Liberty Global Results Presentation Deck

RECONCILIATIONS

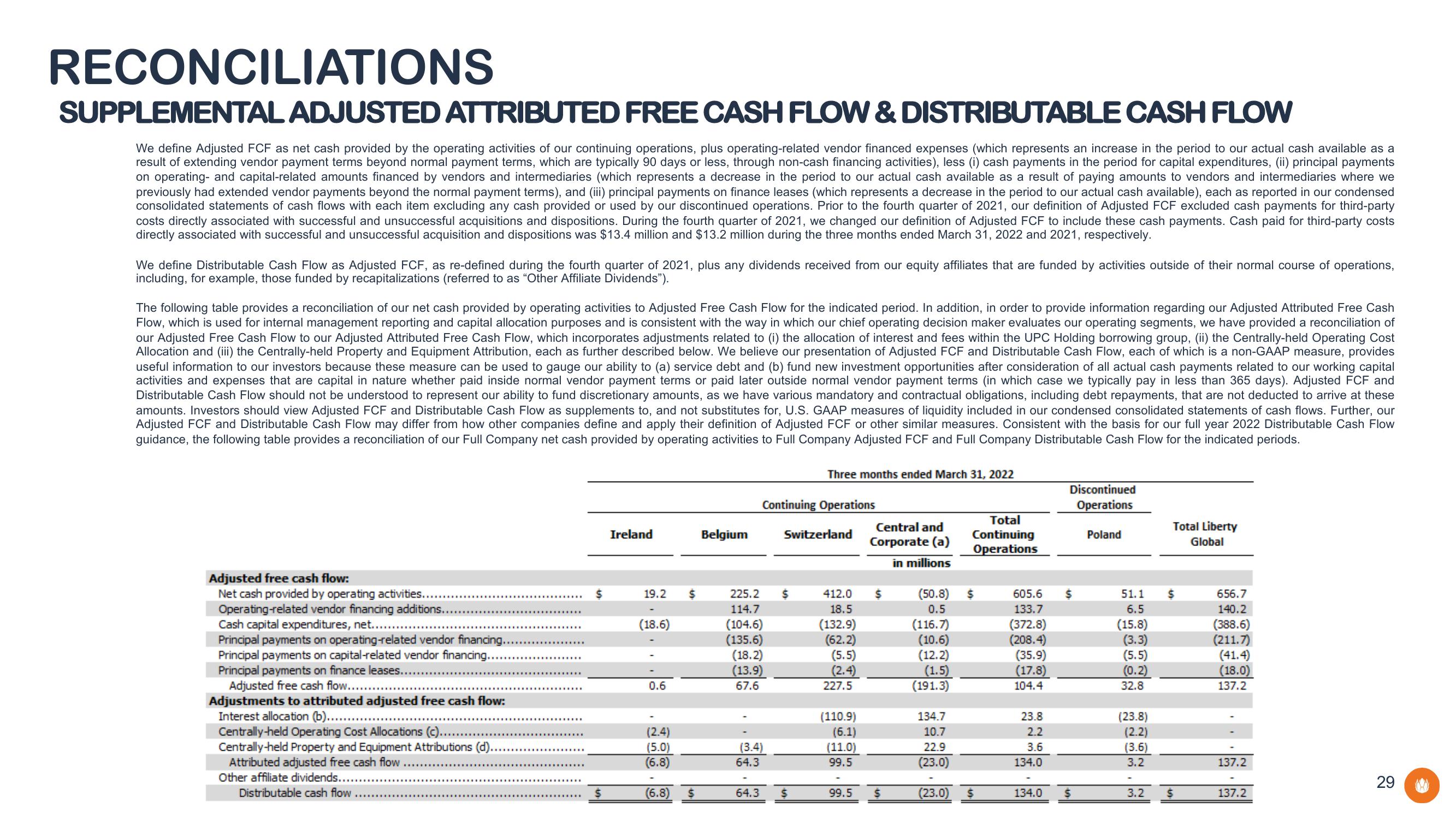

SUPPLEMENTAL ADJUSTED ATTRIBUTED FREE CASH FLOW & DISTRIBUTABLE CASH FLOW

We define Adjusted FCF as net cash provided by the operating activities of our continuing operations, plus operating-related vendor financed expenses (which represents an increase in the period to our actual cash available as a

result of extending vendor payment terms beyond normal payment terms, which are typically 90 days or less, through non-cash financing activities), less (i) cash payments in the period for capital expenditures, (ii) principal payments

on operating- and capital-related amounts financed by vendors and intermediaries (which represents a decrease in the period to our actual cash available as a result of paying amounts to vendors and intermediaries where we

