and cost assumptions are based on the pricing of products at the "mine-gate," with no additional down-stream

costs required. The assumed products are ferroniobium (metallic alloy shots consisting of 65% Nb and 35% Fe), a

titanium dioxide product in powder form, and scandium trioxide in powder form.

The Mineral Reserve has an average LOM NSR of US$ 563.06/tonne.

Optimize Group has provided detailed estimates of the expected costs based on the knowledge of the style of

mining (underground) and potential processing methods (by 3rd party Qualified Persons).

Mineral reserve effective date is June 30, 2022. The financial model was run after the estimate of the NSR above,

which reflects a total cost per tonne of US$ 196.72 versus US$ 189.91. This is not considered a material change.

Price variances for commodities are based on independent market studies versus earlier projected pricing. The

independent market studies do not have a negative effect on the reserve.

¹ Based on the S-K 1300 Elk Creek Technical Report Summary. See "Mineral Reserves and Resources" in the

Disclaimers & Technical Disclosures at the beginning of this presentation.

46View entire presentation