Pershing Square Activist Presentation Deck

III. Pershing's Proposal to McDonald's:

McOpCo IPO

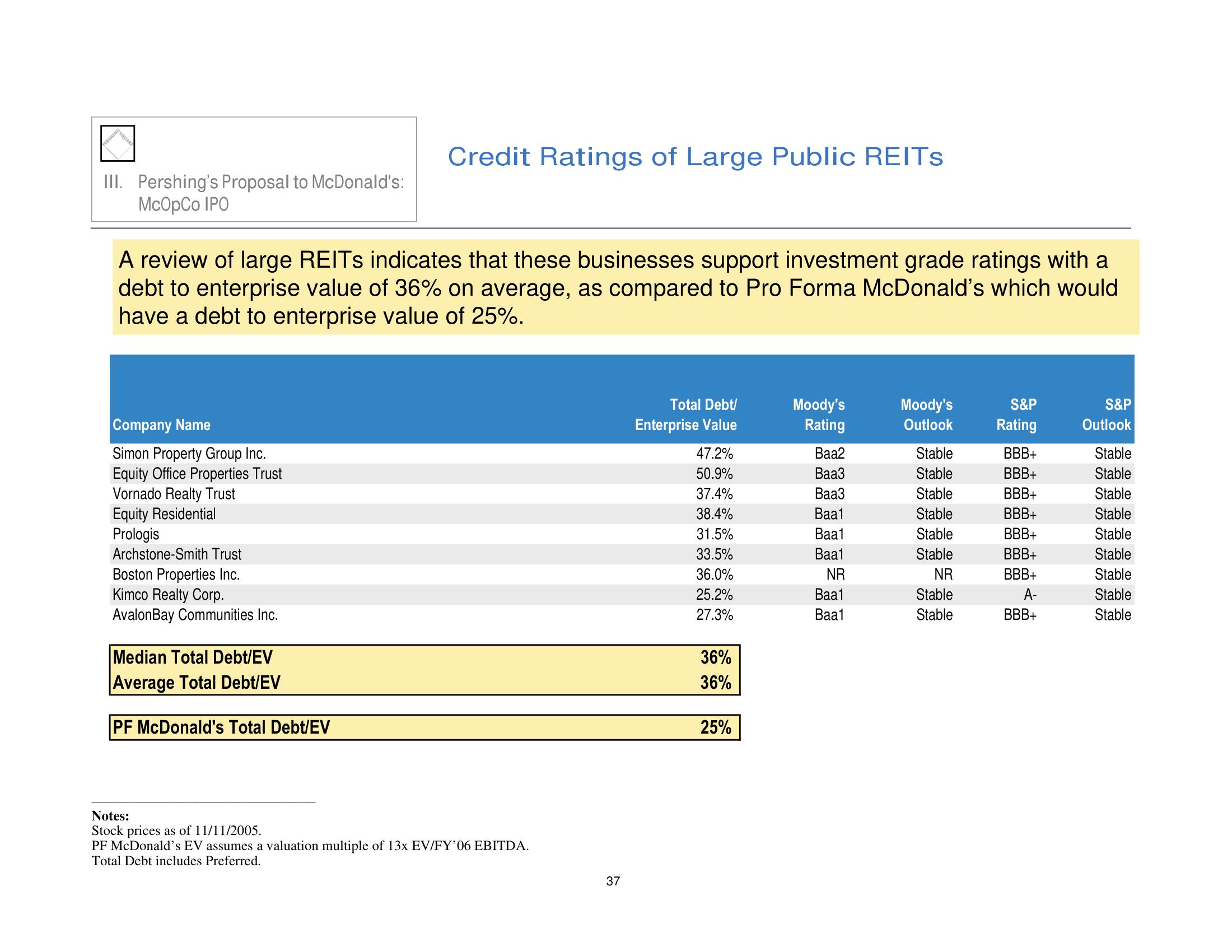

A review of large REITs indicates that these businesses support investment grade ratings with a

debt to enterprise value of 36% on average, as compared to Pro Forma McDonald's which would

have a debt to enterprise value of 25%.

Company Name

Simon Property Group Inc.

Equity Office Properties Trust

Vornado Realty Trust

Equity Residential

Prologis

Archstone-Smith Trust

Boston Properties Inc.

Kimco Realty Corp.

AvalonBay Communities Inc.

Median Total Debt/EV

Average Total Debt/EV

Credit Ratings of Large Public REITS

PF McDonald's Total Debt/EV

Notes:

Stock prices as of 11/11/2005.

PF McDonald's EV assumes a valuation multiple of 13x EV/FY'06 EBITDA.

Total Debt includes Preferred.

37

Total Debt/

Enterprise Value

47.2%

50.9%

37.4%

38.4%

31.5%

33.5%

36.0%

25.2%

27.3%

36%

36%

25%

Moody's

Rating

Baa2

Baa3

Baa3

Baa1

Baal

Baa1

NR

Baa1

Baal

Moody's

Outlook

Stable

Stable

Stable

Stable

Stable

Stable

NR

Stable

Stable

S&P

Rating

BBB+

BBB+

BBB+

BBB+

BBB+

BBB+

BBB+

A-

BBB+

S&P

Outlook

Stable

Stable

Stable

Stable

Stable

Stable

Stable

Stable

StableView entire presentation