Kinnevik Results Presentation Deck

Intro

Net Asset Value

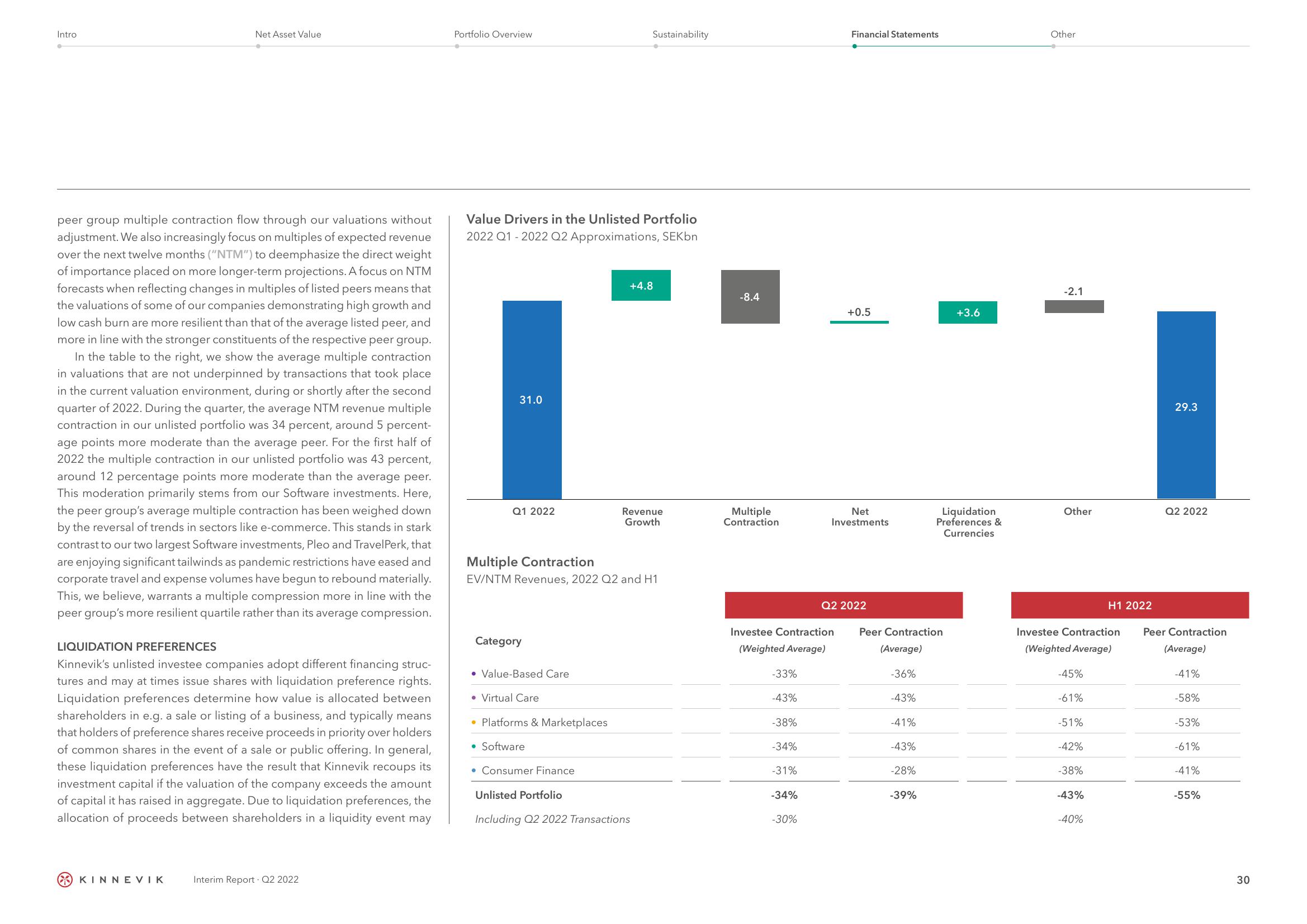

peer group multiple contraction flow through our valuations without

adjustment. We also increasingly focus on multiples of expected revenue

over the next twelve months ("NTM") to deemphasize the direct weight

of importance placed on more longer-term projections. A focus on NTM

forecasts when reflecting changes in multiples of listed peers means that

the valuations of some of our companies demonstrating high growth and

low cash burn are more resilient than that of the average listed peer, and

more in line with the stronger constituents of the respective peer group.

In the table to the right, we show the average multiple contraction

in valuations that are not underpinned by transactions that took place

in the current valuation environment, during or shortly after the second

quarter of 2022. During the quarter, the average NTM revenue multiple

contraction in our unlisted portfolio was 34 percent, around 5 percent-

age points more moderate than the average peer. For the first half of

2022 the multiple contraction in our unlisted portfolio was 43 percent,

around 12 percentage points more moderate than the average peer.

This moderation primarily stems from our Software investments. Here,

the peer group's average multiple contraction has been weighed down

by the reversal of trends in sectors like e-commerce. This stands in stark

contrast to our two largest Software investments, Pleo and TravelPerk, that

are enjoying significant tailwinds as pandemic restrictions have eased and

corporate travel and expense volumes have begun to rebound materially.

This, we believe, warrants a multiple compression more in line with the

peer group's more resilient quartile rather than its average compression.

LIQUIDATION PREFERENCES

Kinnevik's unlisted investee companies adopt different financing struc-

tures and may at times issue shares with liquidation preference rights.

Liquidation preferences determine how value is allocated between

shareholders in e.g. a sale or listing of a business, and typically means

that holders of preference shares receive proceeds in priority over holders

of common shares in the event of a sale or public offering. In general,

these liquidation preferences have the result that Kinnevik recoups its

investment capital if the valuation of the company exceeds the amount

of capital it has raised in aggregate. Due to liquidation preferences, the

allocation of proceeds between shareholders in a liquidity event may

KINNEVIK

Interim Report Q2 2022

Portfolio Overview

Value Drivers in the Unlisted Portfolio

2022 Q1-2022 Q2 Approximations, SEKbn

+4.8

L

31.0

Q1 2022

Category

Multiple Contraction

EV/NTM Revenues, 2022 Q2 and H1

• Value-Based Care

• Virtual Care

Sustainability

• Platforms & Marketplaces

• Software

• Consumer Finance

Revenue

Growth

Unlisted Portfolio

Including Q2 2022 Transactions

-8.4

Multiple

Contraction

-33%

Investee Contraction

(Weighted Average)

-43%

-38%

-34%

-31%

-34%

-30%

Financial Statements

+0.5

Net

Investments

Q2 2022

Peer Contraction

(Average)

-36%

-43%

-41%

-43%

-28%

-39%

+3.6

Liquidation

Preferences &

Currencies

Other

-2.1

Other

Investee Contraction

(Weighted Average)

-45%

-61%

-51%

-42%

-38%

-43%

H1 2022

-40%

29.3

Q2 2022

Peer Contraction

(Average)

-41%

-58%

-53%

-61%

-41%

-55%

30View entire presentation