Azek IPO Presentation Deck

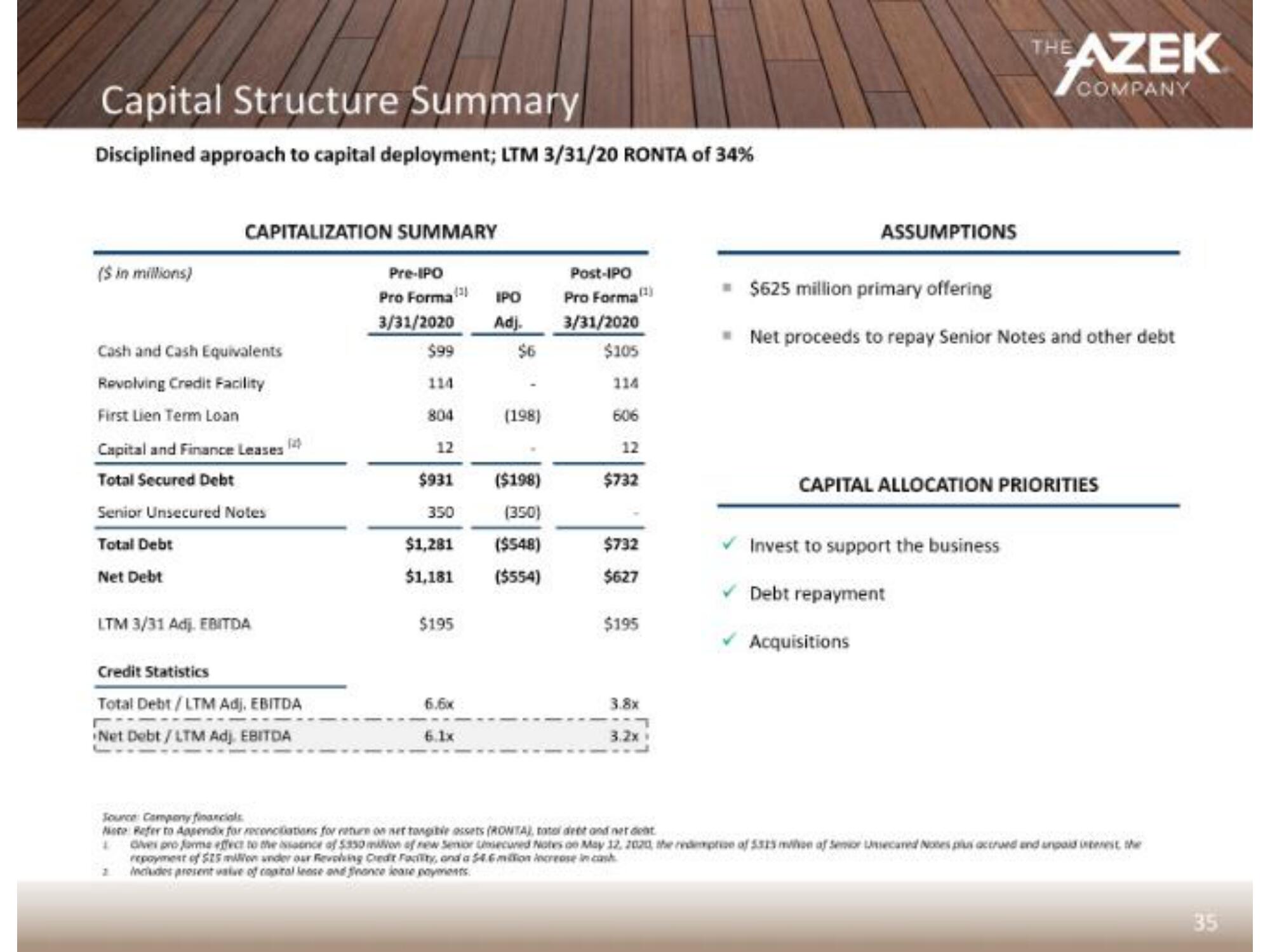

Capital Structure Summary

Disciplined approach to capital deployment; LTM 3/31/20 RONTA of 34%

($ in millions)

CAPITALIZATION SUMMARY

Cash and Cash Equivalents

Revolving Credit Facility

First Lien Term Loan

Capital and Finance Leases

Total Secured Debt

Senior Unsecured Notes

Total Debt

Net Debt

LTM 3/31 Adj. EBITDA

Credit Statistics

Total Debt/LTM Adj. EBITDA

Net Debt/LTM Adj. EBITDA

Pre-IPO

Pro Forma(¹)

3/31/2020

$99

114

804

12

$931

350

$195

IPO

Adj.

($198)

(350)

$1,281 ($548)

$1,181

($554)

6.6x

6.1x

$6

(198)

Post-IPO

Pro Forma

3/31/2020

$105

114

606

12

$732

$732

$627

$195

3.8x

3.2x

Company financials

Note Refer to Appendix for reconciliations for return on net tongibile ossets (ROWTA), tat detand net dent

ASSUMPTIONS

AZEK

COMPANY

$625 million primary offering

Net proceeds to repay Senior Notes and other debt

Invest to support the business

Debt repayment

Acquisitions

THE

CAPITAL ALLOCATION PRIORITIES

Cives pro forme effect to the issance of $350 milion of new Senior Unsecured Notes on May 12, 2020, the redemption of 5315 milion of Senior Unsecured Notes plus accrued and anpaid interest the

repoyment of $25 milion under our Revolving Credit Facility, and a $4.6 million increase in cash

Includes present vstve of capital lease and finance lease payments.

35View entire presentation