Q2 Quarter 2023

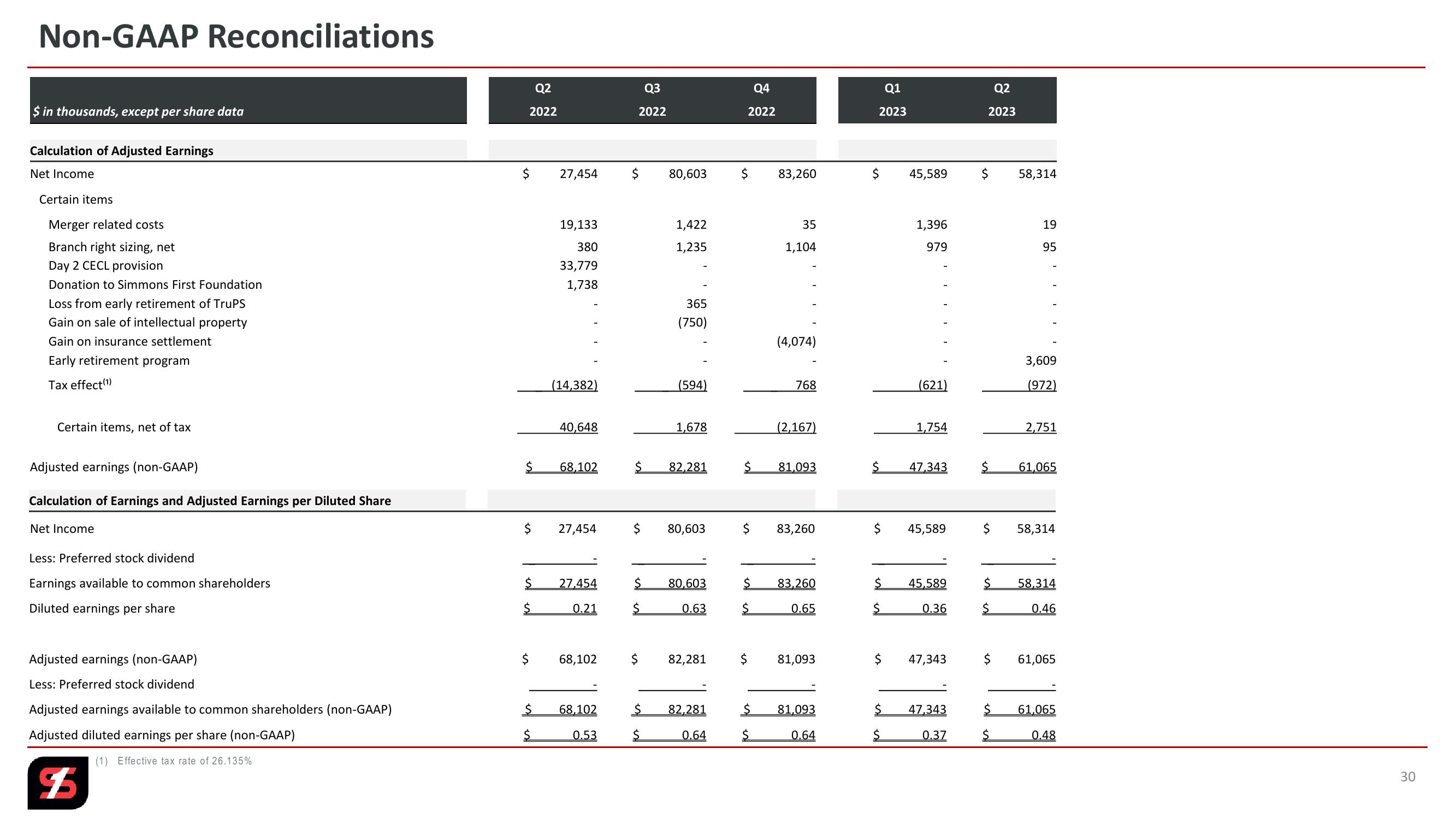

Non-GAAP Reconciliations

$ in thousands, except per share data

Calculation of Adjusted Earnings

Net Income

Certain items

Merger related costs

Branch right sizing, net

Day 2 CECL provision

Donation to Simmons First Foundation

Loss from early retirement of TruPS

Gain on sale of intellectual property

Gain on insurance settlement

Early retirement program

Tax effect(¹)

Certain items, net of tax

Q2

Q3

Q4

Q1

Q2

2022

2022

2022

2023

2023

$

27,454

$

80,603

$

83,260

$

45,589

$

58,314

19,133

1,422

35

380

1,235

1,104

1,396

979

19

95

33,779

1,738

365

(750)

(4,074)

3,609

(14,382)

(594)

768

(621)

(972)

40,648

1,678

(2,167)

1,754

2,751

68,102

82,281

81,093

47,343

$

61,065

Adjusted earnings (non-GAAP)

Calculation of Earnings and Adjusted Earnings per Diluted Share

Net Income

$

27,454

$

80,603

$

83,260

$ 45,589

$

58,314

Less: Preferred stock dividend

Earnings available to common shareholders

Diluted earnings per share

$

27,454

0.21

$

80,603

83,260

45,589

$

0.63

0.65

$

0.36

58,314

0.46

Adjusted earnings (non-GAAP)

$

68,102

$

82,281

$

81,093

$

47,343

$

61,065

Less: Preferred stock dividend

Adjusted earnings available to common shareholders (non-GAAP)

68,102

$

82,281

$

81,093

$

47,343

61,065

Adjusted diluted earnings per share (non-GAAP)

$

0.53

$

0.64

$

0.64

$

0.37

$

0.48

(1) Effective tax rate of 26.135%

$

30View entire presentation