previously had extended vendor payments beyond the normal payment terms), and (iii) principal payments on finance leases (which represents a decrease in the period to our actual cash available), each as reported in our condensed

consolidated statements of cash flows with each item excluding any cash provided or used by our discontinued operations. Prior to the fourth quarter of 2021, our definition of Adjusted FCF excluded cash payments for third-party

costs directly associated with successful and unsuccessful acquisitions and dispositions. During the fourth quarter of 2021, we changed our definition of Adjusted FCF to include these cash payments. Cash paid for third-party costs

directly associated with successful and unsuccessful acquisition and dispositions was $13.4 million and $13.2 million during the three months ended March 31, 2022 and 2021, respectively.

We define Distributable Cash Flow as Adjusted FCF, as re-defined during the fourth quarter of 2021, plus any dividends received from our equity affiliates that are funded by activities outside of their normal course of operations,

including, for example, those funded by recapitalizations (referred to as "Other Affiliate Dividends").

The following table provides a reconciliation of our net cash provided by operating activities to Adjusted Free Cash Flow for the indicated period. In addition, in order to provide information regarding our Adjusted Attributed Free Cash

Flow, which is used for internal management reporting and capital allocation purposes and is consistent with the way in which our chief operating decision maker evaluates our operating segments, we have provided a reconciliation of

our Adjusted Free Cash Flow to our Adjusted Attributed Free Cash Flow, which incorporates adjustments related to (i) the allocation of interest and fees within the UPC Holding borrowing group, (ii) the Centrally-held Operating Cost

Allocation and (iii) the Centrally-held Property and Equipment Attribution, each as further described below. We believe our presentation of Adjusted FCF and Distributable Cash Flow, each of which is a non-GAAP measure, provides

useful information to our investors because these measure can be used to gauge our ability to (a) service debt and (b) fund new investment opportunities after consideration of all actual cash payments related to our working capital

activities and expenses that are capital in nature whether paid inside normal vendor payment terms or paid later outside normal vendor payment terms (in which case we typically pay in less than 365 days). Adjusted FCF and

Distributable Cash Flow should not be understood to represent our ability to fund discretionary amounts, as we have various mandatory and contractual obligations, including debt repayments, that are not deducted to arrive at these

amounts. Investors should view Adjusted FCF and Distributable Cash Flow as supplements to, and not substitutes for, U.S. GAAP measures of liquidity included in our condensed consolidated statements of cash flows. Further, our

Adjusted FCF and Distributable Cash Flow may differ from how other companies define and apply their definition of Adjusted FCF or other similar measures. Consistent with the basis for our full year 2022 Distributable Cash Flow

guidance, the following table provides a reconciliation of our Full Company net cash provided by operating activities to Full Company Adjusted FCF and Full Company Distributable Cash Flow for the indicated periods.

Adjusted free cash flow:

Net cash provided by operating activities...

Operating-related vendor financing additions...........

Cash capital expenditures, net.....

Principal payments on operating-related vendor financing.

Principal payments on capital-related vendor financing..

Principal payments on finance leases..........

Adjusted free cash flow........

Adjustments to attributed adjusted free cash flow:

Interest allocation (b)...........

Centrally-held Operating Cost Allocations (c)............

Centrally-held Property and Equipment Attributions (d)..

Attributed adjusted free cash flow

Other affiliate dividends.......

Distributable cash flow

**************

Ireland

19.2

(18.6)

0.6

(2.4)

(5.0)

(6.8)

(6.8)

$

$

Belgium

225.2

114.7

(104.6)

(135.6)

(18.2)

(13.9)

67.6

(3.4)

64.3

Continuing Operations

64.3

Three months ended March 31, 2022

Switzerland

$

$

412.0

18.5

(132.9)

(62.2)

(5.5)

(2.4)

227.5

(110.9)

(6.1)

(11.0)

99.5

99.5

Central and

Corporate (a)

in millions

$

$

(50.8)

0.5

(116.7)

(10.6)

(12.2)

(1.5)

(191.3)

134.7

10.7

22.9

(23.0)

(23.0)

Total

Continuing

Operations

$

605.6

133.7

(372.8)

(208.4)

(35.9)

(17.8)

104.4

23.8

2.2

3.6

134.0

Discontinued

Operations

134.0 $

Poland

51.1

6.5

(15.8)

(3.3)

(5.5)

(0.2)

32.8

(23.8)

(2.2)

(3.6)

3.2

3.2

Total Liberty

Global

$

$

656.7

140.2

(388.6)

(211.7)

(41.4)

(18.0)

137.2

137.2

137.2

29View entire presentation