Vale Investor Conference Presentation Deck

2022 BofA Securities Global Metals, Mining & Steel Conference

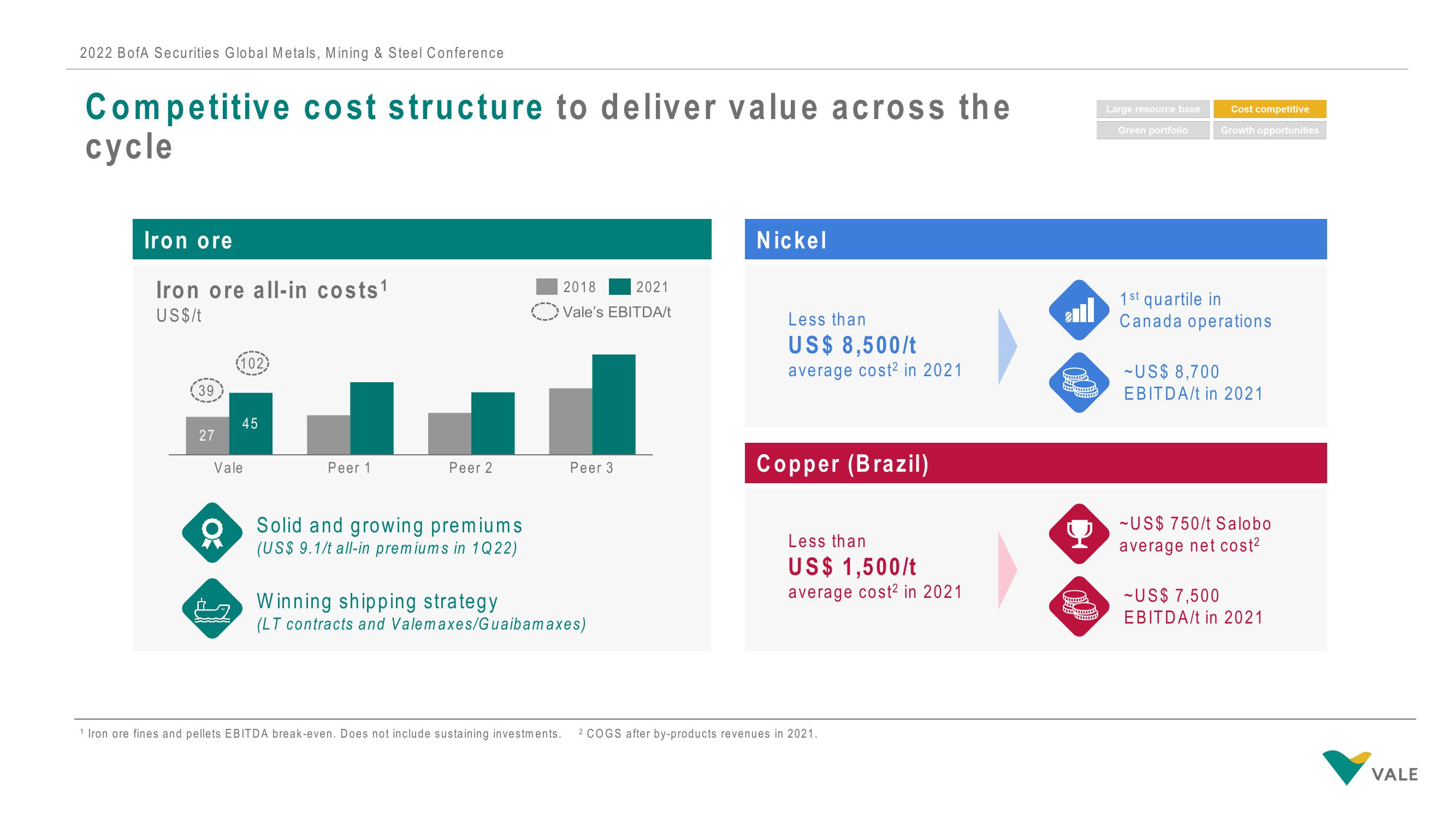

Competitive cost structure to deliver value across the

cycle

Iron ore

Iron ore all-in costs¹

US$/t

39

27

0

(102)

Vale

1

45

Peer 1

Peer 2

Solid and growing premiums

(US$ 9.1/t all-in premiums in 1Q22)

2018

2021

Vale's EBITDA/t

1 Iron ore fines and pellets EBITDA break-even. Does not include sustaining investments.

Peer 3

Winning shipping strategy

(LT contracts and Valemaxes/Guaibamaxes)

Nickel

Less than

US$ 8,500/t

average cost2 in 2021

Copper (Brazil)

Less than

US$ 1,500/t

average cost2 in 2021

2 COGS after by-products revenues in 2021.

F

Large resource base

Green portfolio

Cost competitive

Growth opportunities

1st quartile in

Canada operations

-US$ 8,700

EBITDA/t in 2021

-US$ 750/t Salobo

average net cost²

-US$ 7,500

EBITDA/t in 2021

VALEView entire presentation