Q2 2018 Fixed Income Investor Conference Call

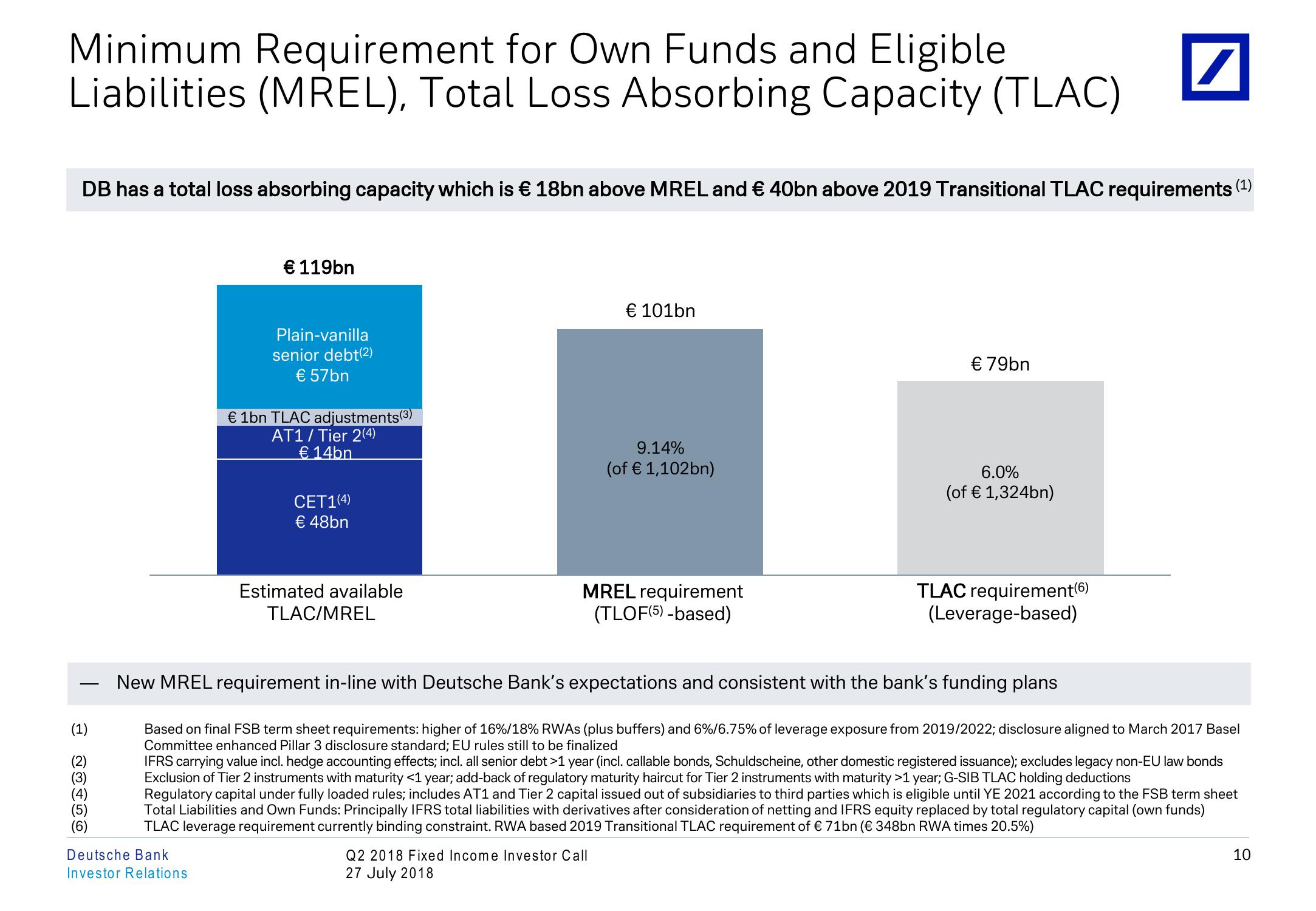

Minimum Requirement for Own Funds and Eligible

Liabilities (MREL), Total Loss Absorbing Capacity (TLAC)

DB has a total loss absorbing capacity which is € 18bn above MREL and € 40bn above 2019 Transitional TLAC requirements (1)

€ 119bn

Plain-vanilla

senior debt (2)

€ 57bn

€ 1bn TLAC adjustments (3)

AT1/Tier 2(4)

€ 14bn

CET1(4)

€ 48bn

Estimated available

TLAC/MREL

€ 101bn

9.14%

(of € 1,102bn)

MREL requirement

(TLOF(5)-based)

€ 79bn

6.0%

(of € 1,324bn)

TLAC requirement (6)

(Leverage-based)

-

(1)

(4)

New MREL requirement in-line with Deutsche Bank's expectations and consistent with the bank's funding plans

Based on final FSB term sheet requirements: higher of 16%/18% RWAS (plus buffers) and 6%/6.75% of leverage exposure from 2019/2022; disclosure aligned to March 2017 Basel

Committee enhanced Pillar 3 disclosure standard; EU rules still to be finalized

IFRS carrying value incl. hedge accounting effects; incl. all senior debt >1 year (incl. callable bonds, Schuldscheine, other domestic registered issuance); excludes legacy non-EU law bonds

Exclusion of Tier 2 instruments with maturity <1 year; add-back of regulatory maturity haircut for Tier 2 instruments with maturity >1 year; G-SIB TLAC holding deductions

Regulatory capital under fully loaded rules; includes AT1 and Tier 2 capital issued out of subsidiaries to third parties which is eligible until YE 2021 according to the FSB term sheet

Total Liabilities and Own Funds: Principally IFRS total liabilities with derivatives after consideration of netting and IFRS equity replaced by total regulatory capital (own funds)

TLAC leverage requirement currently binding constraint. RWA based 2019 Transitional TLAC requirement of € 71bn (€ 348bn RWA times 20.5%)

Deutsche Bank

Investor Relations

Q2 2018 Fixed Income Investor Call

27 July 2018

10View entire presentation