ValueAct Capital Activist Presentation Deck

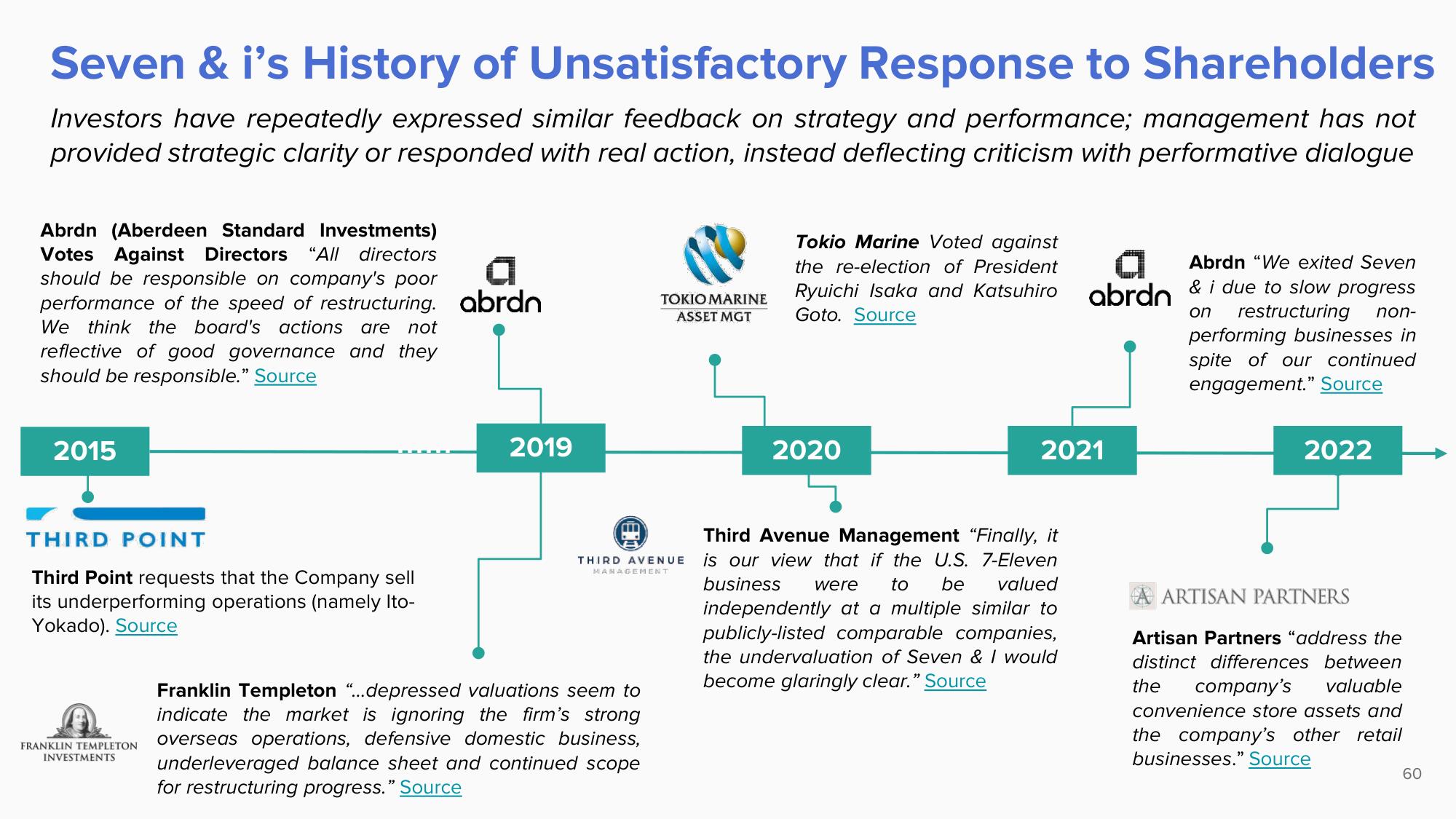

Seven & i's History of Unsatisfactory Response to Shareholders

Investors have repeatedly expressed similar feedback on strategy and performance; management has not

provided strategic clarity or responded with real action, instead deflecting criticism with performative dialogue

Abrdn (Aberdeen Standard Investments)

Votes Against Directors "All directors

should be responsible on company's poor

performance of the speed of restructuring. abrdn

We think the board's actions are not

reflective of good governance and they

should be responsible." Source

2015

THIRD POINT

Third Point requests that the Company sell

its underperforming operations (namely Ito-

Yokado). Source

FRANKLIN TEMPLETON

INVESTMENTS

2019

TOKIO MARINE

ASSET MGT

THIRD AVENUE

MANAGEMENT

Franklin Templeton "...depressed valuations seem to

indicate the market is ignoring the firm's strong

overseas operations, defensive domestic business,

underleveraged balance sheet and continued scope

for restructuring progress." Source

Tokio Marine Voted against

the re-election of President

Ryuichi Isaka and Katsuhiro

Goto. Source

2020

Abrdn "We exited Seven

0

abrdn & i due to slow progress

on restructuring

non-

performing businesses in

spite of our continued

engagement." Source

2021

Third Avenue Management "Finally, it

is our view that if the U.S. 7-Eleven

business were to be valued

independently at a multiple similar to

publicly-listed comparable companies,

the undervaluation of Seven & I would

become glaringly clear." Source

2022

A ARTISAN PARTNERS

Artisan Partners "address the

distinct differences between

the

company's valuable

convenience store assets and

the company's other retail

businesses." Source

60View entire presentation