Pershing Square Activist Presentation Deck

C. McOpCo Financial Analysis

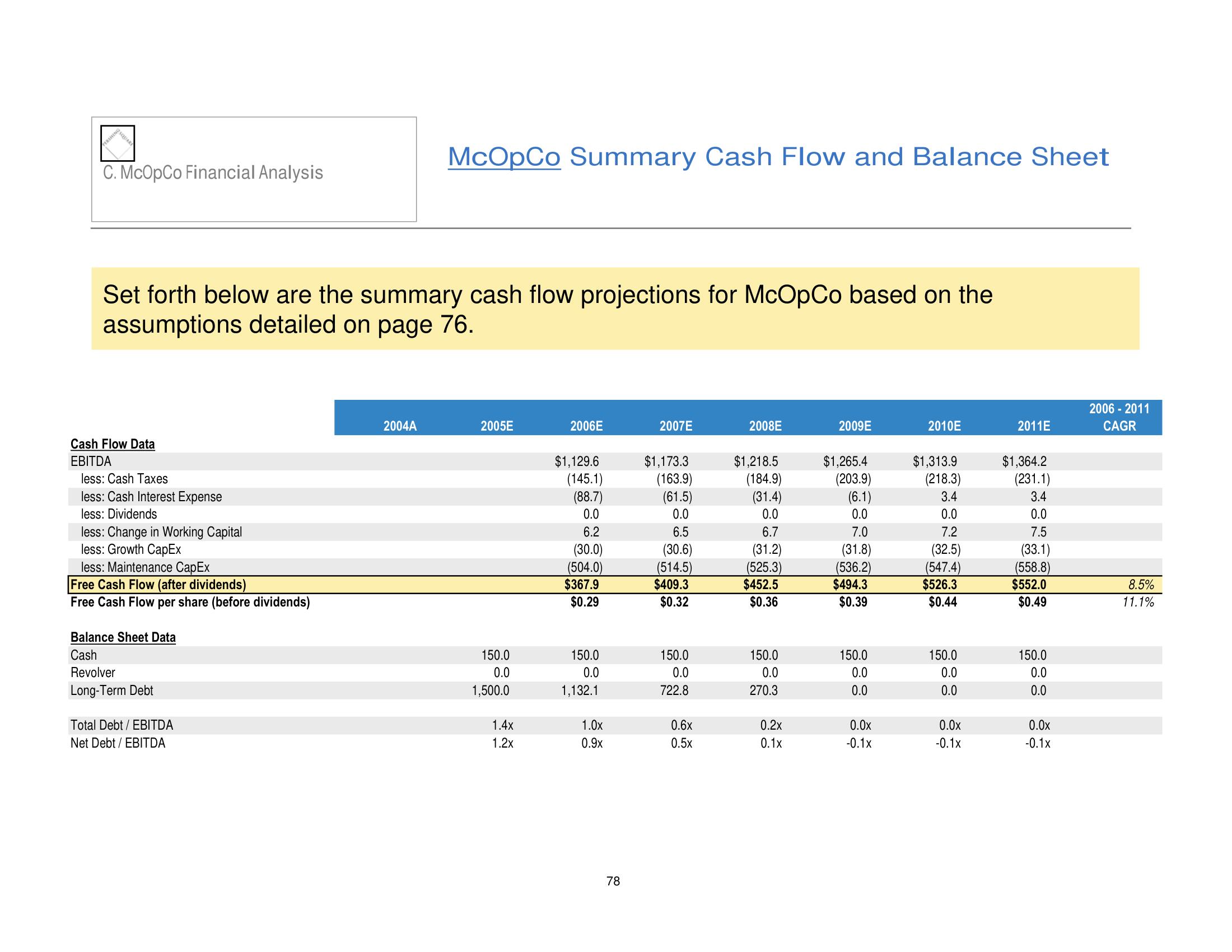

Set forth below are the summary cash flow projections for McOpCo based on the

assumptions detailed on page 76.

Cash Flow Data

EBITDA

less: Cash Taxes

less: Cash Interest Expense

less: Dividends

less: Change in Working Capital

less: Growth CapEx

less: Maintenance CapEx

Free Cash Flow (after dividends)

Free Cash Flow per share (before dividends)

Balance Sheet Data

Cash

Revolver

Long-Term Debt

Total Debt / EBITDA

Net Debt / EBITDA

McOpCo Summary Cash Flow and Balance Sheet

2004A

2005E

150.0

0.0

1,500.0

1.4x

1.2x

2006E

$1,129.6

(145.1)

(88.7)

0.0

6.2

(30.0)

(504.0)

$367.9

$0.29

150.0

0.0

1,132.1

1.0x

0.9x

78

2007E

$1,173.3

(163.9)

(61.5)

0.0

6.5

(30.6)

(514.5)

$409.3

$0.32

150.0

0.0

722.8

0.6x

0.5x

2008E

$1,218.5

(184.9)

(31.4)

0.0

6.7

(31.2)

(525.3)

$452.5

$0.36

150.0

0.0

270.3

0.2x

0.1x

2009E

$1,265.4

(203.9)

(6.1)

0.0

7.0

(31.8)

(536.2)

$494.3

$0.39

150.0

0.0

0.0

0.0x

-0.1x

2010E

$1,313.9

(218.3)

3.4

0.0

7.2

(32.5)

(547.4)

$526.3

$0.44

150.0

0.0

0.0

0.0x

-0.1x

2011E

$1,364.2

(231.1)

3.4

0.0

7.5

(33.1)

(558.8)

$552.0

$0.49

150.0

0.0

0.0

0.0x

-0.1x

2006 - 2011

CAGR

8.5%

11.1%View entire presentation