Baird Investment Banking Pitch Book

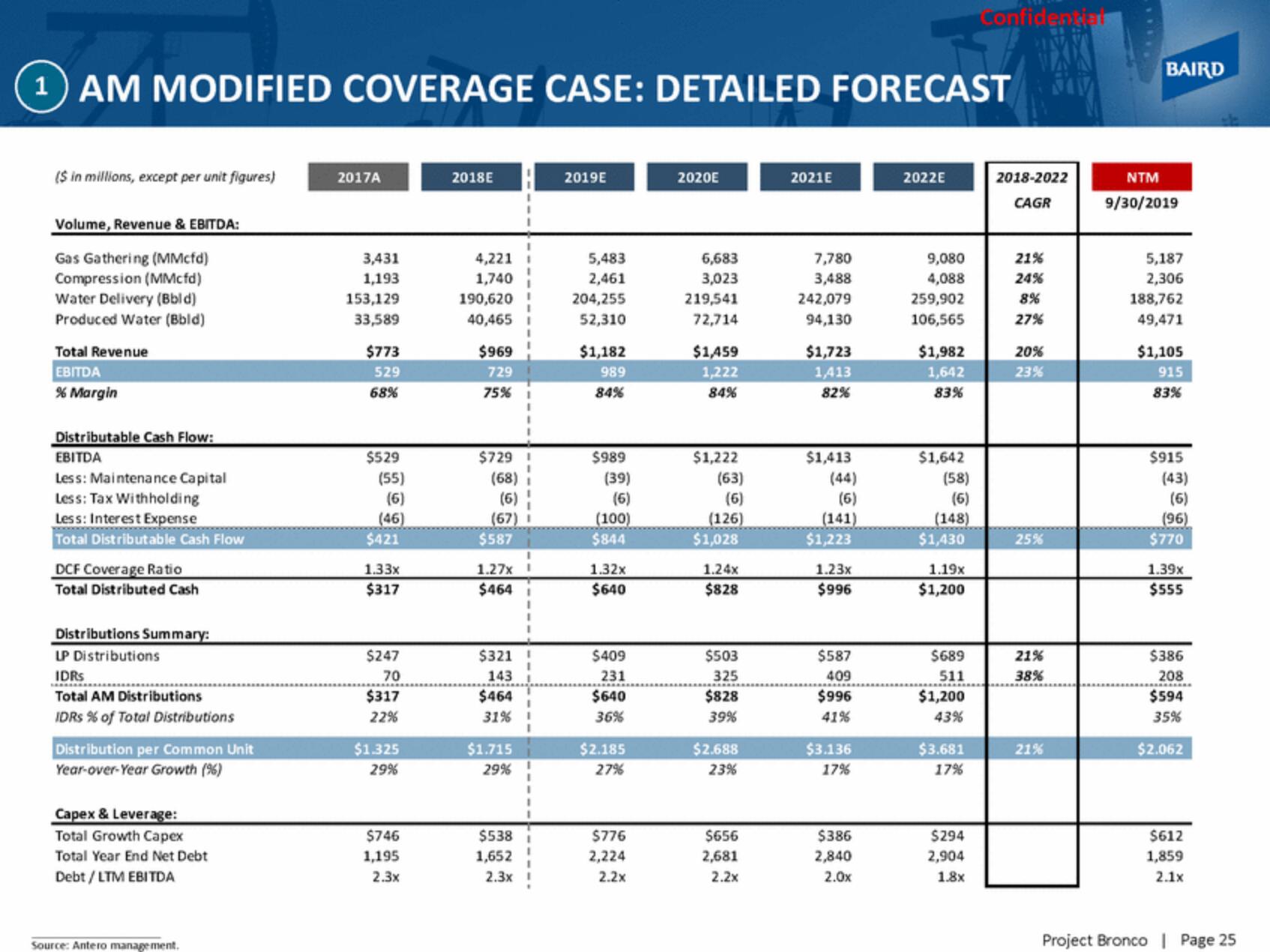

1 AM MODIFIED COVERAGE CASE: DETAILED FORECAST

($ in millions, except per unit figures)

Volume, Revenue & EBITDA:

Gas Gathering (MMcfd)

Compression (MMcfd)

Water Delivery (Bbld)

Produced Water (Bbld)

Total Revenue

EBITDA

% Margin

Distributable Cash Flow:

EBITDA

Less: Maintenance Capital

Less: Tax Withholding

Less: Interest Expense

Total Distributable Cash Flow

DCF Coverage Ratio

Total Distributed Cash

Distributions Summary:

LP Distributions

IDRS

*******

Total AM Distributions

IDRS % of Total Distributions

Distribution per Common Unit

Year-over-Year Growth (%)

Capex & Leverage:

Total Growth Capex

Total Year End Net Debt

Debt/LTM EBITDA

Source: Antero management.

2017A

3,431

1,193

153,129

33,589

$773

529

68%

$529

(55)

(6)

(46)

$421

1.33x

$317

$247

70

$317

22%

$1.325

29%

$746

1,195

2.3x

2018E

4,221

1,740

190,620

40,465

$969

729

75%

$729 1

(68)

(6)

(67)

$587

1.27x

$464

$32

143

$464

31%

$1.715

29%

$538

1,652

2.3x

I

2019E

5,483

2,461

204,255

52,310

$1,182

989

84%

$989

(39)

(6)

(100)

$844

1.32x

$640

$409

231

$640

36%

$2.185

27%

$776

2,224

2.2x

2020E

6,683

3,023

219,541

72,714

$1,459

1,222

84%

$1,222

(63)

(6)

(126)

$1,028

1.24x

$828

325

$828

39%

$2.688

23%

$656

2,681

2.2x

2021E

7,780

3,488

242,079

94,130

$1,723

1,413

82%

$1,413

(6)

(141)

$1,223

1.23x

$996

$587

409

$996

41%

$3.136

17%

$386

2,840

2.0x

2022E

9,080

4,088

259,902

106,565

$1,982

1,642

83%

$1,642

(58)

(6)

(148)

$1,430

1.19x

$1,200

511

$1,200

43%

$3.681

17%

Confidential

$294

2,904

1.8x

2018-2022

CAGR

21%

24%

8%

27%

20%

23%

25%

38%

21%

BAIRD

NTM

9/30/2019

5,187

2,306

188,762

49,471

$1,105

915

83%

$915

(43)

(6)

(96)

$770

1.39x

$555

$386

208

$594

35%

$2.062

$612

1,859

2.1x

Project Bronco | Page 25View entire presentation