Baird Investment Banking Pitch Book

1 AM PRECEDENT TRANSACTIONS ANALYSIS

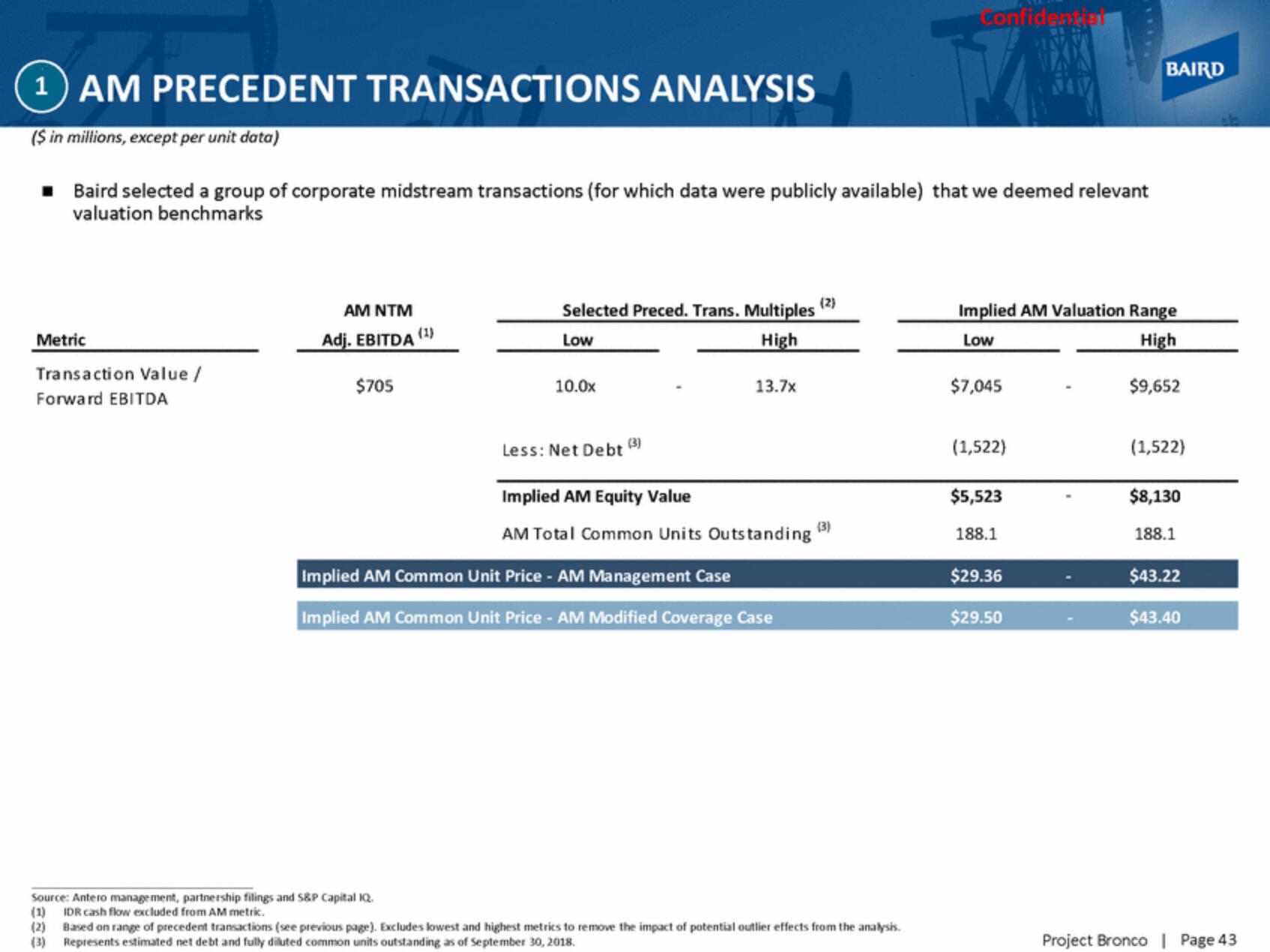

($ in millions, except per unit data)

☐

Baird selected a group of corporate midstream transactions (for which data were publicly available) that we deemed relevant

valuation benchmarks

Metric

Transaction Value /

Forward EBITDA

AM NTM

Adj. EBITDA

$705

(1)

Selected Preced. Trans. Multiples

Low

High

10.0x

Less: Net Debt

(3)

13.7x

(2)

Implied AM Equity Value

AM Total Common Units Outstanding (3)

Implied AM Common Unit Price - AM Management Case

Implied AM Common Unit Price - AM Modified Coverage Case

Confidential

Source: Antero management, partnership filings and S&P Capital IQ.

(1) IDR cash flow excluded from AM metric.

(2) Based on range of precedent transactions (see previous page). Excludes lowest and highest metrics to remove the impact of potential outlier effects from the analysis.

(3) Represents estimated net debt and fully diluted common units outstanding as of September 30, 2018.

Implied AM Valuation Range

Low

High

$7,045

(1,522)

$5,523

188.1

BAIRD

$29.36

$29.50

$9,652

(1,522)

$8,130

188.1

$43.22

$43.40

Project Bronco | Page 43View entire presentation