Credit Suisse Investment Banking Pitch Book

Selected transaction terms

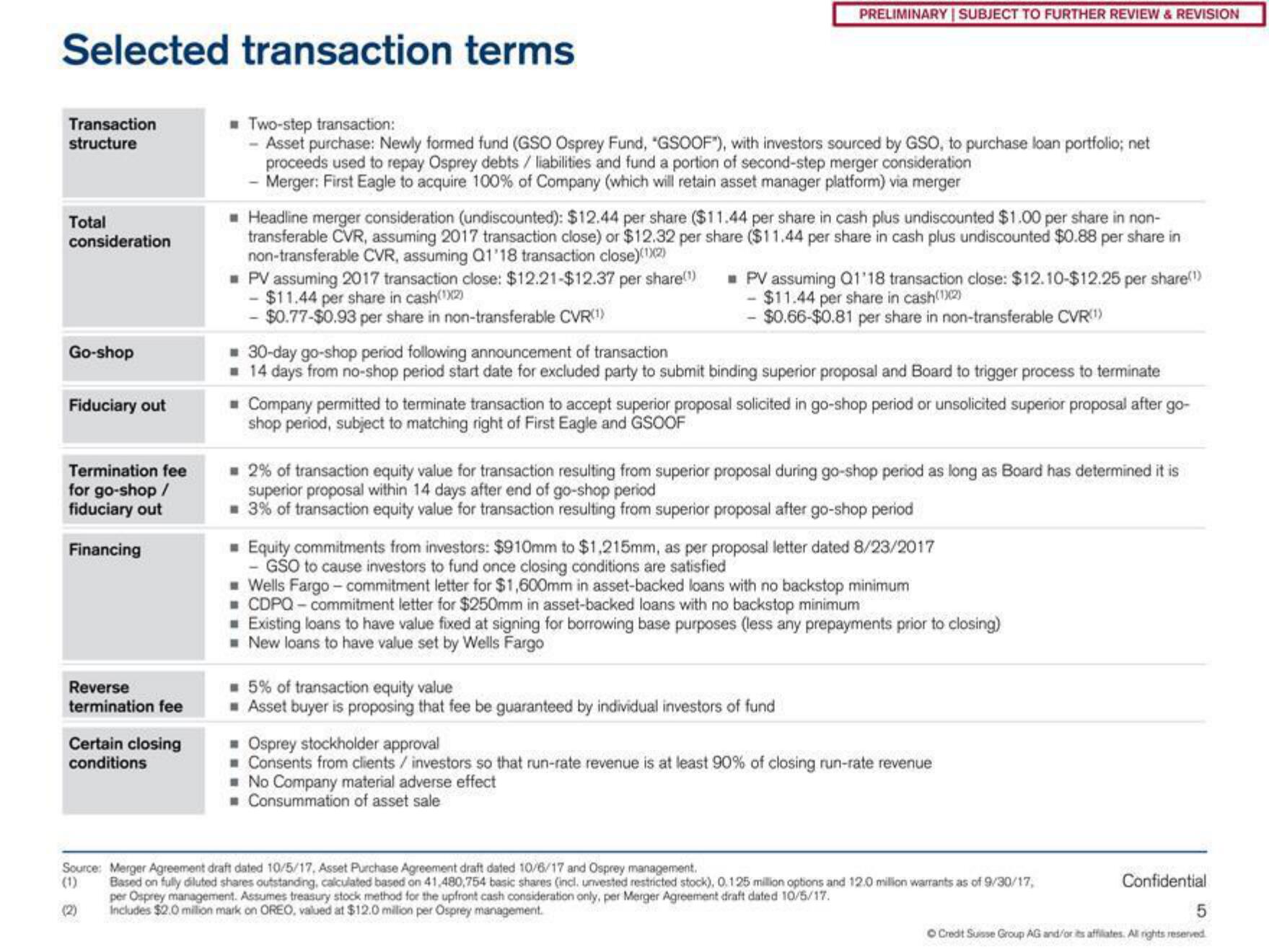

Transaction

structure

Total

consideration

Go-shop

Fiduciary out

Termination fee

for go-shop/

fiduciary out

Financing

Reverse

termination fee

Certain closing

conditions

(2)

PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

Two-step transaction:

- Asset purchase: Newly formed fund (GSO Osprey Fund, "GSOOF"), with investors sourced by GSO, to purchase loan portfolio; net

proceeds used to repay Osprey debts / liabilities and fund a portion of second-step merger consideration

- Merger: First Eagle to acquire 100% of Company (which will retain asset manager platform) via merger

Headline merger consideration (undiscounted): $12.44 per share ($11.44 per share in cash plus undiscounted $1.00 per share in non-

transferable CVR, assuming 2017 transaction close) or $12.32 per share ($11.44 per share in cash plus undiscounted $0.88 per share in

non-transferable CVR, assuming Q1'18 transaction close)(12)

■ PV assuming 2017 transaction close: $12.21-$12.37 per share(¹) ■ PV assuming Q1'18 transaction close: $12.10-$12.25 per share(¹)

- $11.44 per share in cash(12)

$11.44 per share in cash(1)(2)

- $0.77-$0.93 per share in non-transferable CVR(¹)

$0.66-$0.81 per share in non-transferable CVR(¹)

■ 30-day go-shop period following announcement of transaction

14 days from no-shop period start date for excluded party to submit binding superior proposal and Board to trigger process to terminate

■ Company permitted to terminate transaction to accept superior proposal solicited in go-shop period or unsolicited superior proposal after go-

shop period, subject to matching right of First Eagle and GSOOF

2% of transaction equity value for transaction resulting from superior proposal during go-shop period as long as Board has determined it is

superior proposal within 14 days after end of go-shop period

3% of transaction equity value for transaction resulting from superior proposal after go-shop period

Equity commitments from investors: $910mm to $1,215mm, as per proposal letter dated 8/23/2017

- GSO to cause investors to fund once closing conditions are satisfied

Wells Fargo - commitment letter for $1,600mm in asset-backed loans with no backstop minimum

■ CDPQ-commitment letter for $250mm in asset-backed loans with no backstop minimum

☐ Existing loans to have value fixed at signing for borrowing base purposes (less any prepayments prior to closing)

New loans to have value set by Wells Fargo

5% of transaction equity value

Asset buyer is proposing that fee be guaranteed by individual investors of fund

Osprey stockholder approval

■ Consents from clients / investors so that run-rate revenue is at least 90% of closing run-rate revenue

■ No Company material adverse effect

■ Consummation of asset sale

Source: Merger Agreement draft dated 10/5/17, Asset Purchase Agreement draft dated 10/6/17 and Osprey management.

Based on fully diluted shares outstanding, calculated based on 41,480,754 basic shares (incl. unvested restricted stock), 0.125 million options and 12.0 million warrants as of 9/30/17,

per Osprey management. Assumes treasury stock method for the upfront cash consideration only, per Merger Agreement draft dated 10/5/17.

Includes $2.0 million mark on OREO, valued at $12.0 million per Osprey management.

Confidential

5

Ⓒ Credit Suisse Group AG and/or its affiliates. All rights reservedView entire presentation