J.P.Morgan Investment Banking Pitch Book

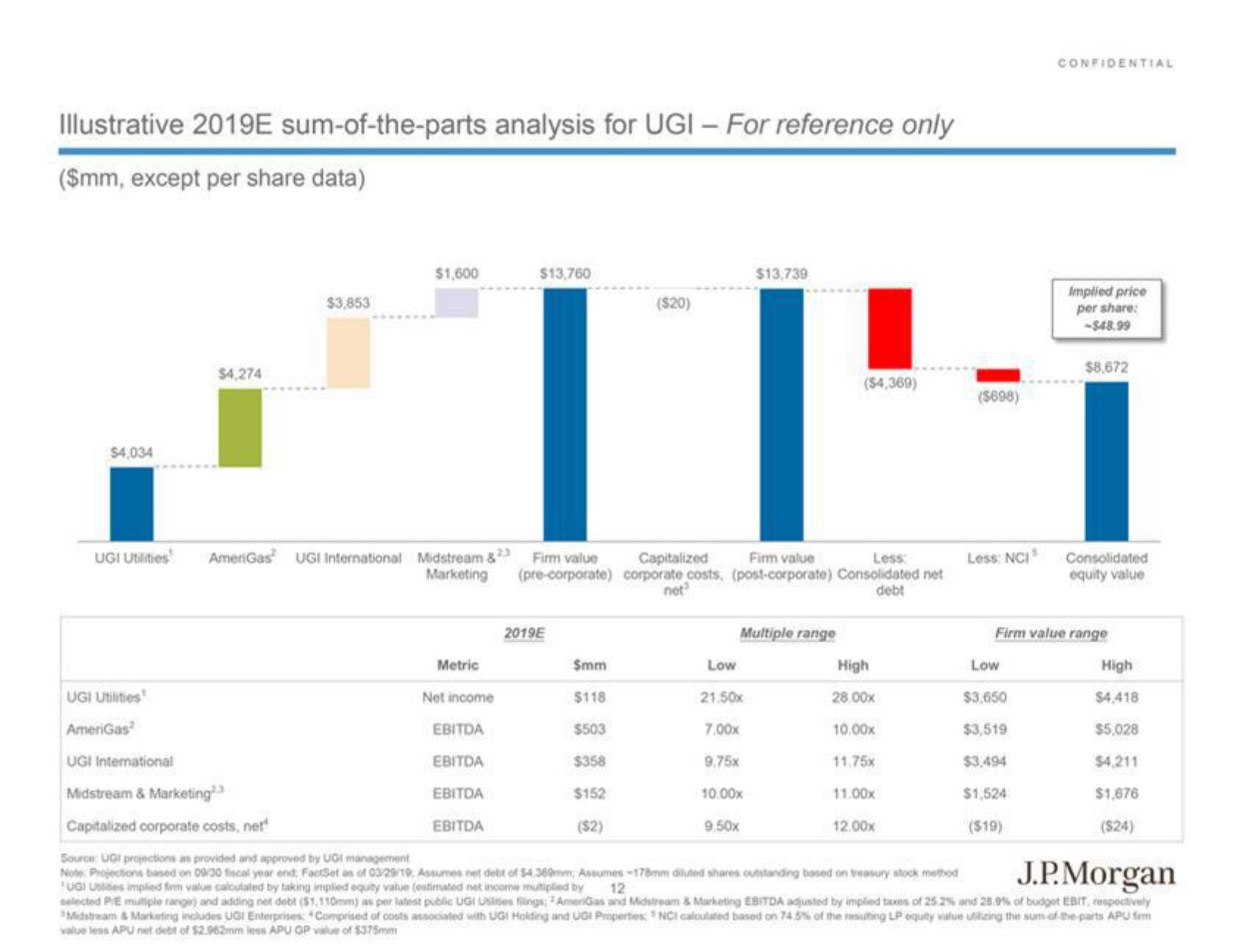

Illustrative 2019E sum-of-the-parts analysis for UGI- For reference only

($mm, except per share data)

$4,034

UGI Utilities

$4,274

$3,853

UGI Utilities

AmeriGas

UGI International

Midstream & Marketing.

Capitalized corporate costs, net

$1,600

AmeriGas UGI International Midstream & 23 Firm value

Metric

$13,760

Net income

EBITDA

EBITDA

EBITDA

EBITDA

($20)

1

Capitalized

Firm value

Less:

Marketing (pre-corporate) corporate costs, (post-corporate) Consolidated net

net

debt

2019E

$mm

$118

$503

$358

$152

($2)

Low

Multiple range

21.50x

7.00x

$13,739

9,75x

10.00x

9.50x

($4,369)

High

28.00x

10.00x

11,75x

11.00x

12.00x

($698)

Less: NCIS

Low

$3,650

$3,519

$3,494

CONFIDENTIAL

$1,524

($19)

Implied price

per share:

-$48.99

$8,672

Firm value range

Consolidated

equity value

High

$4,418

$5,028

$4,211

$1,676

($24)

J.P.Morgan

Source: UGI projections as provided and approved by UGI management

Note: Projections based on 09/30 fiscal year end; FactSet as of 03/29/19: Assumes net debt of $4,360mm, Assumes -178mm diluted shares outstanding based on treasury stock method

UGI Ustes impled firm value calculated by taking implied equity value (estimated net income multiplied by 12

selected PE multiple range) and adding net debt ($1,110mm) as per latest public UGI Uslides filings: AmeriGas and Midstream & Marketing EBITDA adjusted by implied taxes of 25.2% and 28.9% of budget EBIT, respectively

Midstream & Marketing includes UGI Enterprises: Comprised of costs associated with UGI Holding and UGI Properties: NCI calculated based on 74.5% of the resulting LP equity value utilizing the sum of the parts APU firm

value less APU net debt of $2.962mm less APU GP value of $375mmView entire presentation