Levi Strauss Investor Day Presentation Deck

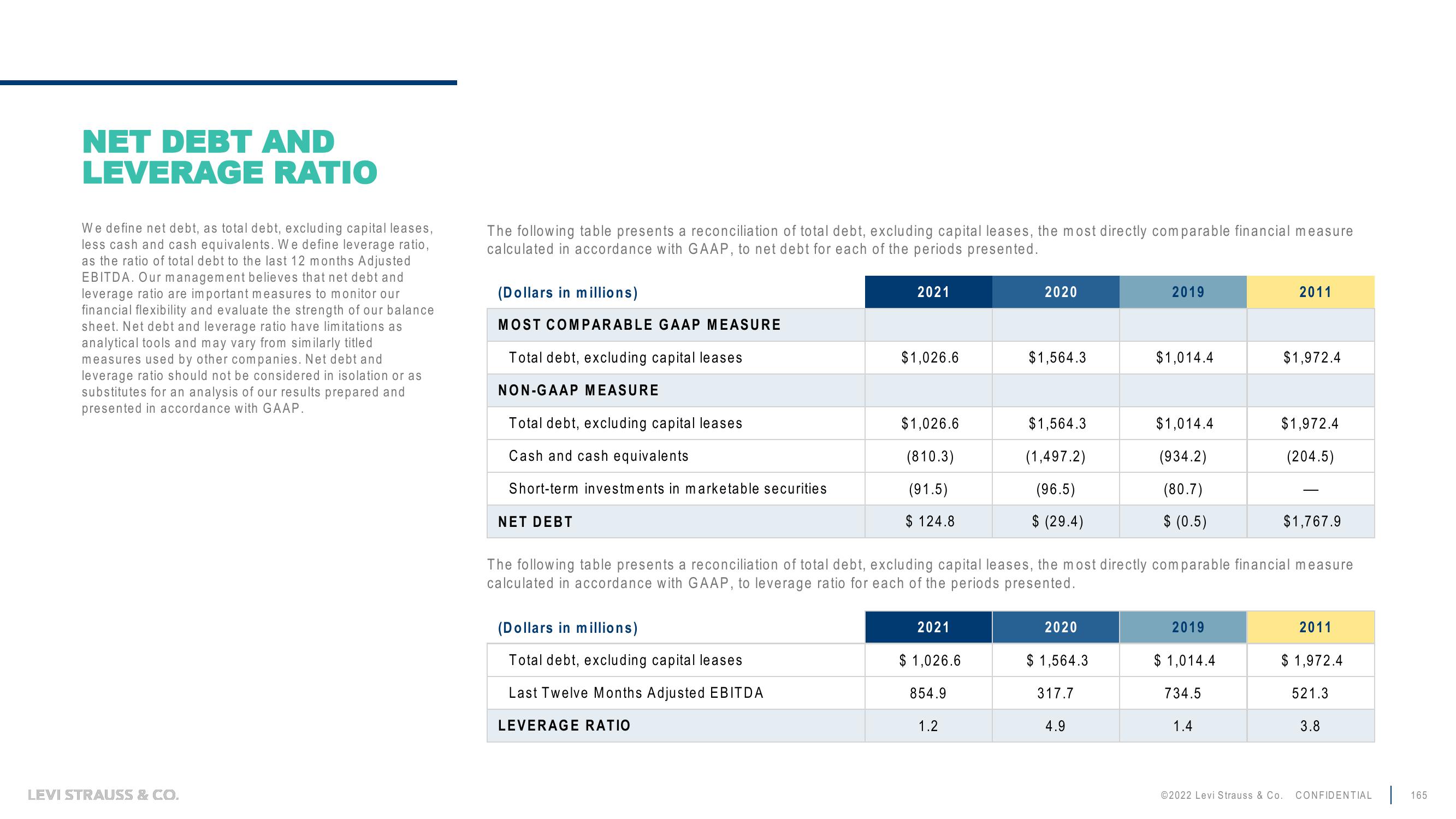

NET DEBT AND

LEVERAGE RATIO

We define net debt, as total debt, excluding capital leases,

less cash and cash equivalents. We define leverage ratio,

as the ratio of total debt to the last 12 months Adjusted

EBITDA. Our management believes that net debt and

leverage ratio are important measures to monitor our

financial flexibility and evaluate the strength of our balance

sheet. Net debt and leverage ratio have limitations as

analytical tools and may vary from similarly titled

measures used by other companies. Net debt and

leverage ratio should not be considered in isolation or as

substitutes for an analysis of our results prepared and

presented in accordance with GAAP.

LEVI STRAUSS & CO.

The following table presents a reconciliation of total debt, excluding capital leases, the most directly comparable financial measure

calculated in accordance with GAAP, to net debt for each of the periods presented.

(Dollars in millions)

MOST COMPARABLE GAAP MEASURE

Total debt, excluding capital leases

NON-GAAP MEASURE

Total debt, excluding capital leases

Cash and cash equivalents

Short-term investments in marketable securities

NET DEBT

2021

(Dollars in millions)

Total debt, excluding capital leases

Last Twelve Months Adjusted EBITDA

LEVERAGE RATIO

$1,026.6

$1,026.6

(810.3)

(91.5)

$ 124.8

2021

$1,026.6

854.9

2020

1.2

$1,564.3

$1,564.3

(1,497.2)

(96.5)

$ (29.4)

2020

$1,564.3

The following table presents a reconciliation of total debt, excluding capital leases, the most directly comparable financial measure

calculated in accordance with GAAP, to leverage ratio for each of the periods presented.

317.7

2019

4.9

$1,014.4

$1,014.4

(934.2)

(80.7)

$ (0.5)

2019

$ 1,014.4

734.5

2011

1.4

$1,972.4

$1,972.4

(204.5)

$1,767.9

2011

$ 1,972.4

521.3

3.8

©2022 Levi Strauss & Co. CONFIDENTIAL

165View entire presentation