J.P.Morgan Investment Banking Pitch Book

PRELIMINARY VALUATION ANALYSIS

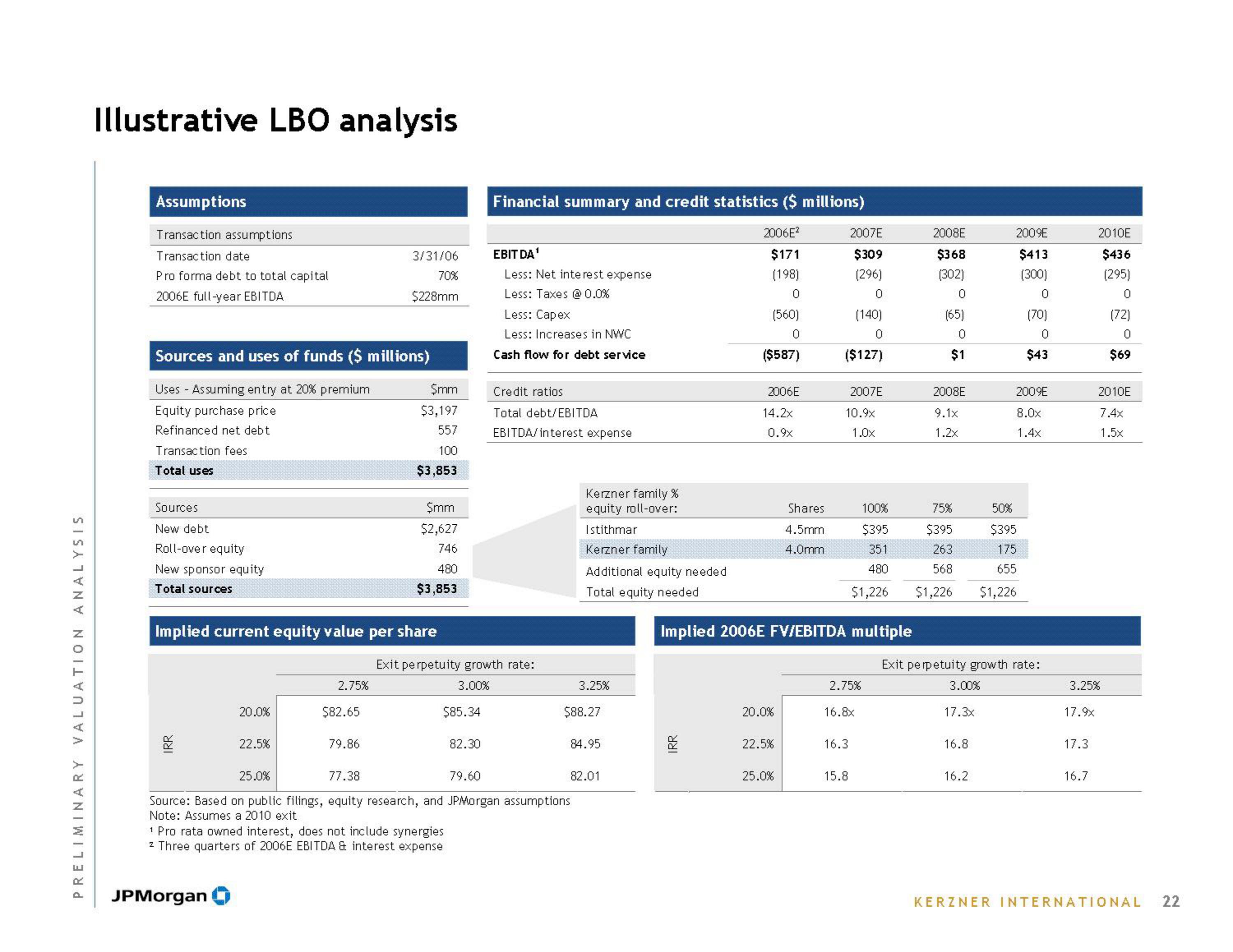

Illustrative LBO analysis

Assumptions

Transaction assumptions

Transaction date

Pro forma debt to total capital

2006E full-year EBITDA

Sources and uses of funds ($ millions)

Uses - Assuming entry at 20% premium

Equity purchase price

Refinanced net debt

Transaction fees

Total uses

Sources

New debt

Roll-over equity

New sponsor equity

Total sources

IRR

Implied current equity value per share

20.0%

22.5%

JPMorgan

2.75%

3/31/06

70%

$228mm

$82.65

79.86

$mm

$3,197

557

100

$3,853

$mm

$2,627

746

480

$3,853

$85.34

1 Pro rata owned interest, does not include synergies

z Three quarters of 2006E EBITDA & interest expense

Financial summary and credit statistics ($ millions)

2006E²

$171

(198)

0

82.30

EBITDA¹

Less: Net interest expense

Less: Taxes @ 0.0%

Less: Capex

Less: Increases in NWC

Cash flow for debt service

Exit perpetuity growth rate:

3.00%

Credit ratios

Total debt/EBITDA

EBITDA/interest expense

25.0%

77.38

79.60

Source: Based on public filings, equity research, and JPMorgan assumptions

Note: Assumes a 2010 exit

Kerzner family %

equity roll-over:

Istithmar

Kerzner family

Additional equity needed

Total equity needed

3.25%

$88.27

84.95

82.01

(560)

0

($587)

IRR

2006E

14.2x

0.9x

20.0%

22.5%

Shares

4.5mm

4.0mm

25.0%

2007E

$309

(296)

0

(140)

0

($127)

Implied 2006E FV/EBITDA multiple

10.9x

1.0x

2007E

2.75%

16.3

16.8x

15.8

2008E

$368

(302)

0

(65)

0

$1

2008E

9.1x

1.2x

100%

75%

50%

$395

$395

$395

351

263

175

480

568

655

$1,226 $1,226 $1,226

3.00%

17.3x

2009E

$413

(300)

0

Exit perpetuity growth rate:

16.8

16.2

(70)

0

$43

2009E

8.0x

1.4x

17.9x

3.25%

17.3

2010E

$436

(295)

0

(72)

0

$69

16.7

2010E

7.4x

1.5x

KERZNER INTERNATIONAL 22View entire presentation