Ares US Real Estate Opportunity Fund III

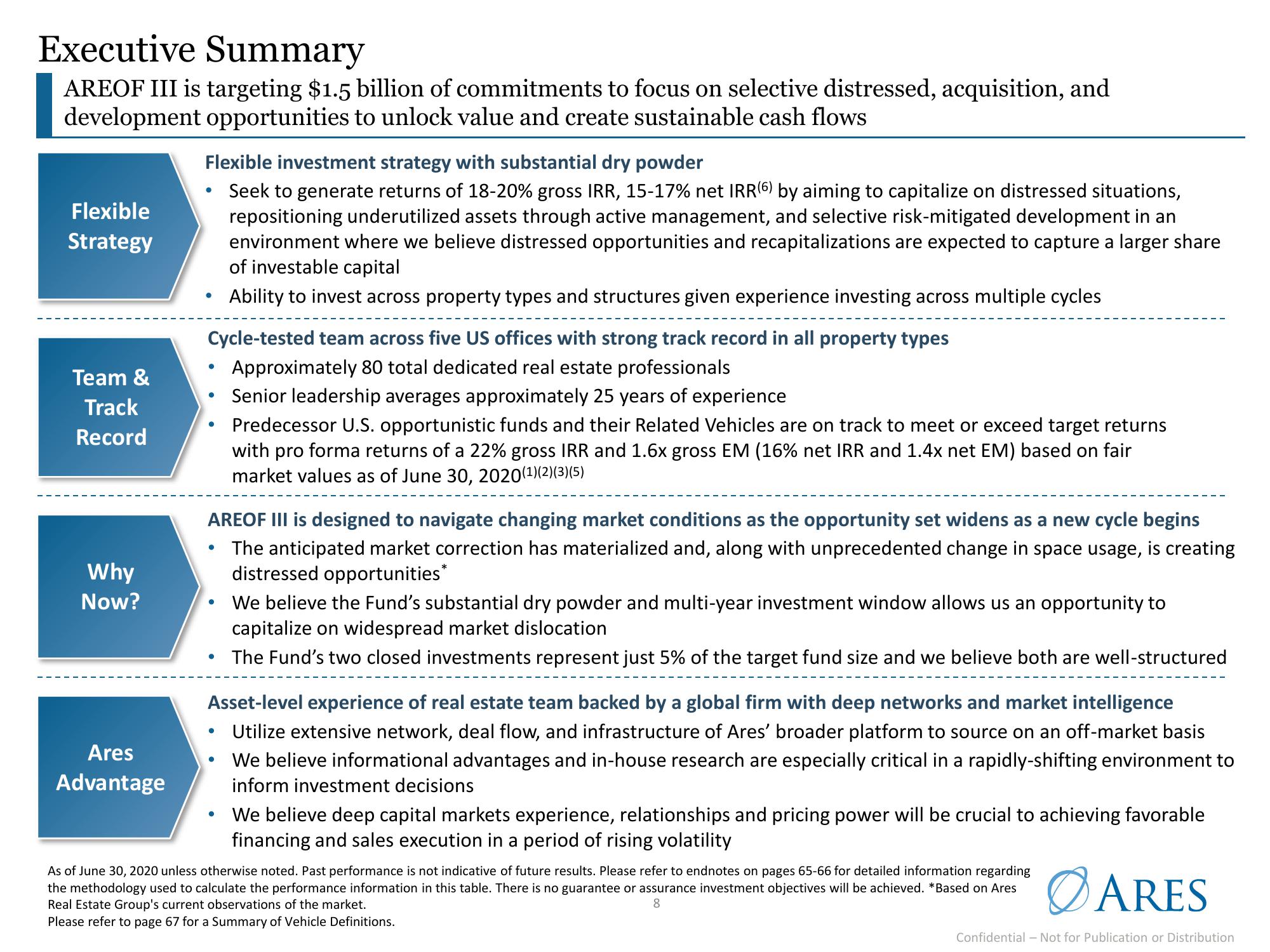

Executive Summary

AREOF III is targeting $1.5 billion of commitments to focus on selective distressed, acquisition, and

development opportunities to unlock value and create sustainable cash flows

Flexible

Strategy

Team &

Track

Record

Why

Now?

Ares

Advantage

Flexible investment strategy with substantial dry powder

Seek to generate returns of 18-20% gross IRR, 15-17% net IRR(6) by aiming to capitalize on distressed situations,

repositioning underutilized assets through active management, and selective risk-mitigated development in an

environment where we believe distressed opportunities and recapitalizations are expected to capture a larger share

of investable capital

Ability to invest across property types and structures given experience investing across multiple cycles

●

Cycle-tested team across five US offices with strong track record in all property types

Approximately 80 total dedicated real estate professionals

Senior leadership averages approximately 25 years of experience

Predecessor U.S. opportunistic funds and their Related Vehicles are on track to meet or exceed target returns

with pro forma returns of a 22% gross IRR and 1.6x gross EM (16% net IRR and 1.4x net EM) based on fair

market values as of June 30, 2020(¹)(2)(3)(5)

●

●

AREOF III is designed to navigate changing market conditions as the opportunity set widens as a new cycle begins

The anticipated market correction has materialized and, along with unprecedented change in space usage, is creating

distressed opportunities*

●

We believe the Fund's substantial dry powder and multi-year investment window allows us an opportunity to

capitalize on widespread market dislocation

The Fund's two closed investments represent just 5% of the target fund size and we believe both are well-structured

Asset-level experience of real estate team backed by a global firm with deep networks and market intelligence

Utilize extensive network, deal flow, and infrastructure of Ares' broader platform to source on an off-market basis

We believe informational advantages and in-house research are especially critical in a rapidly-shifting environment to

inform investment decisions

●

We believe deep capital markets experience, relationships and pricing power will be crucial to achieving favorable

financing and sales execution in a period of rising volatility

As of June 30, 2020 unless otherwise noted. Past performance is not indicative of future results. Please refer to endnotes on pages 65-66 for detailed information regarding

the methodology used to calculate the performance information in this table. There is no guarantee or assurance investment objectives will be achieved. *Based on Ares

Real Estate Group's current observations of the market.

8

Please refer to page 67 for a Summary of Vehicle Definitions.

ARES

Confidential - Not for Publication or DistributionView entire presentation