Factset Mergers and Acquisitions Presentation Deck

FACTSET

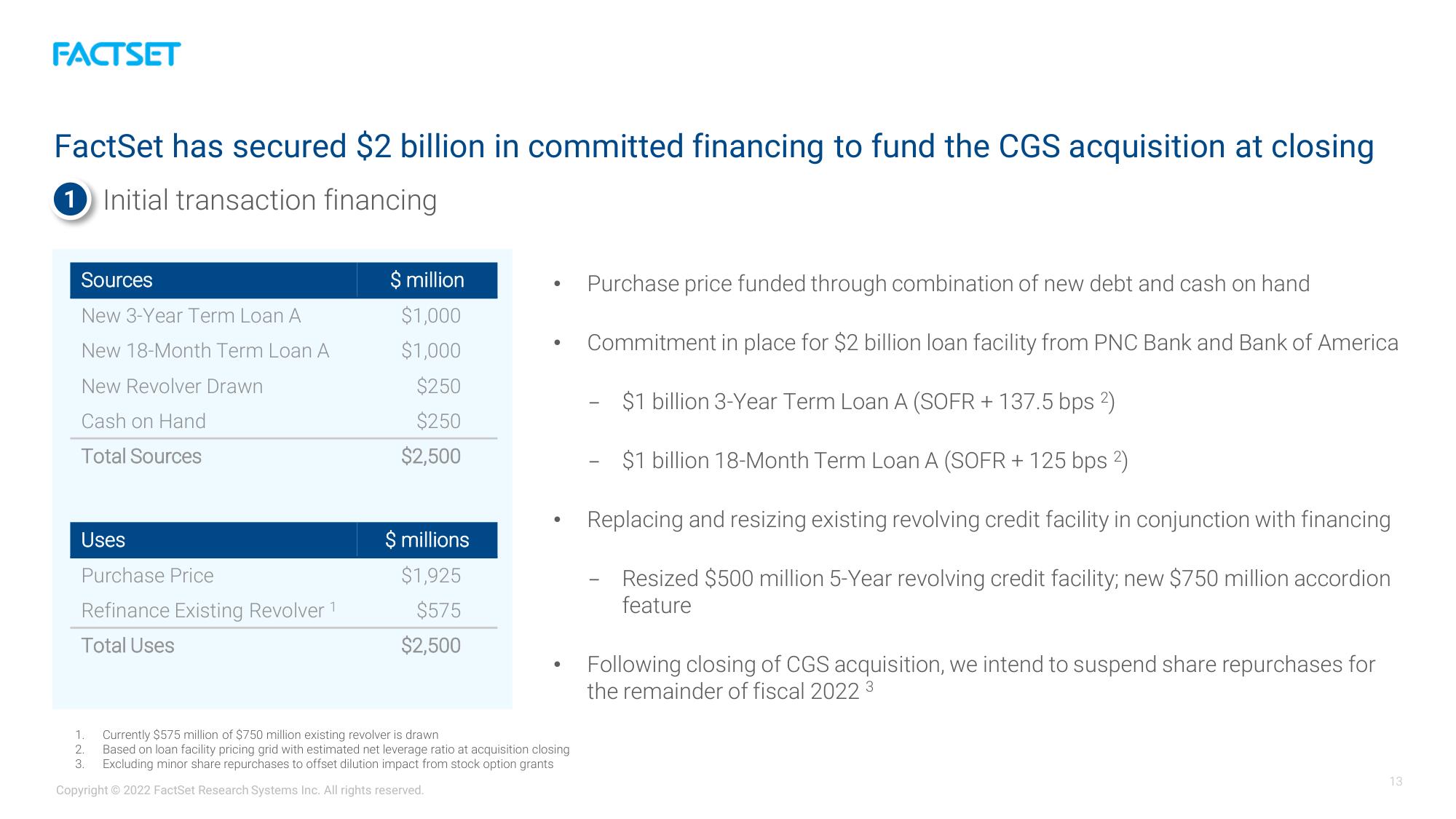

FactSet has secured $2 billion in committed financing to fund the CGS acquisition at closing

1 Initial transaction financing

Sources

New 3-Year Term Loan A

New 18-Month Term Loan A

New Revolver Drawn

Cash on Hand

Total Sources

Uses

Purchase Price

Refinance Existing Revolver 1

Total Uses

$ million

$1,000

$1,000

$250

$250

$2,500

$ millions

$1,925

$575

$2,500

●

●

1.

Currently $575 million of $750 million existing revolver is drawn

2.

Based on loan facility pricing grid with estimated net leverage ratio at acquisition closing

3. Excluding minor share repurchases to offset dilution impact from stock option grants

Copyright © 2022 FactSet Research Systems Inc. All rights reserved.

Purchase price funded through combination of new debt and cash on hand

Commitment in place for $2 billion loan facility from PNC Bank and Bank of America

$1 billion 3-Year Term Loan A (SOFR + 137.5 bps ²)

$1 billion 18-Month Term Loan A (SOFR + 125 bps 2)

Replacing and resizing existing revolving credit facility in conjunction with financing

Resized $500 million 5-Year revolving credit facility; new $750 million accordion

feature

Following closing of CGS acquisition, we intend to suspend share repurchases for

the remainder of fiscal 2022 3

13View entire presentation