Deutsche Bank Results Presentation Deck

Private Bank

In € m, unless stated otherwise

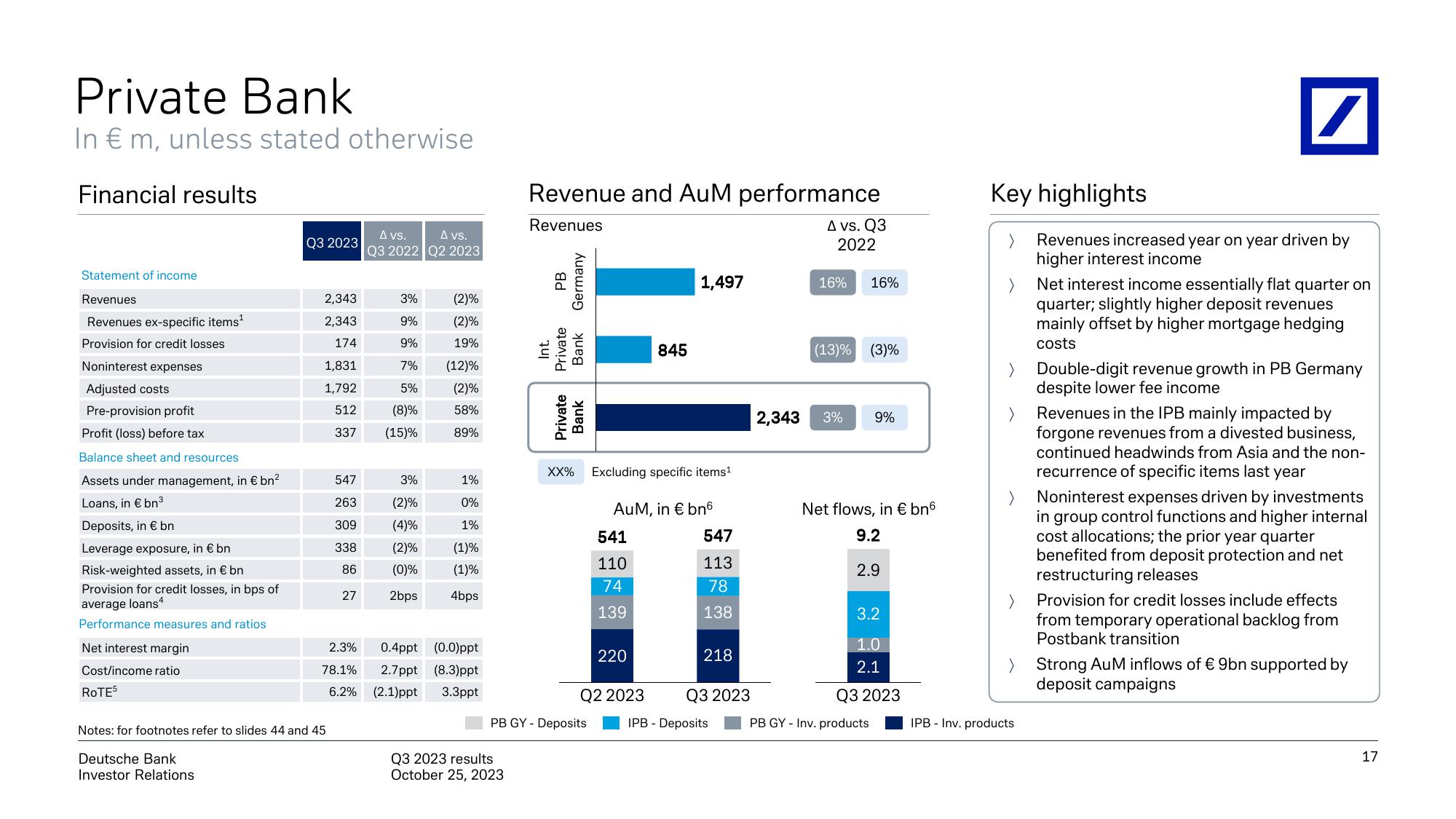

Financial results

Statement of income

Revenues

Revenues ex-specific items¹

Provision for credit losses

Noninterest expenses

Adjusted costs

Pre-provision profit

Profit (loss) before tax

Balance sheet and resources

Assets under management, in € bn²

Loans, in € bn³

Deposits, in € bn

Leverage exposure, in € bn.

Risk-weighted assets, in € bn

Provision for credit losses, in bps of

average loans4

Performance measures and ratios.

Net interest margin

Cost/income ratio.

ROTE5

Q3 2023

Deutsche Bank

Investor Relations

2,343

2,343

174

1,831

1,792

512

337

Notes: for footnotes refer to slides 44 and 45

547

263

309

338

86

27

2.3%

78.1%

6.2%

A vs.

A vs.

Q3 2022 Q2 2023

3%

(2)%

9%

(2)%

9%

19%

7% (12)%

5%

(2)%

(8)%

58%

(15)%

89%

3%

1%

(2)%

0%

(4)%

1%

(2)%

(1)%

(0)%

(1)%

2bps 4bps

0.4ppt (0.0)ppt

2.7 ppt (8.3)ppt

(2.1)ppt 3.3ppt

Revenue and AuM performance

Revenues

Q3 2023 results

October 25, 2023

PB

Germany

Int.

Private

Bank

Private

Bank

PB GY- Deposits

XX% Excluding specific items¹

541

110

74

139

845

AuM, in € bn6

220

Q2 2023

1,497

547

113

78

138

218

Q3 2023

IPB - Deposits

2,343

A vs. Q3

2022

16% 16%

(13)% (3)%

3% 9%

Net flows, in € bn6

9.2

2.9

3.2

1.0

2.1

Q3 2023

PB GY - Inv. products

Key highlights

IPB Inv. products

/

Revenues increased year on year driven by

higher interest income

Net interest income essentially flat quarter on

quarter; slightly higher deposit revenues

mainly offset by higher mortgage hedging

costs

Double-digit revenue growth in PB Germany

despite lower fee income

Revenues in the IPB mainly impacted by

forgone revenues from a divested business,

continued headwinds from Asia and the non-

recurrence of specific items last year

Noninterest expenses driven by investments

in group control functions and higher internal

cost allocations; the prior year quarter

benefited from deposit protection and net

restructuring releases

Provision for credit losses include effects

from temporary operational backlog from

Postbank transition

Strong AuM inflows of € 9bn supported by

deposit campaigns

17View entire presentation