Plastiq SPAC Presentation Deck

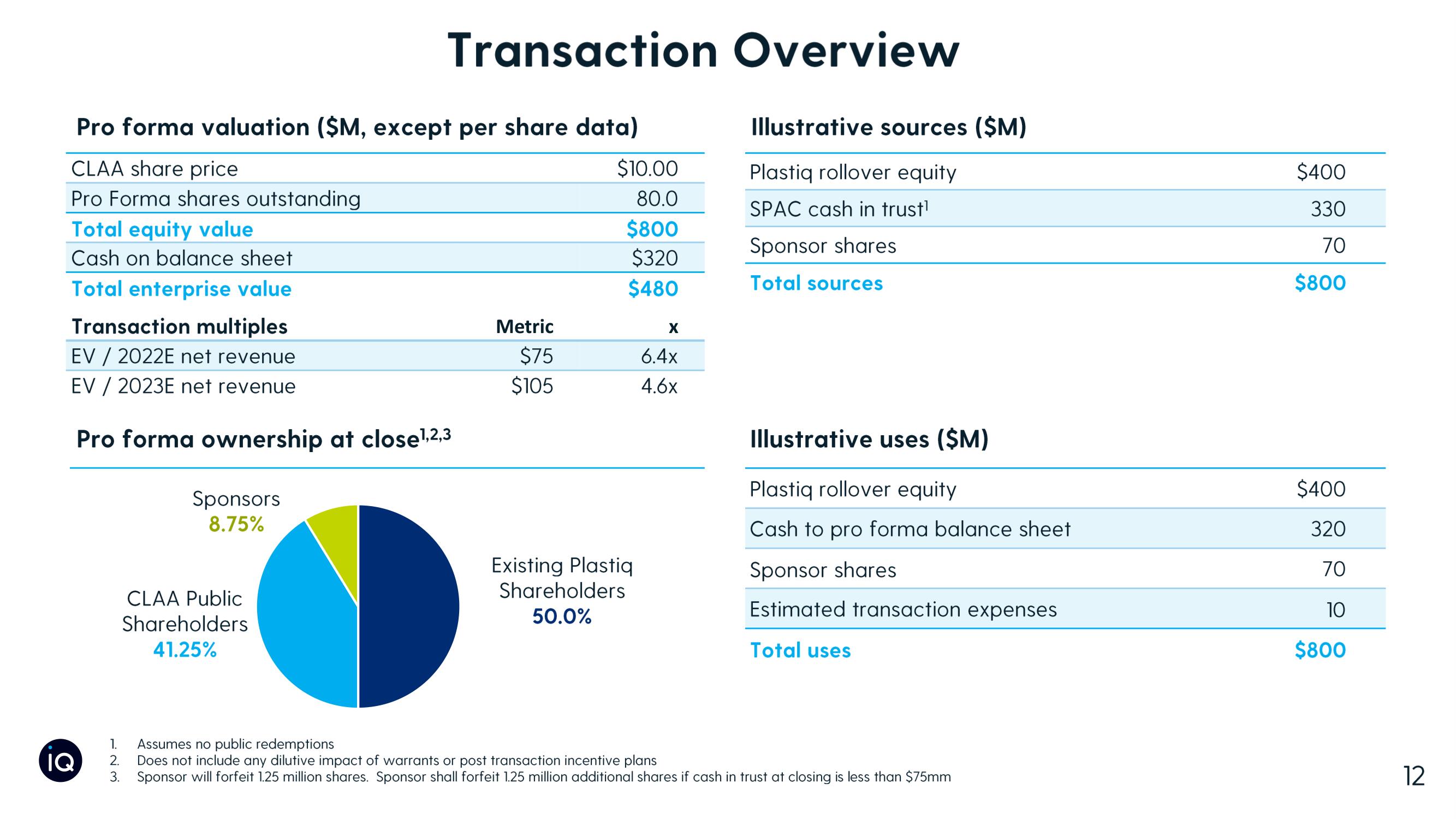

Pro forma valuation ($M, except per share data)

CLAA share price

Pro Forma shares outstanding

Total equity value

Cash on balance sheet

Total enterprise value

Transaction multiples

EV / 2022E net revenue

EV / 2023E net revenue

Pro forma ownership at close¹,2,3

IQ

Transaction Overview

Sponsors

8.75%

WN

CLAA Public

Shareholders

41.25%

Metric

$75

$105

$10.00

80.0

$800

$320

$480

Existing Plastiq

Shareholders

50.0%

X

6.4x

4.6x

1. Assumes no public redemptions

2. Does not include any dilutive impact of warrants or post transaction incentive plans

Illustrative sources ($M)

Plastiq rollover equity

SPAC cash in trust¹

Sponsor shares

Total sources

Illustrative uses ($M)

Plastiq rollover equity

Cash to pro forma balance sheet

Sponsor shares

Estimated transaction expenses

Total uses

3. Sponsor will forfeit 1.25 million shares. Sponsor shall forfeit 1.25 million additional shares if cash in trust at closing is less than $75mm

$400

330

70

$800

$400

320

70

10

$800

12View entire presentation