Experian Investor Presentation Deck

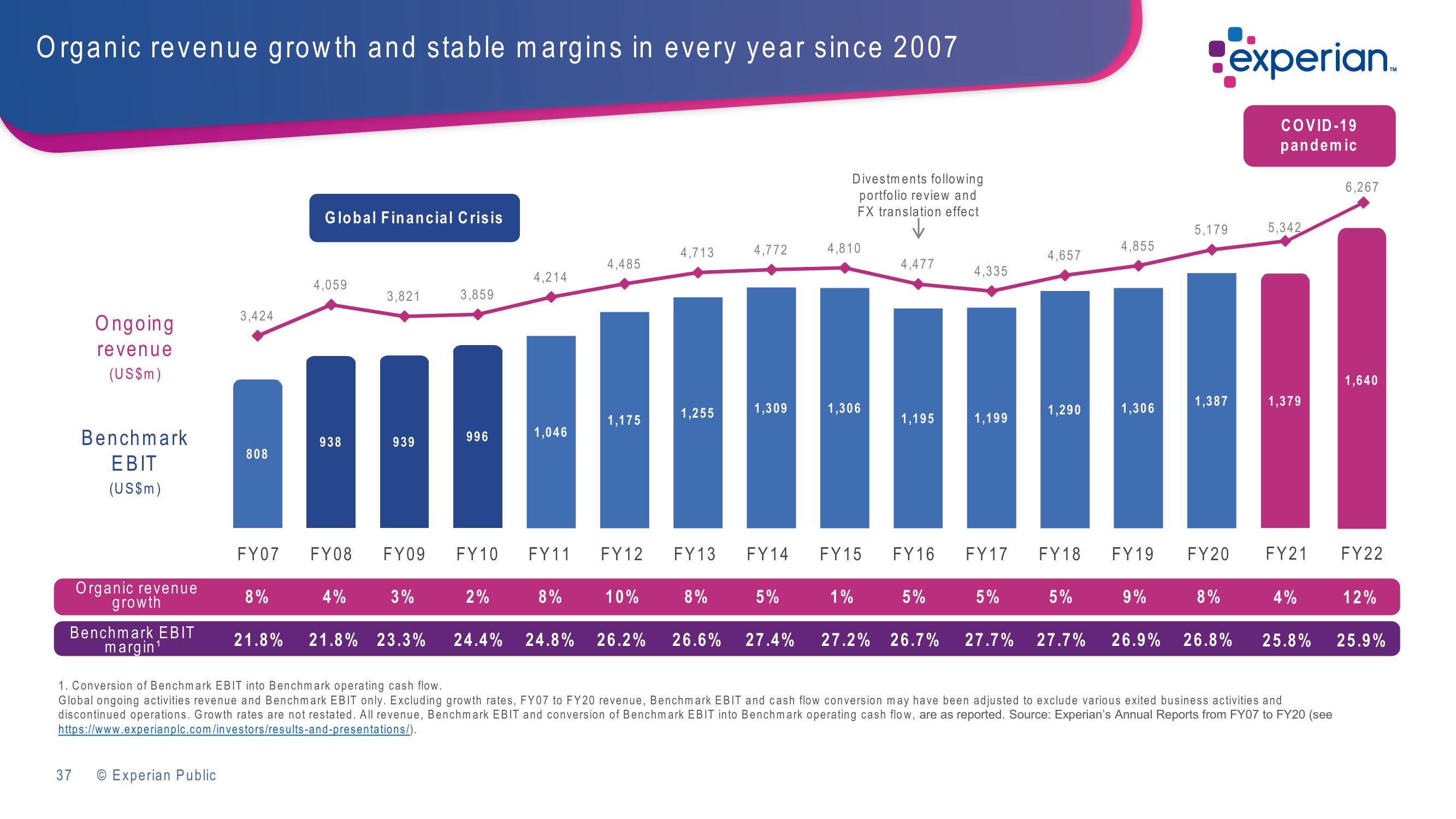

Organic revenue growth and stable margins in every year since 2007

Ongoing

revenue

(US$m)

Benchmark

EBIT

(US$m)

37

Organic revenue

growth

Benchmark EBIT

margin¹

3,424

O Experian Public

808

FY07

8%

Global Financial Crisis

4,059

3,821

4%

939

938

I

FY08 FY09 FY10 FY11 FY12

3%

3,859

21.8% 21.8% 23.3%

996

4,214

2%

1,046

8%

4,485

24.4% 24.8%

1,175

10%

4,713

1,255

4,772

8%

1,309

FY13 FY14

5%

Divestments following

portfolio review and

FX translation effect

4,810

1,306

FY15

1%

4,477

1,195

FY16

5%

26.2% 26.6% 27.4% 27.2% 26.7%

4,335

1,199

FY17

5%

4,657

1,290

FY18

5%

4,855

1,306

FY 19

9%

experian.

COVID-19

pandemic

5,179

1,387

FY20

8%

5,342

1,379

FY21

4%

1. Conversion of Benchmark EBIT into Benchmark operating cash flow.

Global ongoing activities revenue and Benchmark EBIT only. Excluding growth rates, FY07 to FY20 revenue, Benchmark EBIT and cash flow conversion may have been adjusted to exclude various exited business activities and

discontinued operations. Growth rates are not restated. All revenue, Benchmark EBIT and conversion of Benchmark EBIT into Benchmark operating cash flow, are as reported. Source: Experian's Annual Reports from FY07 to FY20 (see

https://www.experianplc.com/investors/results-and-presentations/).

27.7% 27.7% 26.9% 26.8% 25.8%

6,267

1,640

FY22

12%

25.9%View entire presentation