Barclays Capital 2010 Global Financial Services Conference

Who are we?

XRBS

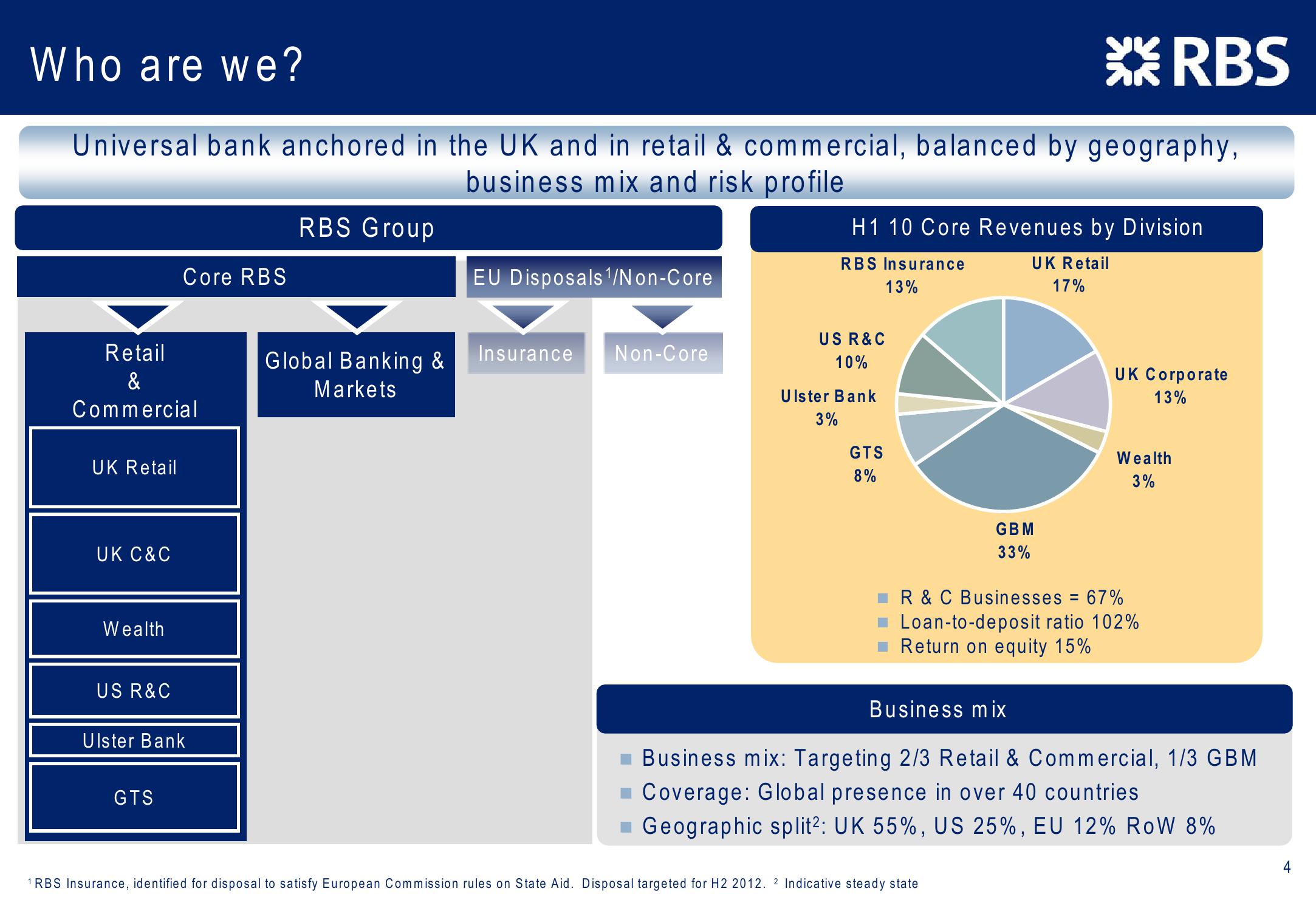

Universal bank anchored in the UK and in retail & commercial, balanced by geography,

business mix and risk profile

RBS Group

Core RBS

EU Disposals/Non-Core

H1 10 Core Revenues by Division

RBS Insurance

13%

UK Retail

17%

Retail

&

Global Banking &

Markets

Insurance

Non-Core

US R&C

10%

Ulster Bank

Commercial

UK Retail

3%

GTS

8%

UK C&C

GBM

33%

UK Corporate

13%

Wealth

3%

Wealth

US R&C

Ulster Bank

GTS

R&C Businesses = 67%

Loan-to-deposit ratio 102%

Return on equity 15%

Business mix

Business mix: Targeting 2/3 Retail & Commercial, 1/3 GBM

Coverage: Global presence in over 40 countries

Geographic split²: UK 55%, US 25%, EU 12% RoW 8%

1 RBS Insurance, identified for disposal to satisfy European Commission rules on State Aid. Disposal targeted for H2 2012. 2 Indicative steady state

4View entire presentation