Ginkgo Results Presentation Deck

Ginkgo is in a stronger position now vs. any time in our history

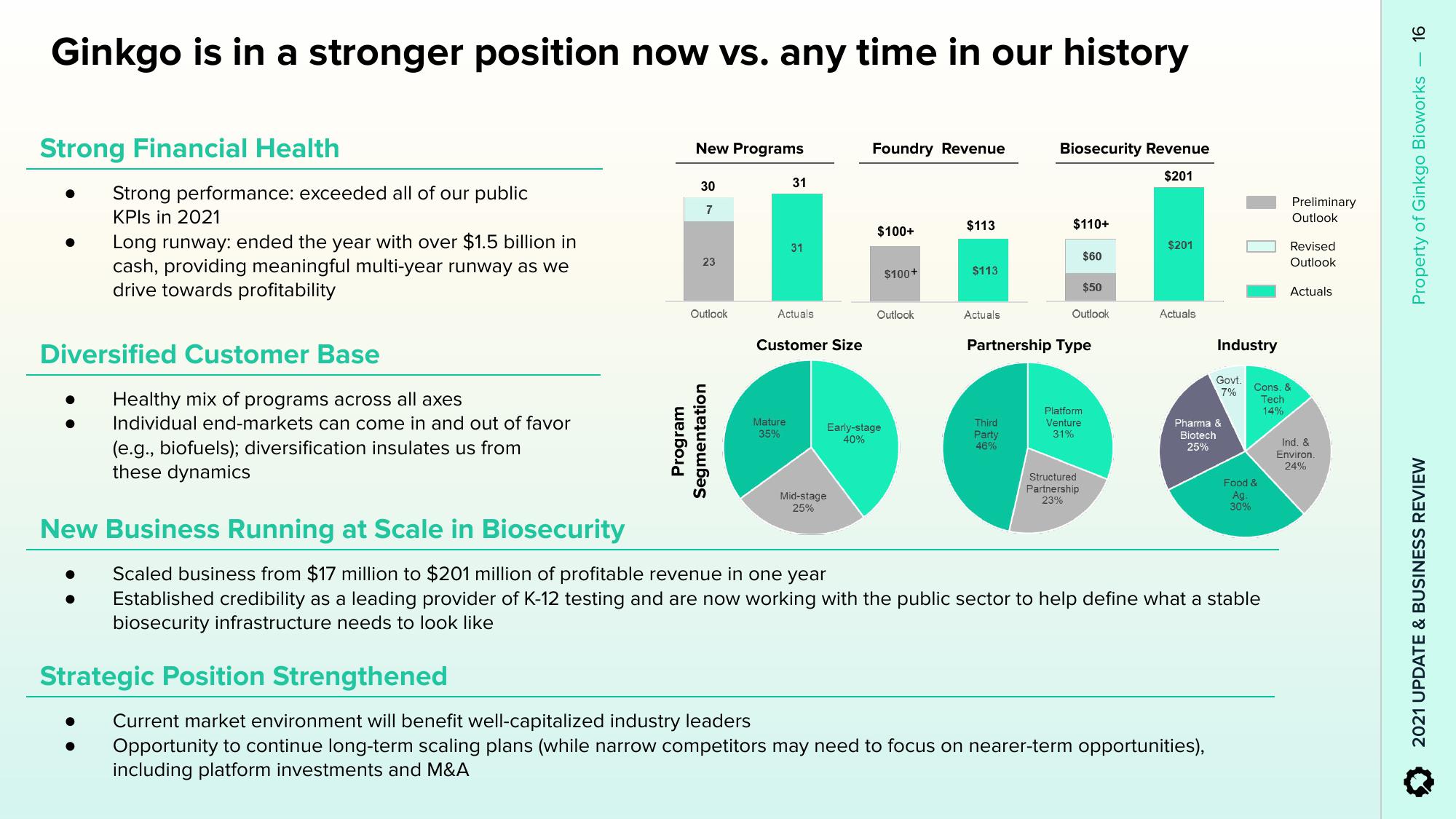

Strong Financial Health

Strong performance: exceeded all of our public

KPIs in 2021

Long runway: ended the year with over $1.5 billion in

cash, providing meaningful multi-year runway as we

drive towards profitability

Diversified Customer Base

Healthy mix of programs across all axes

Individual end-markets can come in and out of favor

(e.g., biofuels); diversification insulates us from

these dynamics

New Business Running at Scale in Biosecurity

New Programs

Strategic Position Strengthened

30

7

23

Outlook

Program

Segmentation

31

31

Actuals

Mature

35%

Customer Size

Mid-stage

25%

Foundry Revenue

$100+

$100+

Outlook

Early-stage

40%

$113

$113

Actuals

Biosecurity Revenue

$201

Third

Party

46%

$110+

$60

$50

Outlook

Partnership Type

Structured

Partnership

23%

Platform

Venture

31%

$201

Actuals

Industry

Govt.

7%

Pharma &

Biotech

25%

Current market environment will benefit well-capitalized industry leaders

Opportunity to continue long-term scaling plans (while narrow competitors may need to focus on nearer-term opportunities),

including platform investments and M&A

Scaled business from $17 million to $201 million of profitable revenue in one year

Established credibility as a leading provider of K-12 testing and are now working with the public sector to help define what a stable

biosecurity infrastructure needs to look like

Food &

Ag.

30%

Cons. &

Tech

14%

Preliminary

Outlook

Revised

Outlook

Actuals

Ind. &

Environ.

24%

16

Property of Ginkgo Bioworks

2021 UPDATE & BUSINESS REVIEWView entire presentation