WeWork Restructuring Presentation Deck

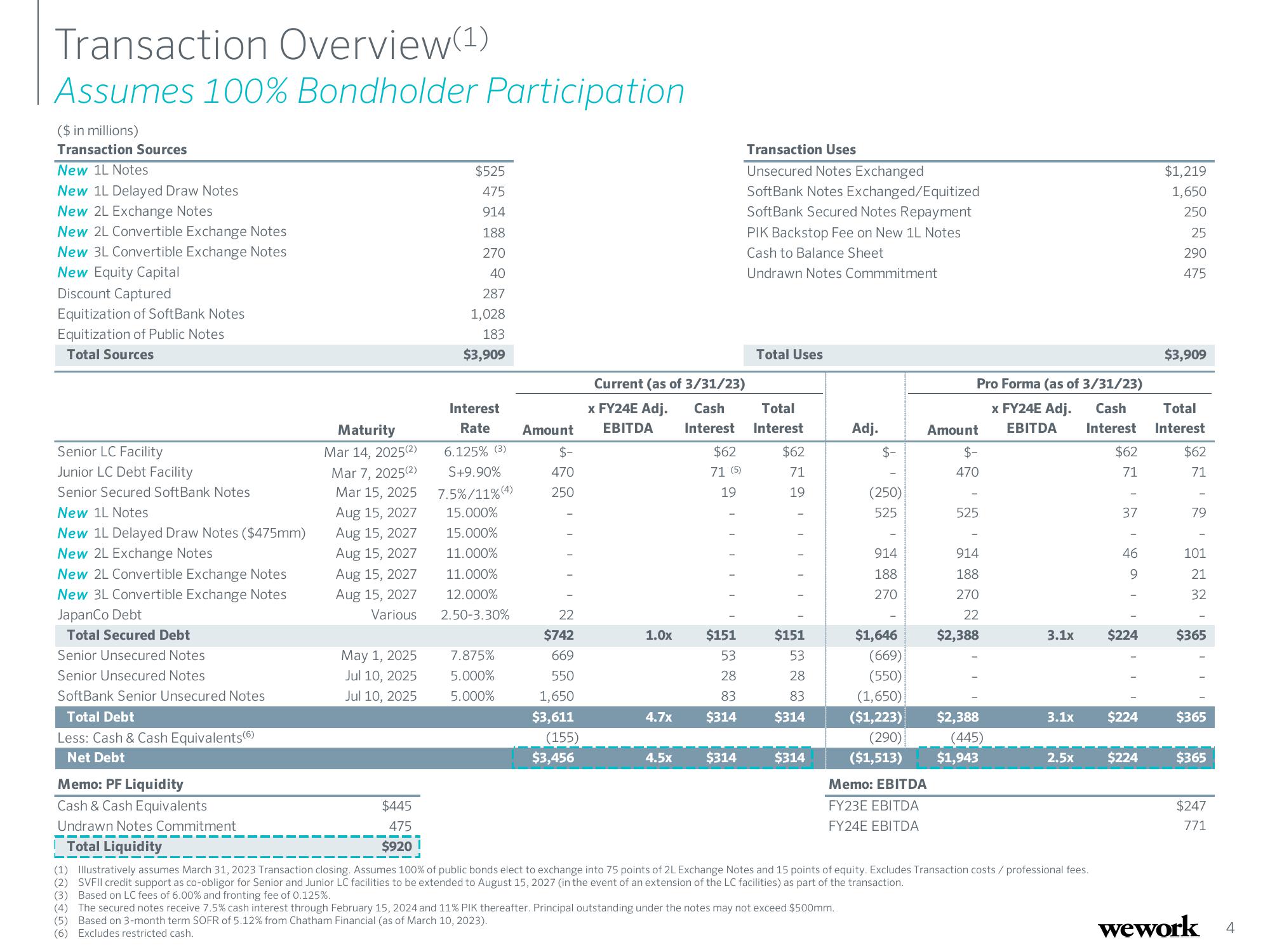

Transaction Overview(1)

Assumes 100% Bondholder Participation

($ in millions)

Transaction Sources

New 1L Notes

New 1L Delayed Draw Notes

New 2L Exchange Notes

New 2L Convertible Exchange Notes

New 3L Convertible Exchange Notes

New Equity Capital

Discount Captured

Equitization of SoftBank Notes

Equitization of Public Notes

Total Sources

Senior LC Facility

Junior LC Debt Facility

Senior Secured SoftBank Notes

New 1L Notes

New 1L Delayed Draw Notes ($475mm)

New 2L Exchange Notes

New 2L Convertible Exchange Notes

New 3L Convertible Exchange Notes

JapanCo Debt

Total Secured Debt

Senior Unsecured Notes

Senior Unsecured Notes

SoftBank Senior Unsecured Notes

Total Debt

Less: Cash & Cash Equivalents(6)

Net Debt

Memo: PF Liquidity

Cash & Cash Equivalents

Undrawn Notes Commitment

Total Liquidity

‒‒‒‒‒‒‒

Maturity

Mar 14, 2025(2)

Mar 7, 2025(2)

Mar 15, 2025

Aug 15, 2027

Aug 15, 2027

Aug 15, 2027

Aug 15, 2027

Aug 15, 2027

Various

May 1, 2025

Jul 10, 2025

Jul 10, 2025

$445

475

$920

$525

475

914

188

270

40

287

1,028

183

$3,909

Interest

Rate

6.125% (3)

S+9.90%

7.5%/11% (4)

15.000%

15.000%

11.000%

11.000%

12.000%

2.50-3.30%

7.875%

5.000%

5.000%

Amount

$-

470

250

22

$742

669

550

1,650

$3,611

(155)

$3,456

Current (as of 3/31/23)

x FY24E Adj.

EBITDA

Cash

Interest

$62

71 (5)

19

$151

53

28

83

4.7x $314

1.0x

4.5x $314

Transaction Uses

Unsecured Notes Exchanged

SoftBank Notes Exchanged/Equitized

SoftBank Secured Notes Repayment

PIK Backstop Fee on New 1L Notes

Cash to Balance Sheet

Undrawn Notes Commmitment

Total Uses

Total

Interest

$62

71

19

LEI

$151

53

28

83

$314

$314

Adj.

$-

(250)

525

(3) Based on LC fees of 6.00% and fronting fee of 0.125%.

(4) The secured notes receive 7.5% cash interest through February 15, 2024 and 11% PIK thereafter. Principal outstanding under the notes may not exceed $500mm.

(5) Based on 3-month term SOFR of 5.12% from Chatham Financial (as of March 10, 2023).

(6) Excludes restricted cash.

914

188

270

$1,646

Pro Forma (as of 3/31/23)

x FY24E Adj.

EBITDA

Cash

Interest

$62

71

Amount

$-

470

Memo: EBITDA

FY23E EBITDA

FY24E EBITDA

525

914

188

270

22

$2,388

(669)

(550)

(1,650)

($1,223)

(290)

($1,513) $1,943

$2,388

(445)

3.1x

3.1x

2.5x

(1) Illustratively assumes March 31, 2023 Transaction closing. Assumes 100% of public bonds elect to exchange into 75 points of 2L Exchange Notes and 15 points of equity. Excludes Transaction costs / professional fees.

(2) SVFII credit support as co-obligor for Senior and Junior LC facilities to be extended to August 15, 2027 (in the event of an extension of the LC facilities) as part of the transaction.

37

46

$224

$224

$224

$1,219

1,650

250

25

290

475

$3,909

Total

Interest

$62

71

79

101

21

32

$365

$365

$365

$247

771

wework 4View entire presentation