Sainsbury's Credit Presentation Deck

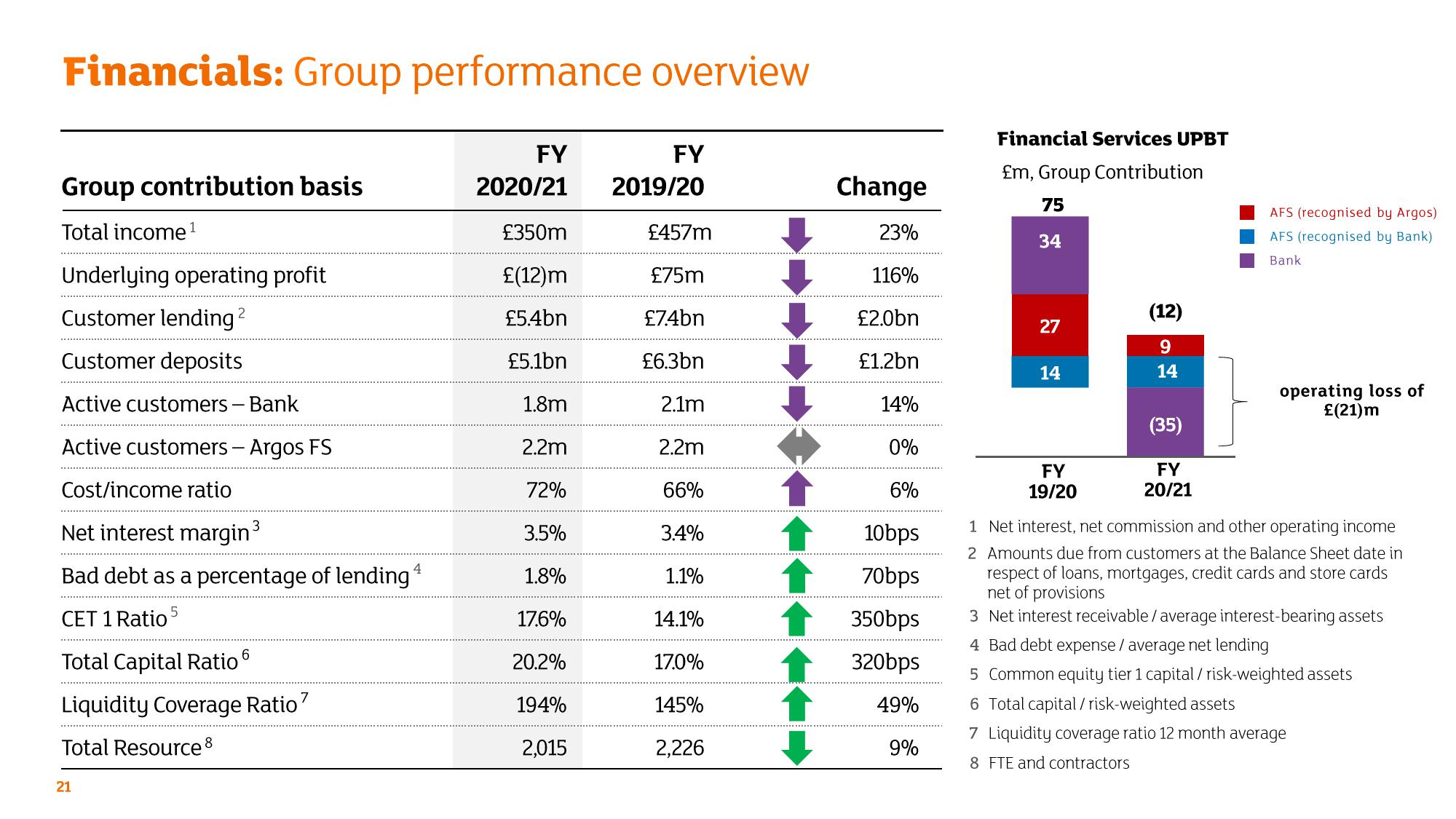

Financials: Group performance overview

Group contribution basis

Total income ¹

Underlying operating profit

2

Customer lending ²

Customer deposits

Active customers - Bank

Active customers - Argos FS

Cost/income ratio

Net interest margin ³

Bad debt as a percentage of lending 4

CET 1 Ratio 5

Total Capital Ratio 6

Liquidity Coverage Ratio"

Total Resource 8

21

FY

FY

2020/21 2019/20

£350m

£(12)m

£5.4bn

£5.1bn

1.8m

2.2m

72%

3.5%

1.8%

17.6%

20.2%

194%

2,015

£457m

£75m

£7.4bn

£6.3bn

2.1m

2.2m

66%

3.4%

1.1%

14.1%

17.0%

145%

2,226

Change

23%

116%

£2.0bn

£1.2bn

14%

0%

6%

10bps

70bps

350bps

320bps

49%

9%

Financial Services UPBT

£m, Group Contribution

75

34

27

14

FY

19/20

(12)

9

14

(35)

FY

20/21

AFS (recognised by Argos)

AFS (recognised by Bank)

Bank

operating loss of

£(21)m

1 Net interest, net commission and other operating income

2 Amounts due from customers at the Balance Sheet date in

respect of loans, mortgages, credit cards and store cards

net of provisions

3 Net interest receivable / average interest-bearing assets

4 Bad debt expense / average net lending

5 Common equity tier 1 capital / risk-weighted assets

6 Total capital/risk-weighted assets

7 Liquidity coverage ratio 12 month average

8 FTE and contractorsView entire presentation