Baird Investment Banking Pitch Book

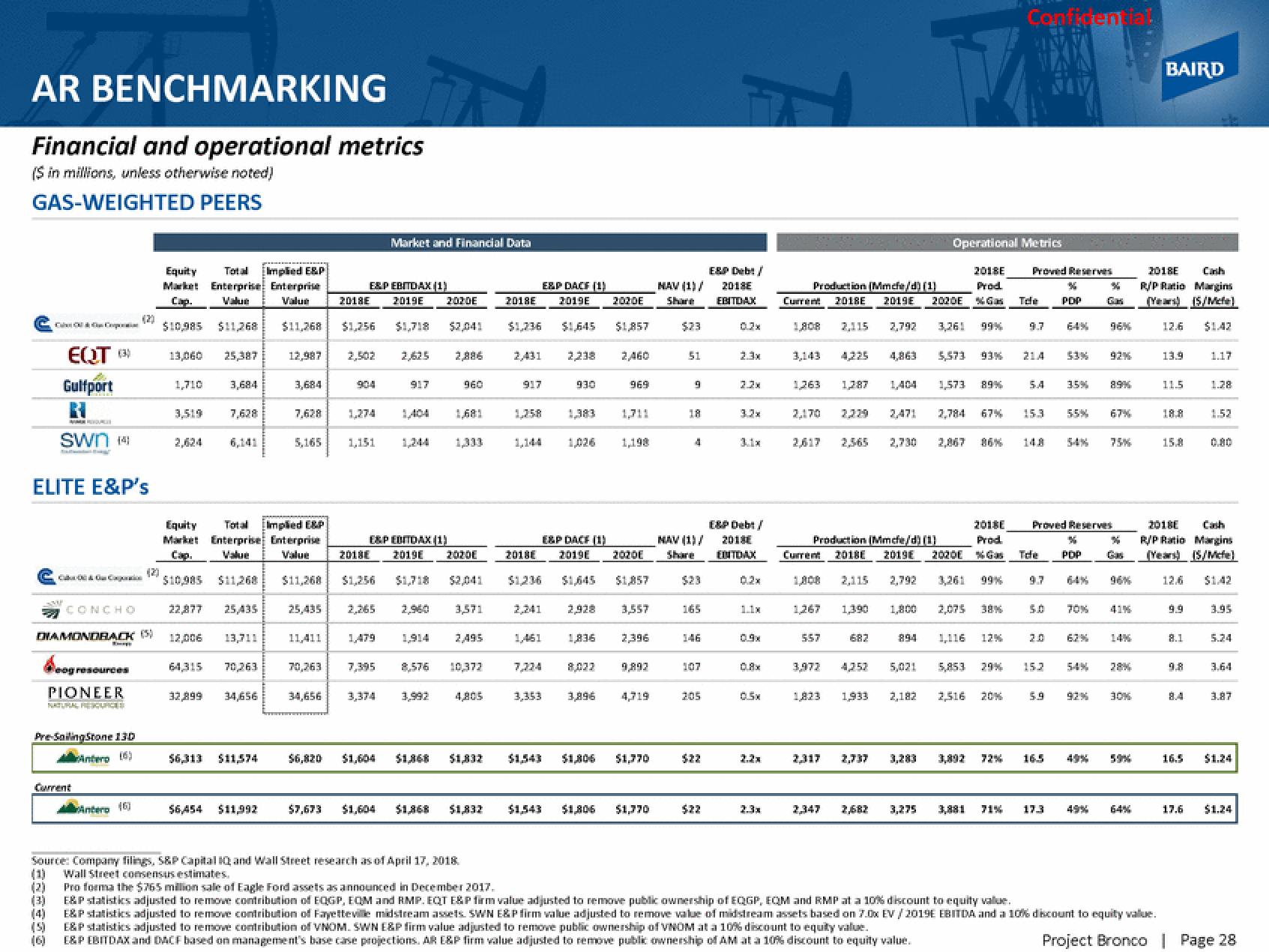

AR BENCHMARKING

Financial and operational metrics

($ in millions, unless otherwise noted)

GAS-WEIGHTED PEERS

EQT (3)

Gulfport

ELITE E&P's

Corpora

swn (4)

