Hostess Investor Presentation Deck

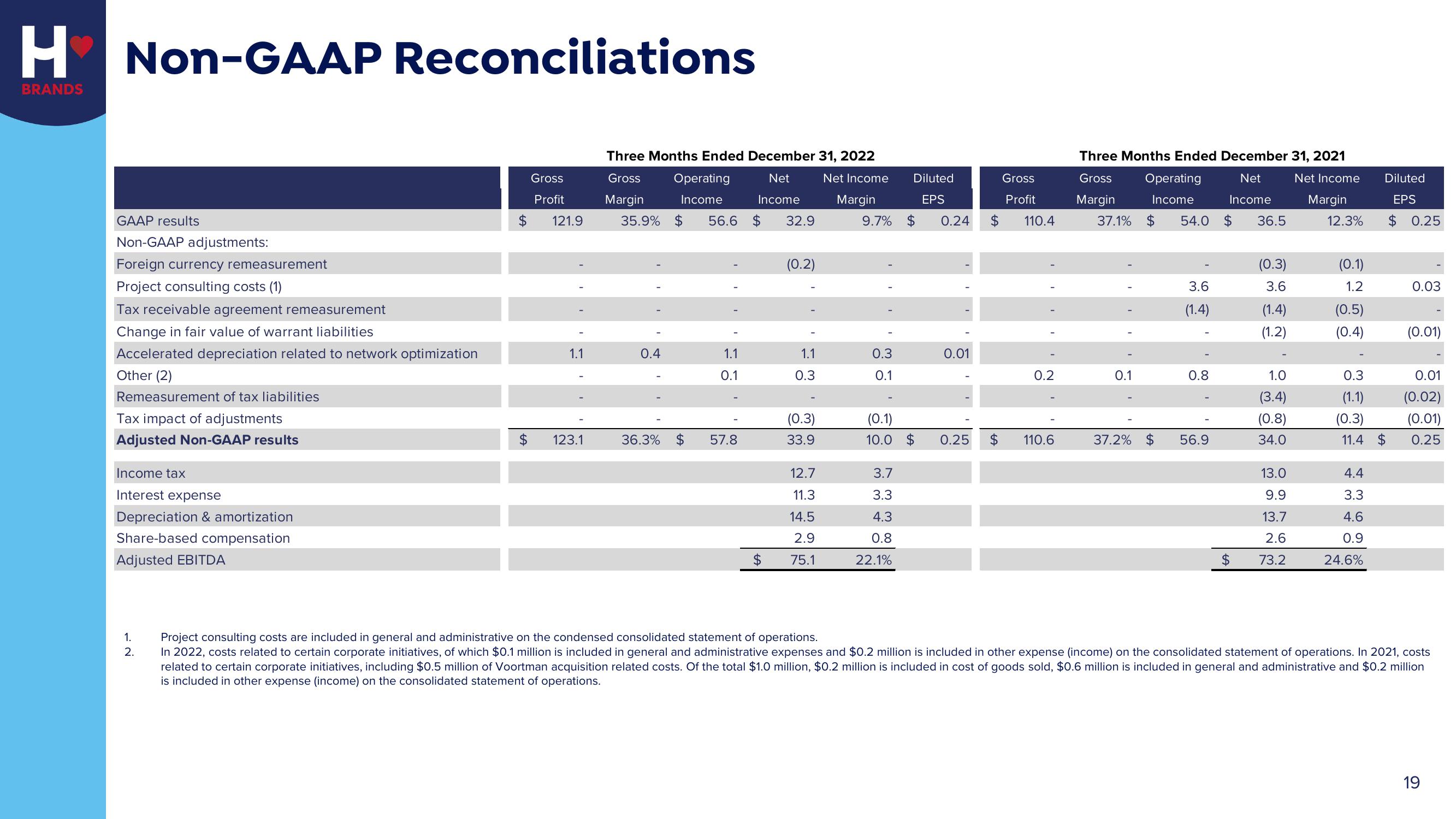

H Non-GAAP Reconciliations

BRANDS

GAAP results

Non-GAAP adjustments:

Foreign currency remeasurement

Project consulting costs (1)

Tax receivable agreement remeasurement

Change in fair value of warrant liabilities

Accelerated depreciation related to network optimization

Other (2)

Remeasurement of tax liabilities

Tax impact of adjustments

Adjusted Non-GAAP results

Income tax

Interest expense

Depreciation & amortization

Share-based compensation

Adjusted EBITDA

1.

2.

Gross

Profit

$ 121.9

1.1

123.1

Gross

Margin

35.9% $

Three Months Ended December 31, 2022

Net Income

Margin

9.7% $ 0.24 $

Net

Income

0.4

36.3%

Operating

Income

56.6 $ 32.9

1.1

0.1

57.8

(0.2)

1.1

0.3

(0.3)

33.9

12.7

11.3

14.5

2.9

75.1

0.3

0.1

Diluted

EPS

(0.1)

10.0 $

3.7

3.3

4.3

0.8

22.1%

0.01

0.25 $

Gross

Profit

110.4

0.2

110.6

Three Months Ended December 31, 2021

Gross

Net Income

Margin

Margin

37.1% $ 54.0 $

12.3%

Net

Income

0.1

37.2%

Operating

Income

3.6

(1.4)

0.8

56.9

36.5

(0.3)

3.6

(1.4)

(1.2)

1.0

(3.4)

(0.8)

34.0

13.0

9.9

13.7

2.6

73.2

(0.1)

1.2

(0.5)

(0.4)

0.3

(1.1)

(0.3)

Diluted

EPS

$ 0.25

11.4 $

4.4

3.3

4.6

0.9

24.6%

0.03

(0.01)

0.01

(0.02)

(0.01)

0.25

Project consulting costs are included in general and administrative on the condensed consolidated statement of operations.

In 2022, costs related to certain corporate initiatives, of which $0.1 million is included in general and administrative expenses and $0.2 million is included in other expense (income) on the consolidated statement of operations. In 2021, costs

related to certain corporate initiatives, including $0.5 million of Voortman acquisition related costs. Of the total $1.0 million, $0.2 million is included in cost of goods sold, $0.6 million is included in general and administrative and $0.2 million

is included in other expense (income) on the consolidated statement of operations.

19View entire presentation