2nd Quarter 2021 Investor Presentation

28% vs Q

VS Q121

Core EPS up 17%

Loan production in 1H21

originations; loan yields held steady $1.8B

and deposit costs decline further

on pace to

significantly exceed 2020 volume

NPL ratio declines

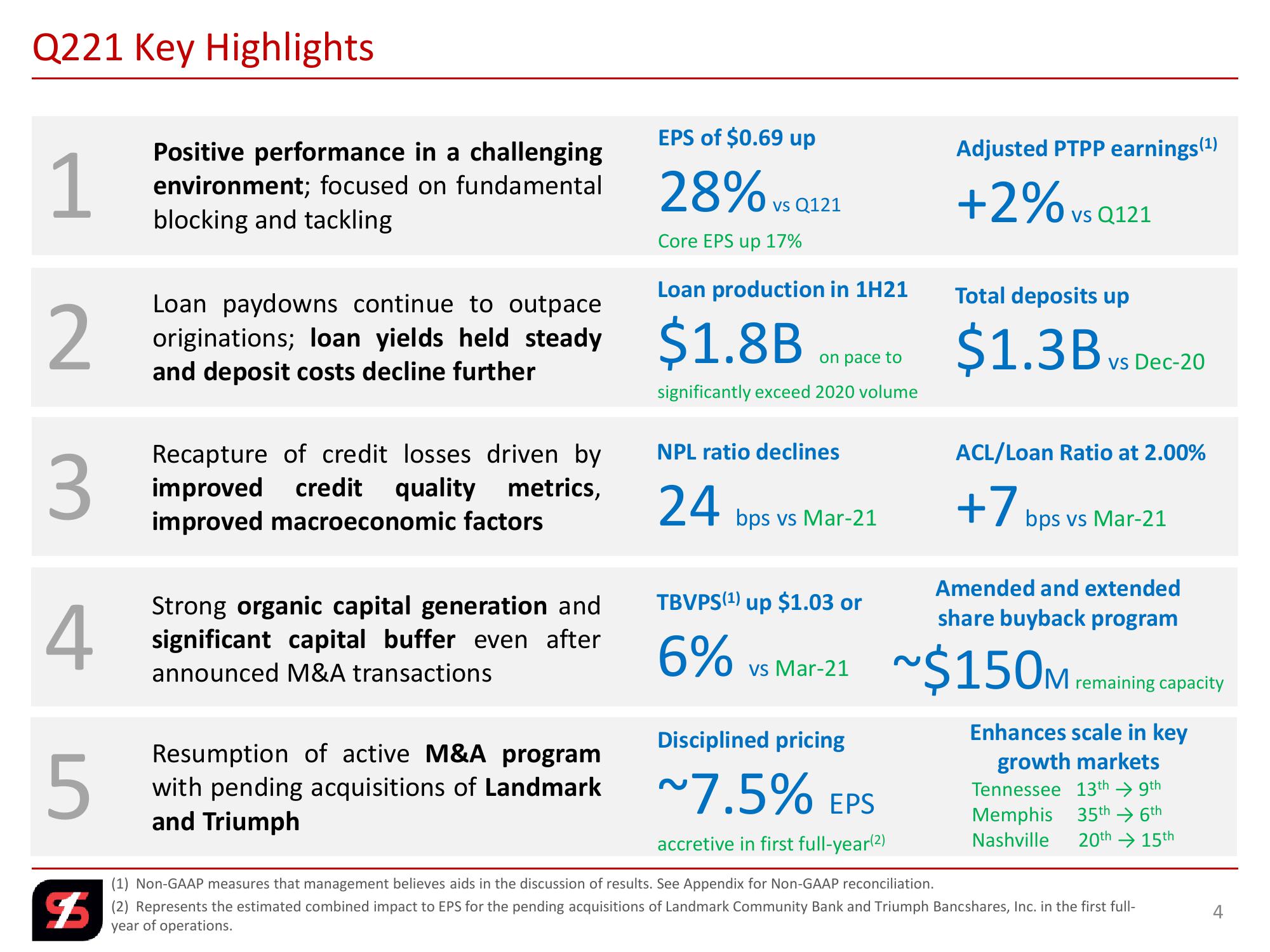

Q221 Key Highlights

EPS of $0.69 up

1

Positive performance in a challenging

environment; focused on fundamental

blocking and tackling

Loan paydowns continue to outpace

2

Recapture of credit losses driven by

3

improved credit

credit quality

quality

metrics,

improved macroeconomic factors

TBVPS (¹) up $1.03 or

4

5

Resumption of active M&A program

with pending acquisitions of Landmark

and Triumph

F

Strong organic capital generation and

significant capital buffer even after

announced M&A transactions

24

6%

bps vs Mar-21

vs Mar-21

Disciplined pricing

~7.5% EPS

accretive in first full-year(2)

Adjusted PTPP earnings (1)

+2% vs Q121

Total deposits up

$1.3B

VS

Dec-20

ACL/Loan Ratio at 2.00%

+7 bps vs Mar-21

Amended and extended

share buyback program

~$150M

(1) Non-GAAP measures that management believes aids in the discussion of results. See Appendix for Non-GAAP reconciliation.

M remain

remaining capacity

Enhances scale in key

growth markets

Tennessee 13th

Memphis

9th

35th 6th

Nashville 20th 15th

(2) Represents the estimated combined impact to EPS for the pending acquisitions of Landmark Community Bank and Triumph Bancshares, Inc. in the first full-

year of operations.

4View entire presentation