Maersk Results Presentation Deck

A.P. Moller Maersk Group

- Interim Report 02 2015

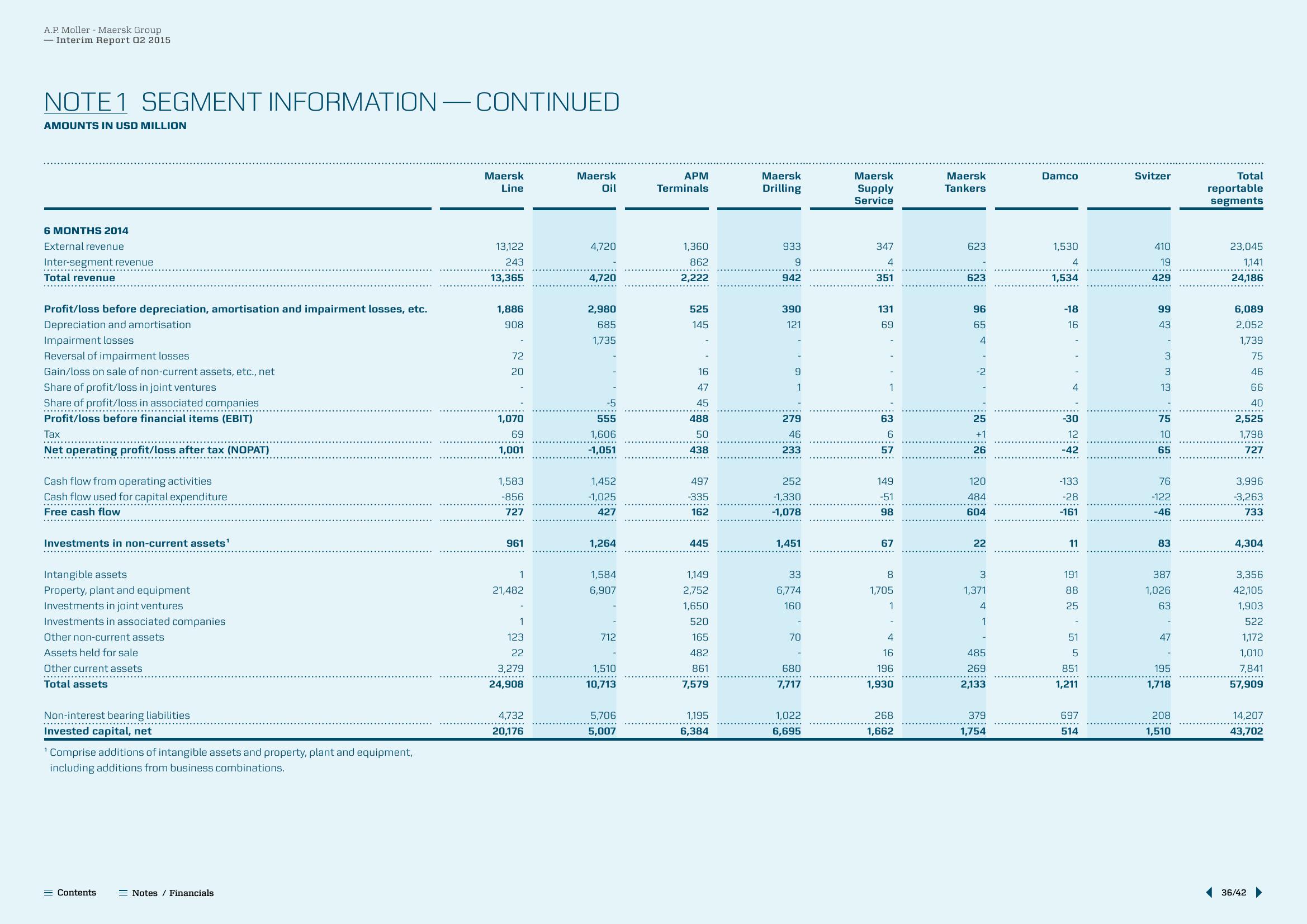

NOTE 1 SEGMENT INFORMATION - CONTINUED

AMOUNTS IN USD MILLION

6 MONTHS 2014

External revenue

Inter-segment revenue

Total revenue

Profit/loss before depreciation, amortisation and impairment losses, etc.

Depreciation and amortisation

Impairment losses

Reversal of impairment losses

Gain/loss on sale of non-current assets, etc., net

Share of profit/loss in joint ventures

Share of profit/loss in associated companies

Profit/loss before financial items (EBIT)

..……..…….....

Tax

Net operating profit/loss after tax (NOPAT)

Cash flow from operating activities

Cash flow used for capital expenditure

Free cash flow

Investments in non-current assets¹

Intangible assets

Property, plant and equipment

Investments in joint ventures

Investments in associated companies

Other non-current assets

Assets held for sale

Other current assets

Total assets

Non-interest bearing liabilities

Invested capital, net

¹ Comprise additions of intangible assets and property, plant and equipment,

including additions from business combinations.

= Contents

Notes / Financials

Maersk

Line

13,122

243

13,365

1,886

908

72

20

1,070

69

1,001

1,583

-856

727

961

1

21,482

1

123

22

3,279

24,908

4,732

20,176

Maersk

Oil

4,720

4,720

2,980

685

1,735

-5

555

1,606

-1,051

1,452

-1,025

427

1,264

1,584

6,907

712

1,510

10,713

5,706

5,007

APM

Terminals

1,360

862

2,222

525

145

16

47

45

488

50

438

497

-335

162

445

1,149

2,752

1,650

520

165

482

861

7,579

1,195

6,384

Maersk

Drilling

933

9

942

390

121

9

1

279

46

233

252

-1,330

-1,078

1,451

33

6,774

160

70

680

7,717

1,022

6,695

Maersk

Supply

Service

347

4

351

131

69

1

63

6

57

149

-51

98

67

8

1,705

1

4

16

196

1,930

268

1,662

Maersk

Tankers

623

623

96

65

4

-2

25

+1

26

120

484

604

22

3

1,371

4

1

485

269

2,133

379

1,754

Damco

1,530

4

1,534

-18

16

4

-30

12

-42

-133

-28

-161

11

191

88

25

51

5

851

1,211

697

514

Svitzer

410

19

429

99

43

-

3

3

13

75

10

65

76

-122

-46

83

387

1,026

63

47

195

1,718

208

1,510

Total

reportable

segments

23,045

1,141

24,186

6,089

2,052

1,739

75 46 66

40

2,525

1,798

727

3,996

-3,263

733

4,304

3,356

42,105

1,903

522

1,172

1,010

7,841

57,909

14,207

43,702

36/42View entire presentation