Greenlight Company Presentation

The Market Rewards Good Stewardship

Friends... and Frenemies

2013 P/E Multiples, Net of Cash

25.0x

20.0x

15.0x

10.0x

5.0x

0.0x

TXN

Greenlight Capital, Inc.

IBM

GOOG

EMC

CSCO

Friends of shareholders

Frenemies of shareholders

MSFT

AAPL

DELL

12

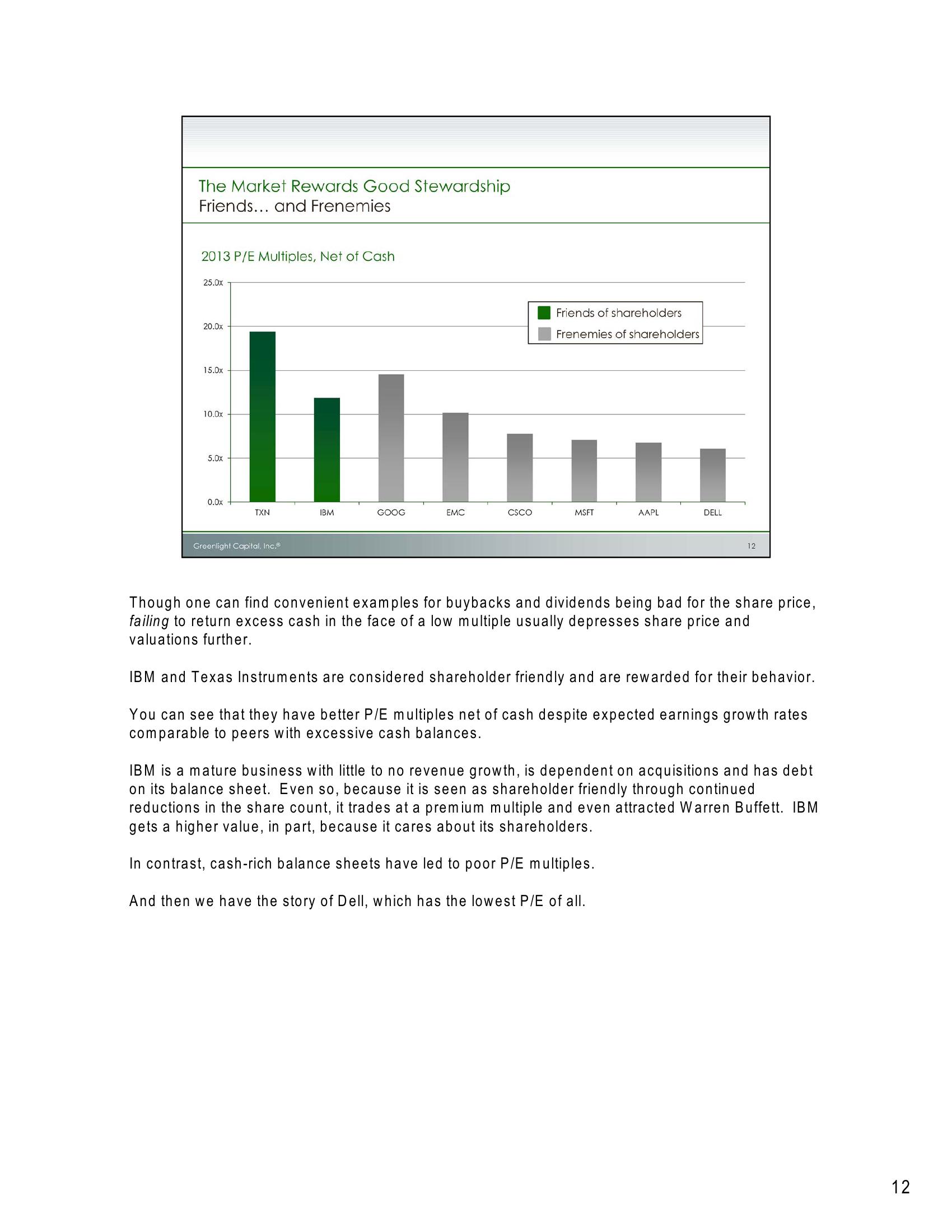

Though one can find convenient examples for buybacks and dividends being bad for the share price,

failing to return excess cash in the face of a low multiple usually depresses share price and

valuations further.

IBM and Texas Instruments are considered shareholder friendly and are rewarded for their behavior.

You can see that they have better P/E multiples net of cash despite expected earnings growth rates

comparable to peers with excessive cash balances.

IBM is a mature business with little to no revenue growth, is dependent on acquisitions and has debt

on its balance sheet. Even so, because it is seen as shareholder friendly through continued

reductions in the share count, it trades at a premium multiple and even attracted Warren Buffett. IBM

gets a higher value, in part, because it cares about its shareholders.

In contrast, cash-rich balance sheets have led to poor P/E multiples.

And then we have the story of Dell, which has the lowest P/E of all.

12View entire presentation