Beogre

(1)

(2)

(3)

C&C

(4)

(5)

Current

Simpt

og resources

Pre-Sailing Stone 130

Antero (6)

PIONEER

NATURAL RESOURCES

Equity

Total Implied E&P

Market Enterprise Enterprise

Value

Value

$10,985 $11,268

CONCHO

22,877

25,435

DIAMONDBACK (5) 12,006

Antero (6)

Equity Total Implied E&P

Market Enterprise Enterprise

Cap. Value

Value

$10,985 $11,268 $11,268

(20

13,060 25,387

1,710

3,519

3,684

64,315

7,628

13,711

70,263

32,899 34,656

$6,313 $11,574

$6,454 $11,992

12,987 2,502

3,684

7,628

5,165

ESP EBITDAX (1)

2018E 2019E 2020E

$1,256

1,274

1.151

Market and Financial Data

25,435 2,265

2,625 2,886

EXPEDITDAX (1)

2018E 2019E 2020E

$11,268 $1,256 $1,718

$7,673 $1,604

960

3,571

11,411 1,479

70,263 7,395 8,576 10,372

34,656 3,374 3,992

4,805

2,495

$6,820 $1,604 $1,868 $1,832

Source: Company filings, S&P Capital IQ and Wall Street research as of April 17, 2018.

Wall Street consensus estimates.

$1,832

ESP DACF (1)

2018E 2019E

$1,645

$1,236

2,431

917

2018E

2,241

1,461

3,353

2,238

930

1,383

E&P DACE (1)

2019E

$1,645

1,836

8.033

3,896

$1,806

2020E

$1,543 $1,806

$1,857

2,460

969

2,928 3,557

1,311

1,198

2020E

$1,857

2,396

4,719

$1,770

$1,770

E&P Debt/

NAV (1)/ 2018E

Share EBITDAX

$23

51

9

18

4

165

107

0.2 x

205

2.2x

NAV (1)/

Share EDITOAX

3.2x

E&P Debt /

02x

09x

0.5x

2.2x

2.3x

2018E

Production (Mmcfe/d) (1)

Prod

2018E

2019E 2020E Gas

3,261 99%

Current

1,808 2,115 2,792

3,143

1,263 1,387

1,267

557

1,404

2,471

682

2018E

Prod.

Production (Mmche/d) (1)

Current 2018E 2019E 2020 %Gas

2,115

894

Operational Metrics

3.972 4,357 5,021

5,573 93%

1,390 1,800 2,075

1,823 1,933 2,182

1,573 89%

2,784

99%

1,116 12%

5,853

29%

2,516 20%

Conficen la

3,892 72%

Proved Reserves

X

PDP

Tele

9.7

214

5.4

15.3

Tde

9.7

50

20

152

3.5%

55%

Proved Reserves

2,347 2,682 3,275 3,881 71% 17.3

%

PDP

70%

*

Gas

54%

96%

92%

89%

67%

%

96%

5.9 92% 30%

16.5 49% 59%

BAIRD

2018E Canh

R/P Ratio Margins

(Y) (S/Mche

12.6 $1.42

13.9

11.5

18.8

15.8

9.9

8.1

2018E

R/P Ratio Margins

(Years) (S/Mche]

12.6

9.8

16.5

1.17

17.6

1.28

1.52

3.95

5.24

3.64

3.87

$1.24

Pro forma the $765 million sale of Eagle Ford assets as announced in December 2017.

E&P statistics adjusted to remove contribution of EQGP, EQM and RMP. EQT E&P firm value adjusted to remove public ownership of EQGP, EQM and RMP at a 10% discount to equity value.

E&P statistics adjusted to remove contribution of Fayetteville midstream assets. SWN E&P firm value adjusted to remove value of midstream assets based on 7.0x EV /2019E EBITDA and a 10% discount to equity value.

E&P statistics adjusted to remove contribution of VNOM. SWN E&P firm value adjusted to remove public ownership of VNOM at a 10% discount to equity value.

E&P EBITDAX and DACF based on management's base case projections. AR E&P firm value adjusted to remove public ownership of AM at a 10% discount to equity value.

Project Bronco | Page 28View entire presentation