HPS Specialty Loan Fund VI

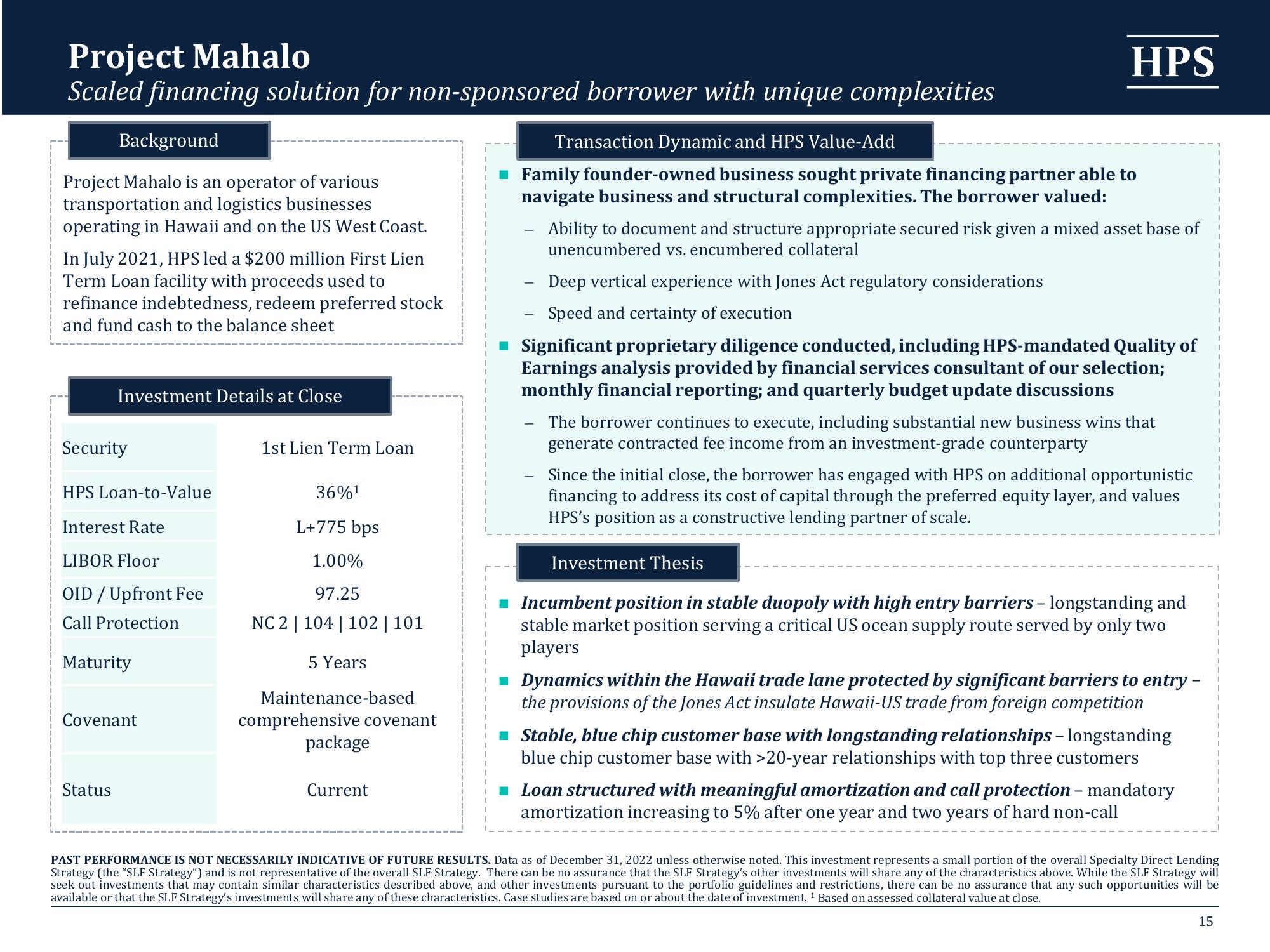

Project Mahalo

Scaled financing solution for non-sponsored borrower with unique complexities

Background

Project Mahalo is an operator of various

transportation and logistics businesses

operating in Hawaii and on the US West Coast.

In July 2021, HPS led a $200 million First Lien

Term Loan facility with proceeds used to

refinance indebtedness, redeem preferred stock

and fund cash to the balance sheet

Investment Details at Close

Security

HPS Loan-to-Value

Interest Rate

LIBOR Floor

OID / Upfront Fee

Call Protection

Maturity

Covenant

Status

1st Lien Term Loan

36%¹

L+775 bps

1.00%

97.25

NC 2 | 104 | 102 | 101

5 Years

Maintenance-based

comprehensive covenant

package

Current

Transaction Dynamic and HPS Value-Add

■ Family founder-owned business sought private financing partner able to

navigate business and structural complexities. The borrower valued:

-

HPS

-

Ability to document and structure appropriate secured risk given a mixed asset base of

unencumbered vs. encumbered collateral

Deep vertical experience with Jones Act regulatory considerations

Speed and certainty of execution

■ Significant proprietary diligence conducted, including HPS-mandated Quality of

Earnings analysis provided by financial services consultant of our selection;

monthly financial reporting; and quarterly budget update discussions

The borrower continues to execute, including substantial new business wins that

generate contracted fee income from an investment-grade counterparty

Since the initial close, the borrower has engaged with HPS on additional opportunistic

financing to address its cost of capital through the preferred equity layer, and values

HPS's position as a constructive lending partner of scale.

Investment Thesis

■ Incumbent position in stable duopoly with high entry barriers - longstanding and

stable market position serving a critical US ocean supply route served by only two

players

Dynamics within the Hawaii trade lane protected by significant barriers to entry -

the provisions of the Jones Act insulate Hawaii-US trade from foreign competition

■ Stable, blue chip customer base with longstanding relationships - longstanding

blue chip customer base with >20-year relationships with top three customers

■ Loan structured with meaningful amortization and call protection - mandatory

amortization increasing to 5% after one year and two years of hard non-call

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. Data as of December 31, 2022 unless otherwise noted. This investment represents a small portion of the overall Specialty Direct Lending

Strategy (the "SLF Strategy") and is not representative of the overall SLF Strategy. There can be no assurance that the SLF Strategy's other investments will share any of the characteristics above. While the SLF Strategy will

seek out investments that may contain similar characteristics described above, and other investments pursuant to the portfolio guidelines and restrictions, there can be no assurance that any such opportunities will be

available or that the SLF Strategy's investments will share any of these characteristics. Case studies are based on or about the date of investment. ¹ Based on assessed collateral value at close.

15View entire presentation