Opendoor SPAC Presentation Deck

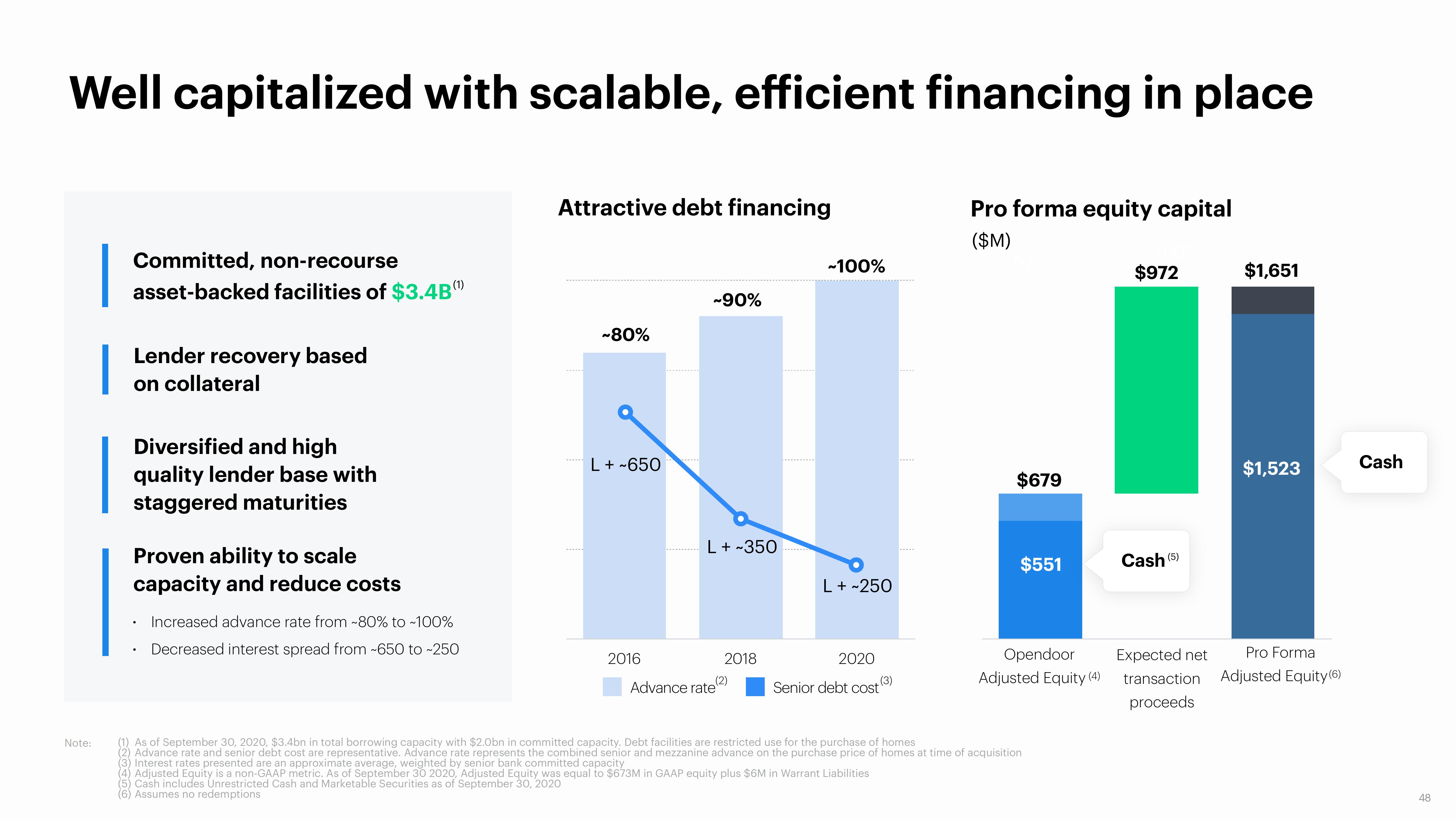

Well capitalized with scalable, efficient financing in place

Note:

Committed, non-recourse

asset-backed facilities of $3.4B(¹)

Lender recovery based

on collateral

Diversified and high

quality lender base with

staggered maturities

Proven ability to scale

capacity and reduce costs

. Increased advance rate from ~80% to -100%

Decreased interest spread from ~650 to -250

Attractive debt financing

~80%

L+~650

2016

~90%

L + ~350

2018

(2)

Advance rate"

-100%

L + ~250

2020

Senior debt cost

(3)

Pro forma equity capital

($M)

$679

$551

Opendoor

Adjusted Equity (4)

(1) As of September 30, 2020, $3.4bn in total borrowing capacity with $2.0bn in committed capacity. Debt facilities are restricted use for the purchase of homes

(2) Advance rate and senior debt cost are representative. Advance rate represents the combined senior and mezzanine advance on the purchase price of homes at time of acquisition

(3) Interest rates presented are an approximate average, weighted by senior bank committed capacity

(4) Adjusted Equity is a non-GAAP metric. As of September 30 2020, Adjusted Equity was equal to $673M in GAAP equity plus $6M in Warrant Liabilities

(5) Cash includes Unrestricted Cash and Marketable Securities as of September 30, 2020

(6) Assumes no redemptions

$972

Cash (5)

Expected net

transaction

proceeds

$1,651

$1,523

Pro Forma

Adjusted Equity (6)

Cash

48View entire presentation