Goldman Sachs Investment Banking Pitch Book

Goldman

Sachs

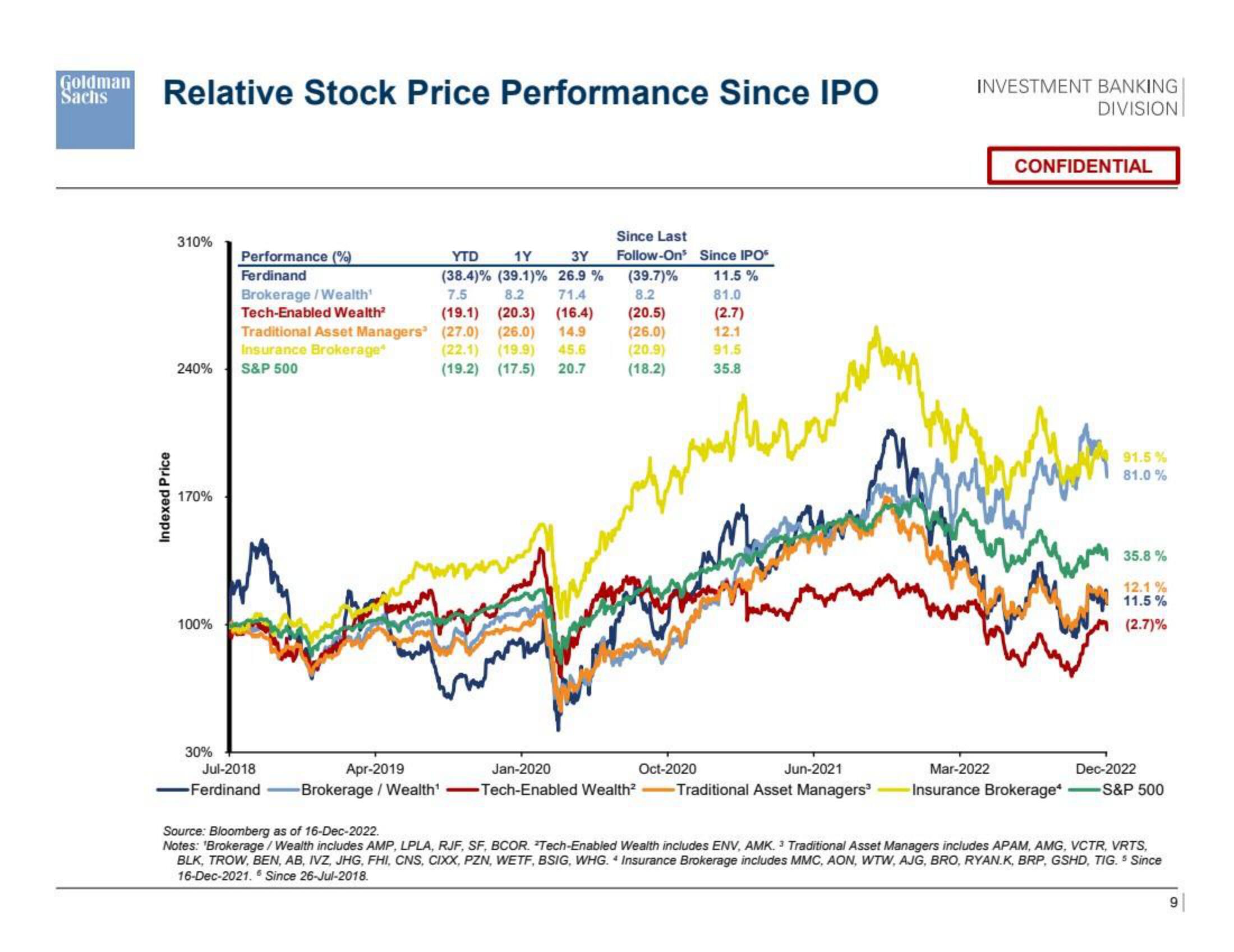

Relative Stock Price Performance Since IPO

Indexed Price

310%

240%

170%

100%

30%

Performance (%)

Ferdinand

Brokerage/Wealth¹

Tech-Enabled Wealth²

Traditional Asset Managers

Insurance Brokerage*

S&P 500

Jul-2018

-Ferdinand

YTD 1Y 3Y

(38.4) % (39.1) % 26.9%

7.5 8.2 71.4

(19.1) (20.3) (16.4)

(27.0) (26.0) 14.9

(22.1) (19.9) 45.6

(19.2) (17.5) 20.7

Since Last

Follow-On³ Since IPO

(39.7)% 11.5%

8.2

81.0

(20.5)

(2.7)

(26.0)

12.1

(20.9)

91.5

(18.2)

35.8

ار ادا کرنے

werden.

Apr-2019

Jan-2020

Oct-2020

Jun-2021

-Brokerage / Wealth¹ -Tech-Enabled Wealth²-Traditional Asset Managers³

INVESTMENT BANKING

DIVISION

CONFIDENTIAL

91.5%

81.0 %

35.8%

12.1%

11.5%

(2.7)%

Mar-2022

Dec-2022

Insurance Brokerage* -S&P 500

Source: Bloomberg as of 16-Dec-2022.

Notes: "Brokerage / Wealth includes AMP, LPLA, RJF, SF, BCOR. *Tech-Enabled Wealth includes ENV, AMK. 3 Traditional Asset Managers includes APAM, AMG, VCTR, VRTS,

BLK, TROW, BEN, AB, IVZ, JHG, FHI, CNS, CIXX, PZN, WETF, BSIG, WHG. 4 Insurance Brokerage includes MMC, AON, WTW, AJG, BRO, RYAN.K, BRP, GSHD, TIG. ³ Since

16-Dec-2021. Since 26-Jul-2018.

9View entire presentation