Moelis & Company Investment Banking Pitch Book

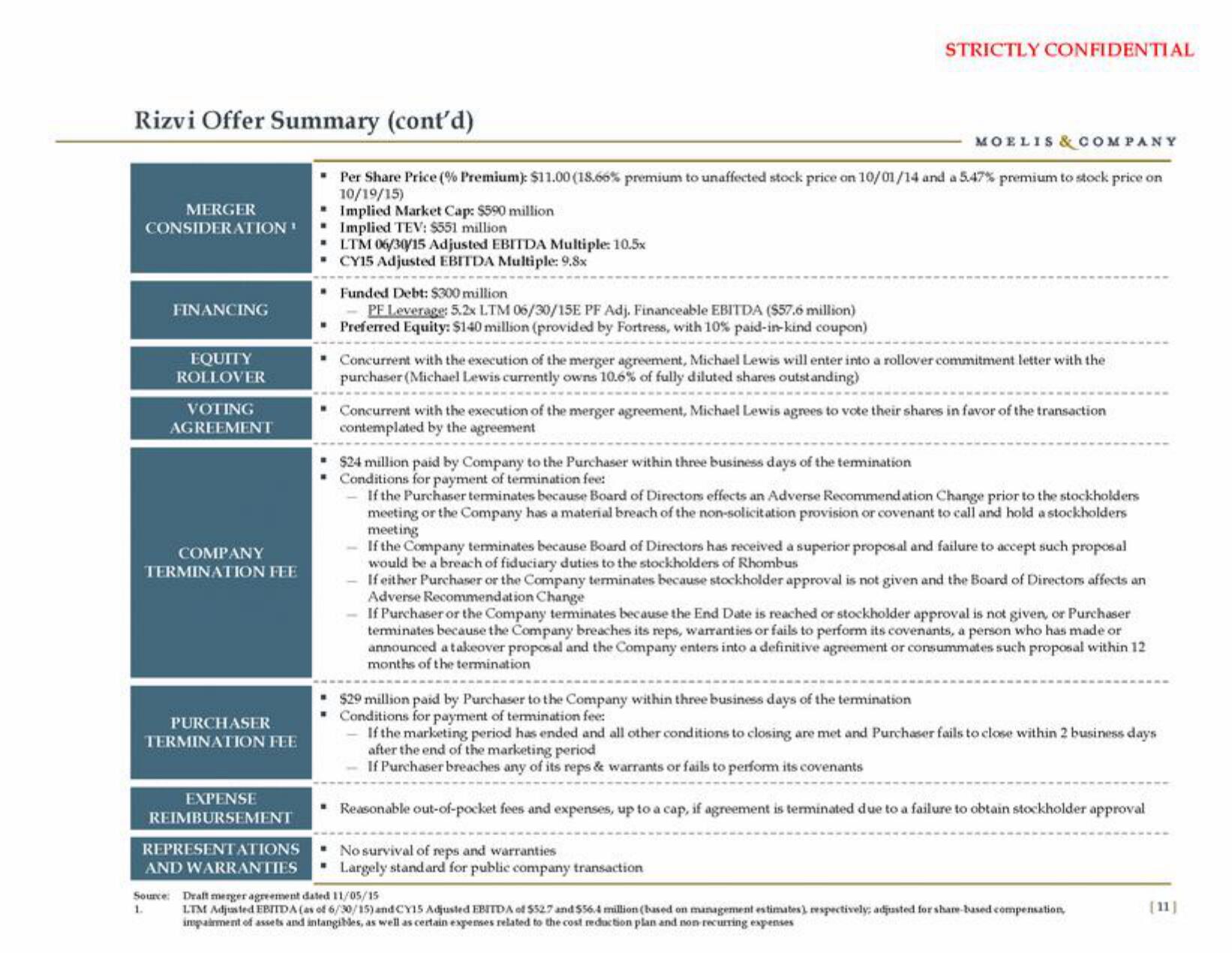

Rizvi Offer Summary (cont'd)

MERGER

CONSIDERATION ¹

FINANCING

EQUITY

ROLLOVER

VOTING

AGREEMENT

COMPANY

TERMINATION FEE

PURCHASER

TERMINATION FEE

EXPENSE

REIMBURSEMENT

REPRESENTATIONS

AND WARRANTIES

MOELIS & COMPANY

▪ Per Share Price (% Premium): $11.00 (18.66% premium to unaffected stock price on 10/01/14 and a 5.47% premium to stock price on

10/19/15)

Implied Market Cap: $590 million

Implied TEV: $551 million

LTM 06/30/15 Adjusted EBITDA Multiple: 10.5x

CY15 Adjusted EBITDA Multiple: 9.8x

STRICTLY CONFIDENTIAL

Funded Debt: $300 million

PF Leverage: 5.2x LTM 06/30/15E PF Adj. Financeable EBITDA ($57.6 million)

Preferred Equity: $140 million (provided by Fortress, with 10% paid-in-kind coupon)

Concurrent with the execution of the merger agreement, Michael Lewis will enter into a rollover commitment letter with the

purchaser (Michael Lewis currently owns 10.6% of fully diluted shares outstanding)

Concurrent with the execution of the merger agreement, Michael Lewis agrees to vote their shares in favor of the transaction

contemplated by the agreement

$24 million paid by Company to the Purchaser within three business days of the termination

Conditions for payment of termination fee:

-If the Purchaser terminates because Board of Directors effects an Adverse Recommendation Change prior to the stockholders

meeting or the Company has a material breach of the non-solicitation provision or covenant to call and hold a stockholders

meeting

-If the Company terminates because Board of Directors has received a superior proposal and failure to accept such proposal

would be a breach of fiduciary duties to the stockholders of Rhombus

- If either Purchaser or the Company terminates because stockholder approval is not given and the Board of Directors affects an

Adverse Recommendation Change

If Purchaser or the Company terminates because the End Date is reached or stockholder approval is not given, or Purchaser

terminates because the Company breaches its reps, warranties or fails to perform its covenants, a person who has made or

announced a takeover proposal and the Company enters into a definitive agreement or consummates such proposal within 12

months of the termination

$29 million paid by Purchaser to the Company within three business days of the termination

Conditions for payment of termination fee:

-If the marketing period has ended and all other conditions to closing are met and Purchaser fails to close within 2 business days

after the end of the marketing period

If Purchaser breaches any of its reps & warrants or fails to perform its covenants

Reasonable out-of-pocket fees and expenses, up to a cap, if agreement is terminated due to a failure to obtain stockholder approval

No survival of reps and warranties

Largely standard for public company transaction

Source: Draft merger agreement dated 11/05/15

LTM Adjusted EBITDA (as of 6/30/15) and CY15 Adjusted EBITDA of $527 and $56.4 million (based on management estimates), respectively; adjusted for share-based compensation,

impairment of assets and intangibles, as well as certain expenses related to the cost reduction plan and non recurring expenses

[11]View entire presentation